Why These Altcoins Are Trending Today — April 24

0

0

After several days of heightened trading activity, the broader crypto market is showing signs of cooling off. Over the past 24 hours, total market capitalization has dipped by nearly $20 billion, reflecting a pause in momentum and a more cautious sentiment among traders.

Despite the slowdown, a few altcoins are drawing significant attention from investors. Some of them include Berachain (BERA), PancakeSwap (CAKE), and KernelDAO (KERNEL).

Berachain (BERA)

Layer-1 (L1) coin BERA is a trending altcoin today. It is down 8% over the past day, aligning with the broader market decline. At press time, BERA trades at $3.40. On the daily chart, the coin’s negative Elder-Ray Index reflects the selling pressure among market participants.

As of this writing, this momentum indicator, which measures the strength of buyers (bull power) and sellers (bear power) by comparing an asset’s high and low prices to its exponential moving average (EMA), is at -0.49.

When an asset’s Elder-Ray Index returns a negative value like this, bear power dominates. Hence, BERA risks falling to $3.18.

BERA Price Analysis. Source: TradingView

BERA Price Analysis. Source: TradingView

On the other hand, a spike in new demand could push BERA’s price to $3.91.

PancakeSwap (CAKE)

BNB-based CAKE is another trending altcoin today. It currently trades at $1.93, having dropped 5% in price over the past 24 hours. Its Balance of Power (BoP) rests at -0.77, reflecting the selling activity among CAKE holders.

The BoP indicator measures the strength of buyers versus sellers by comparing closing prices to trading ranges. When BOP is negative, sellers dominate the market, suggesting bearish momentum and potential downward price pressure.

If CAKE sellers remain in control, they could push its price below the support at $1.91 and toward $1.61.

CAKE Price Analysis. Source: TradingView

CAKE Price Analysis. Source: TradingView

However, if CAKE accumulation commences, the token could witness a rebound and climb toward $2.09.

KernelDAO (KERNEL)

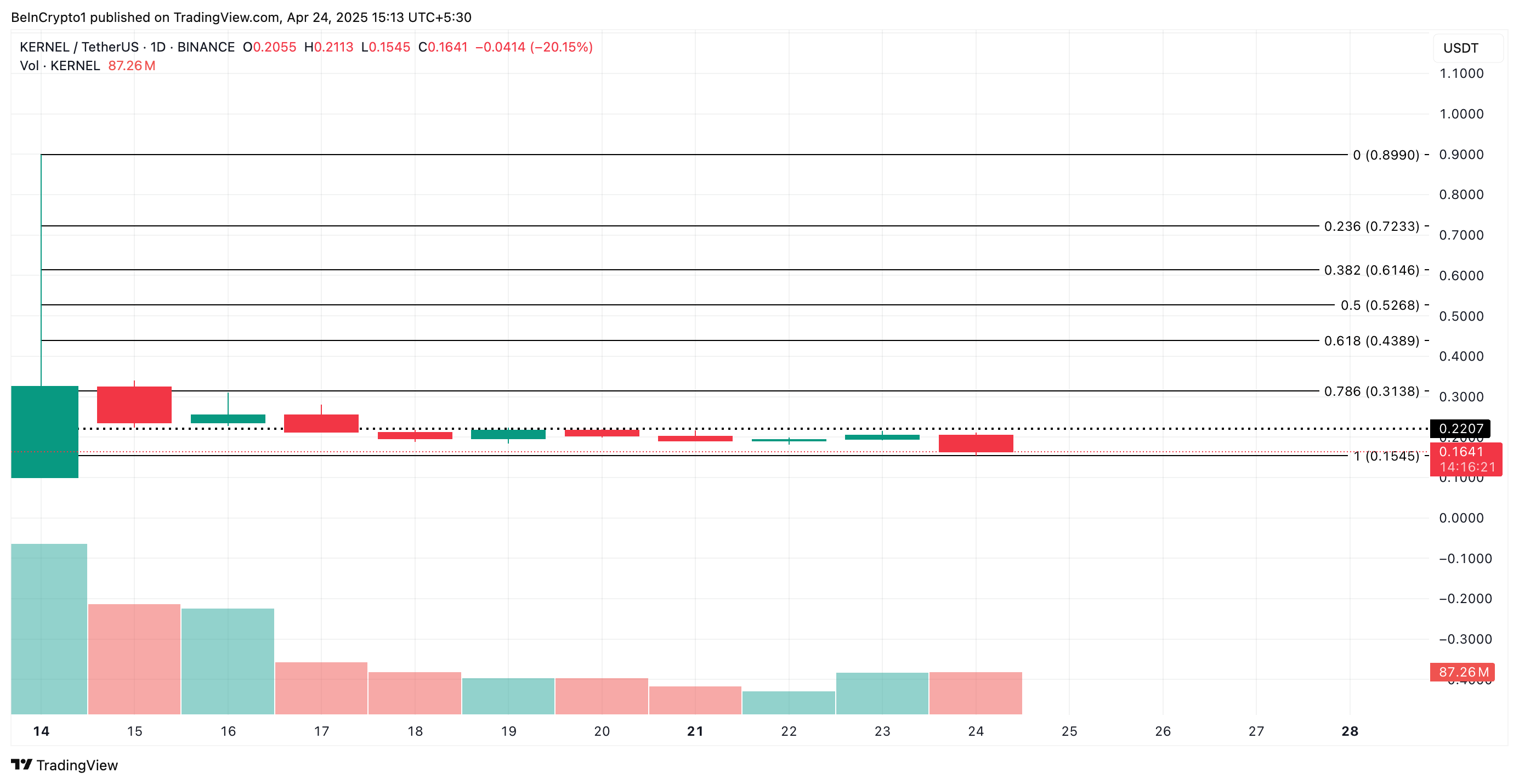

KERNEL is another altcoin that has caught traders’ attention today. It is down 19% over the past day, and currently trades at $0.16.

Its daily trading volume has rocketed by over 150%, highlighting the strengthening sell-offs among KERNEL traders.

When an asset’s price drops while its trading volume increases, it signals that investors are selling off their positions in high volumes. This indicates strong bearish sentiment with many KERNEL traders exiting the market, setting the stage for further declines.

If this continues, KERNEL’s price could revisit its $0.15.

KERNEL Price Analysis. Source: TradingView

KERNEL Price Analysis. Source: TradingView

Conversely, if demand soars, the token could rally to $0.22.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.