Why is the Crypto Market Up Today?

0

0

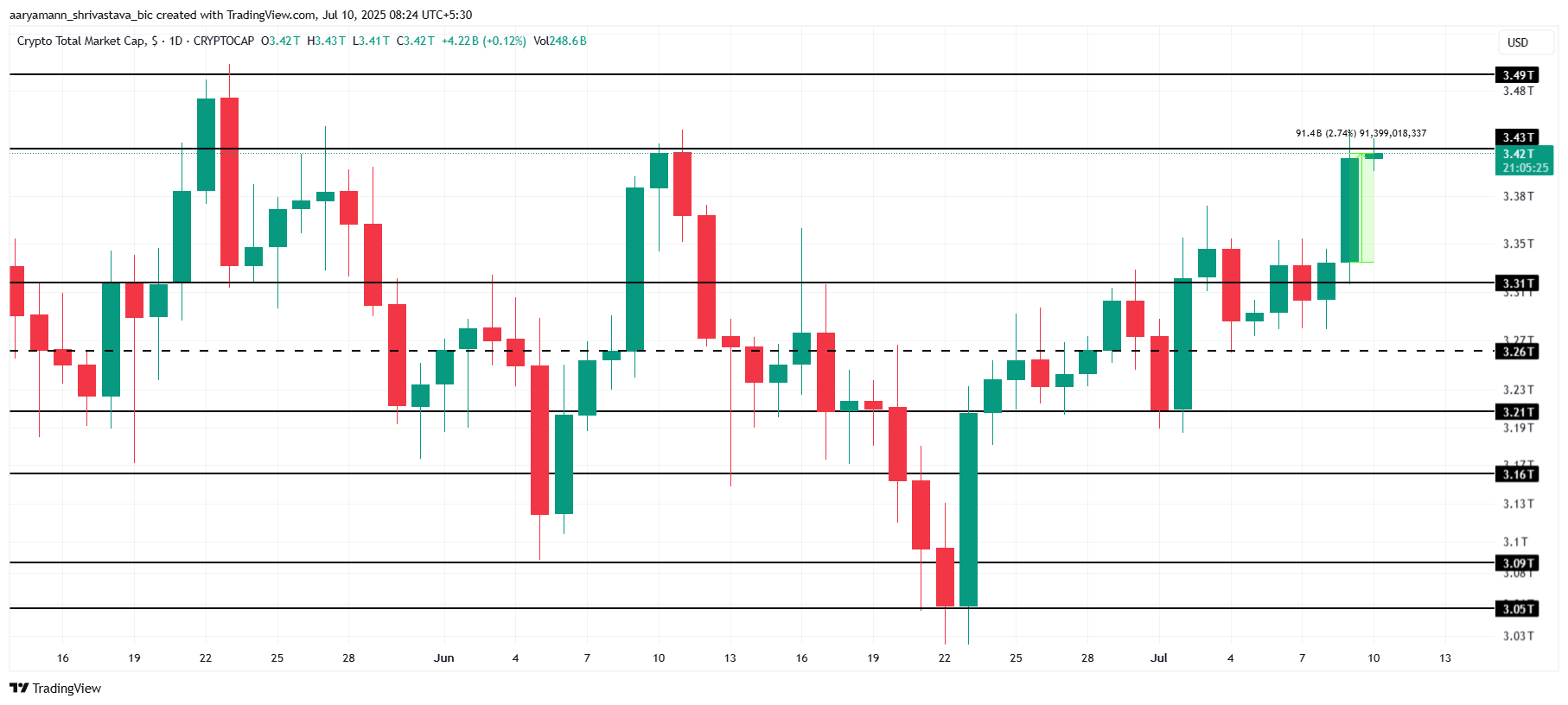

The total crypto market cap (TOTAL) rose by $91 billion, propelled by a rally in tech stocks. Bitcoin’s (BTC) price formed a new all-time high at $111,999, inches from crossing $112,000. SPX6900 (SPX) led the rally among the altcoins, marking a 12% rise, now standing 16% from the ATH.

In the news today:-

- President Donald Trump has announced a 50% tariff on Brazilian imports, set to take effect on August 1, citing “unfair trade practices” and criticism of Brazil’s Supreme Court. The move escalates tensions following diplomatic issues, including Bolsonaro’s ongoing trial for inciting an anti-democratic coup attempt.

- The Federal Reserve’s most recent meeting minutes, released on Wednesday, indicate that the majority of policymakers anticipate interest rate cuts to start this year, potentially as early as July 30. The minutes from the June 17–18 meeting confirmed that the central bank maintained its benchmark rate at 4.25% to 4.50%.

The Crypto Market Jumps

The total crypto market cap saw a significant boost, rising by $91 billion to reach $3.42 trillion. This surge was driven by the strong performance of tech stocks, which in turn positively impacted the crypto market. The correlation between tech stocks and crypto assets is evident in this movement.

TOTAL is currently facing a key resistance level at $3.43 trillion, which has kept the market cap from rising further over the past two months. If this resistance is broken and secured as support, it could pave the way for additional gains, pushing the market cap to higher levels.

Total Crypto Market Cap Analysis. Source: TradingView

Total Crypto Market Cap Analysis. Source: TradingView

However, if the crypto market follows past patterns, TOTAL could face a retracement and fall back to the support level of $3.31 trillion. A drop to this level would suggest that the bullish momentum has weakened, and the market could experience further consolidation before attempting another rally.

Bitcoin Forms New ATH

Bitcoin’s price currently sits at $111,171, following a new all-time high (ATH) of $111,999 achieved within the last 24 hours. This rise has been fueled by strong support from investors and positive broader market cues, signaling renewed confidence in Bitcoin’s potential to sustain upward momentum.

Crossing the critical $112,000 mark remains essential for Bitcoin to attract further momentum. If Bitcoin manages to break this resistance, it could spark a surge in investor FOMO (fear of missing out), driving increased inflows and potentially pushing the price to a new ATH. This would confirm the bullish sentiment.

Bitcoin Price Analysis. Source: TradingView

Bitcoin Price Analysis. Source: TradingView

On the other hand, if Bitcoin faces selling pressure from investors, it could fall back below $110,000, with the risk of a further drop to $108,000. A breach of these support levels would invalidate the bullish outlook, signaling a possible market correction and a loss of momentum.

SPX6900 Nears Monthly High

SPX has surged 11.5% in the last 24 hours, currently trading at $1.52. The price is just under the key resistance of $1.55, marking a significant rise for the meme coin this month. This upward movement signals increasing investor interest and a potential for further gains if the trend continues.

Currently, SPX stands about 16% away from reaching its all-time high (ATH) of $1.77. To achieve this target, SPX must first flip the $1.55 resistance level into support. Successfully securing this level will increase the likelihood of continued upward momentum, bringing the altcoin closer to its ATH.

SPX Price Analysis. Source: TradingView

SPX Price Analysis. Source: TradingView

However, if SPX fails to break and hold $1.55 as support, the price could consolidate above the local support of $1.42. A drop below this level could lead to a fall back to $1.25, potentially invalidating the bullish outlook and erasing the recent gains.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.