Ethereum Validator Queue Grows to Over 9,000 Amid Restaking Mania

0

0

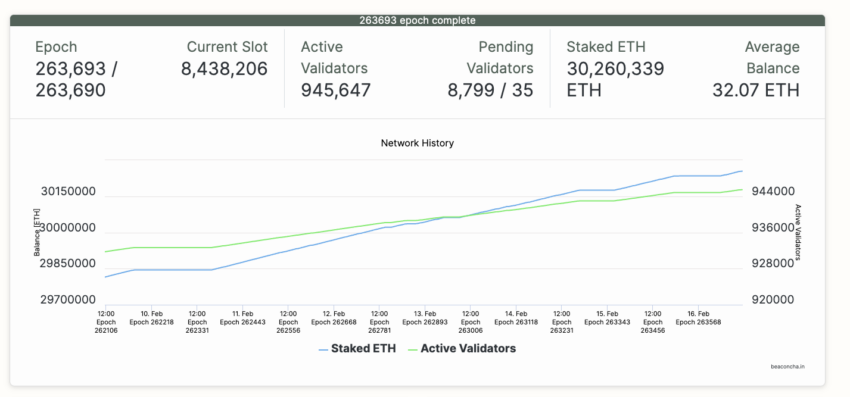

There are currently almost 9,000 validators waiting in line on the Ethereum network as the crypto’s price touches $3,000. The number of validators could hit one million by April’s Bitcoin halving as restaking takes off.

Ethereum Explorer beaconcha.in reveals 8,799 aspiring validators who could, when added to the network, take the number of validators closer to one million. No validators intend leaving the network.

Validators Crowd For Restaking Potential

In the past week, the amount of ETH staked on the network reached $1.24 billion. The network also onboarded 12,741 nodes over the same period. The total number of active validators is now at 945,647.

Read more: What Are Nodes?

Staked ETH and Active Validators | Source: Beaconcha.in

Staked ETH and Active Validators | Source: Beaconcha.in

The so-called Ethereum merge in 2022 changed Ethereum’s consensus mechanism from proof-of-work to proof-of-stake. This upgrade replaced miners with validators who are incentivized to secure the network. After that, node validators could stake 32 ETH to secure the network and earn crypto rewards.

Many aspiring validators come amid the rise of applications that could increase the returns from staked ETH. So-called restaking services boost returns by restaking staked ETH invested in liquid staking services like Lido Finance and Ethereum. Crypto analyst and trader Miles Deutscher said that restaking would be one of several opportunities to reap significant returns in 2024.

“Restaking is a form of staking that enables you to stake your ETH again. So if you had already staked your Ethereum in a liquid staking protocol like Lido, you can take that staked ETH and stake it in another middleware solution which gives you additional yield, so you’re essentially stacking yield on top of yield,” Deutscher said.

How Ethereum Mistook Validator as CEX

On its own, the Ethereum staking smart contract offers roughly 4% in annual percentage yield to its validators. Those who do not have the required amount can add their tokens to a staking pool to earn rewards.

Institutions can also earn revenue by staking ETH on multiple nodes on behalf of customers. Such a service removes the hassle of setting up the Ethereum software on a person’s computer. In exchange, companies take a small cut of the rewards.

Read more: What Is Crypto Staking? A Guide to Earning Passive Income

However, not all large validators are institutions. One individual who has staked 32,000 ETH across 1,000 nodes recently claimed he could not collect staking rewards because he was mistaken for a centralized crypto exchange.

BeInCrypto reached out to lead ETH developer Tim Beiko for comment on the node validator count reaching one million but did not hear back at press time.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.