Why CoW Protocol is soaring 60% while the crypto market struggles

0

0

CoW Protocol, the decentralized finance (DeFi) protocol built on the Ethereum mainnet, is up more than 60% in the past 24 hours.

Per data from CoinMarketCap, the performance sees the native token COW stand out as the best performing altcoin among the top 500 by market cap at the time of writing.

CoW Protocol’s gains put it above Vana (VANA), Story (IP) and Polymath (POLY), which have also rallied between 26% and 42% in the past 24 hours.

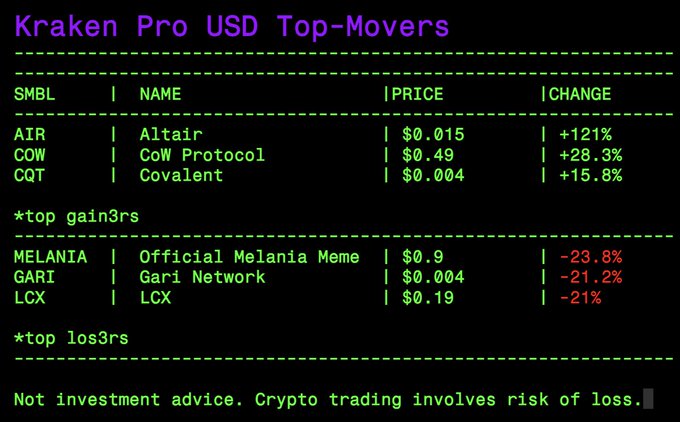

Kraken exchange pointed out that COW/USD has been among the top three on its platform.

Why is CoW Protocol price surging?

DeFi platform CoW Protocol’s main offerings include swaps, automated market making, and maximal extractible value (MEV) blocker.

On Feb. 25, the price of CoW Protocol went vertical as it exploded from lows of $0.28 to hit intraday highs of $0.56.

The gains, which at the daily peak included a 100% jump in token value, came as the crypto market reacted to news of the token’s listing.

Crypto exchange Upbit, the largest centralized exchange in South Korea, announced that it would be listing COW.

Spot trading pairs the exchange outlined for support starting on February 25, 2025 at 20:30 KST were BTC, Korean won and Tether (USDT).

Instant market reaction during the Asian trading session saw CoW Protocol’s native token go parabolic.

COW’s price reached $0.56 before retesting support at $0.48.

Prior to today’s surge, COW price had recoiled from supply reload zones around $0.44 and $0.46 in the past month.

COW price prediction

The highest price level in this period was the $0.61 that informed the bearish flip on January 31, 2025.

In this case, the DeFi protocol’s governance token has its price up 54% in the past week and -25% in the past month.

Downside action over the last 30 days coincided with weakness for top cryptocurrencies as Bitcoin price struggled below $100k.

But as BTC plummeted to near $88k amid fresh sell-off pressure, COW token seemed to defy this trend.

At the current price of $0.51, the gains see CoW Protocol hover about 56% from its all-time high of $1.22 reached on December 25, 2024.

If bulls keep the support level around $0.29, a key demand zone, intact, they could build fresh momentum to target $0.77 and then the psychological $1.

Both the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) on the daily chart support an upside continuation.

The MACD sees a bullish crossover with a rising histogram, while the RSI is at 57 after flipping from the oversold territory.

Profit taking may nonetheless see bears target levels below $0.29.

The post Why CoW Protocol is soaring 60% while the crypto market struggles appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.