0

0

This article was first published on The Bit Journal.

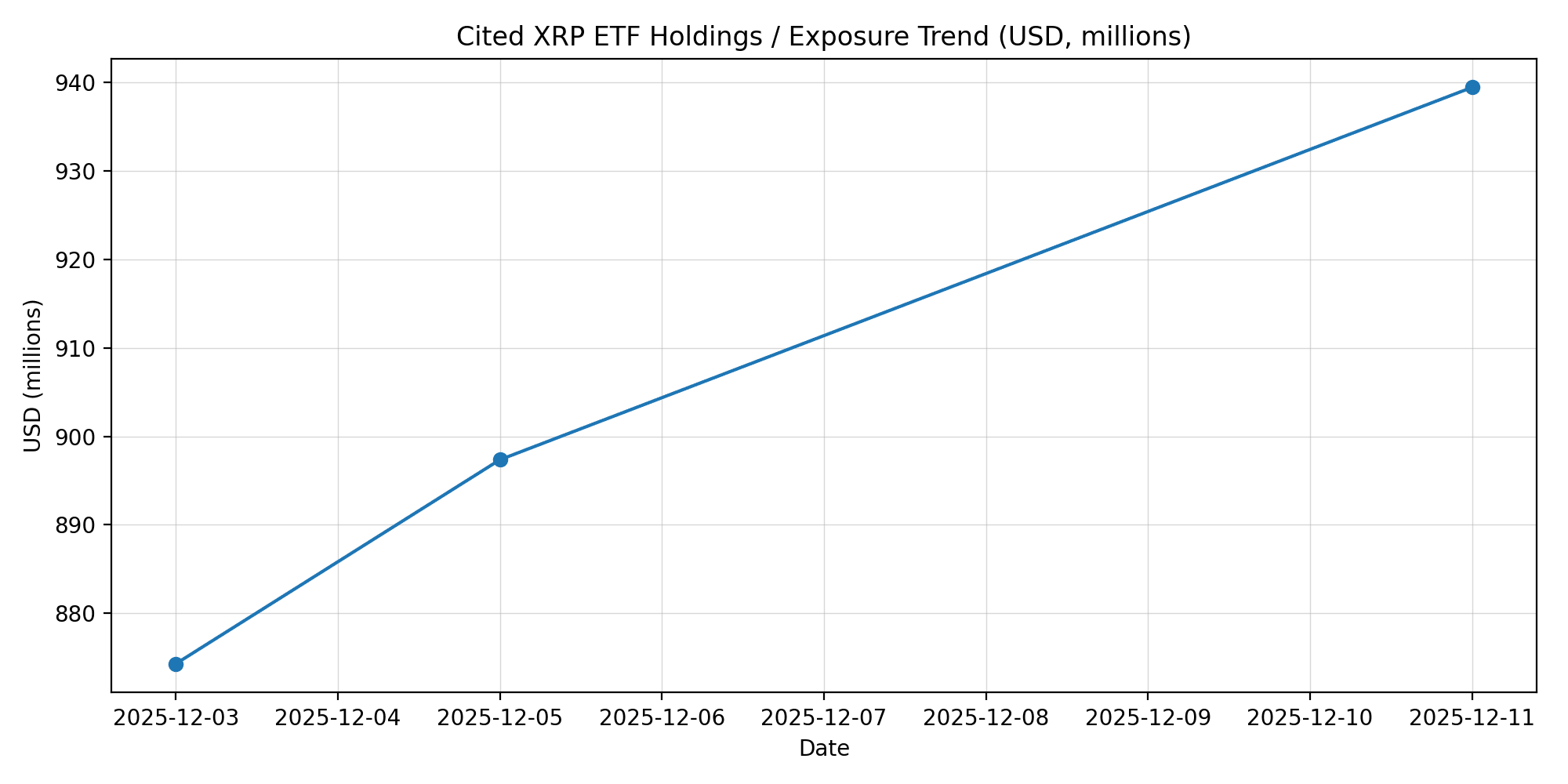

ETF-held XRP exposure has risen to about $939.46 million after roughly $10.2 million in new buying over the past 2 weeks, based on flow updates dated December 11, 2025. The number is close to $1B, but the real signal is the cadence. A steady stream of adds usually comes from process-driven accounts, not impulse.

The XRP ETF flow tape has shown repeated daily inflows since mid-November, with cumulative inflows cited around $954 million as of December 10. A streak matters because it implies breadth. Instead of one whale, it points to many tickets landing across multiple sessions.

As assets grow, trading gets easier. More size typically attracts tighter spreads and smoother creations and redemptions, which reduces friction for the next buyer. That is where the XRP ETF story starts to matter beyond headlines.

For institutions, the XRP ETF wrapper turns a volatile token into something that fits standard custody, compliance, and reporting. That does not eliminate risk, but it lowers operational headaches, which can be the difference between watching from the sidelines and sizing a position.

The structure also encourages gradual scaling. Committees often start small, review behavior, then add again. When the XRP ETF keeps seeing net adds, it suggests that testing phase is still rolling forward.

Price is the scoreboard, but it is not the whole game. Trend tools like moving averages help map direction. Support and resistance zones show where liquidity previously clustered, and they often shape the next move. Momentum gauges such as RSI and MACD can hint when a run is stretched or when selling pressure is easing.

Derivatives can confirm or contradict the spot story. Open interest shows how crowded a trade is, while funding rates reveal whether leveraged longs or shorts are paying to stay in. If open interest rises fast while price stalls, leverage may be building under the surface.

ETF metrics add a third layer. Daily flows show appetite, assets under management show staying power, and the gap between trading price and net asset value can signal stress. When the XRP ETF draws inflows even during choppy sessions, it often reads like allocation, not adrenaline.

Hitting $1B does not guarantee a rally. Macro conditions, liquidity, and risk appetite still steer price. But scale can improve market quality. A larger XRP ETF complex can attract more market makers, deepen order books, and make execution cleaner for large allocators who care about precision.

The flip side is digestion. If inflows slow abruptly or premiums widen, the market may be cooling. Watching the XRP ETF flow trend alongside volatility often gives a clearer picture than price alone.

A $10.2 million daily add has pushed ETF-held XRP exposure to about $939.46 million and kept the march toward $1B alive in this cycle. The bigger takeaway is consistency: repeated inflows, growing assets, and a structure that fits institutional workflows. If the pattern holds, the XRP ETF bid can keep shaping liquidity and sentiment even when price swings. This content is for informational purposes only and does not constitute financial advice.

What does the net assets figure represent?

It is the dollar value of XRP exposure held inside the fund structure.

Do inflows force price higher?

No. Flows help demand, but price still depends on liquidity, leverage, and broader sentiment.

Why watch net asset value?

It helps show whether the fund trades close to the value of what it holds.

XRP ETF: A regulated exchange-traded fund structure that provides XRP exposure.

Net inflow: New money entering a fund after outflows are subtracted.

Net asset value: The per-share value of the fund’s underlying holdings.

Open interest: The number of outstanding derivative contracts.

Read More: XRP ETF Holdings Near $1B After Fresh $10.2M Inflow">XRP ETF Holdings Near $1B After Fresh $10.2M Inflow

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.