Pepe whale dumps billions of tokens at a loss: what’s next for PEPE price?

0

0

While bears dominated the crypto market on Monday, large-scale players seemed to surrender.

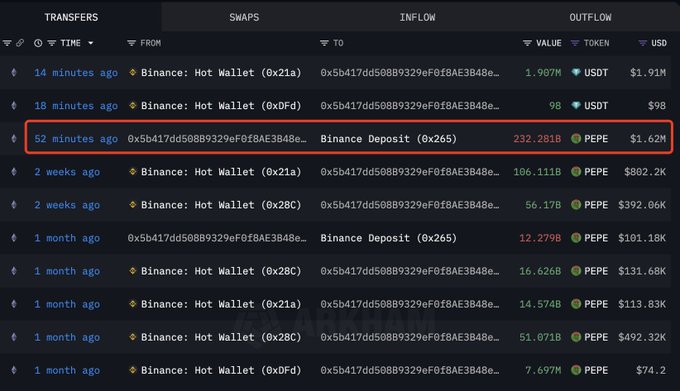

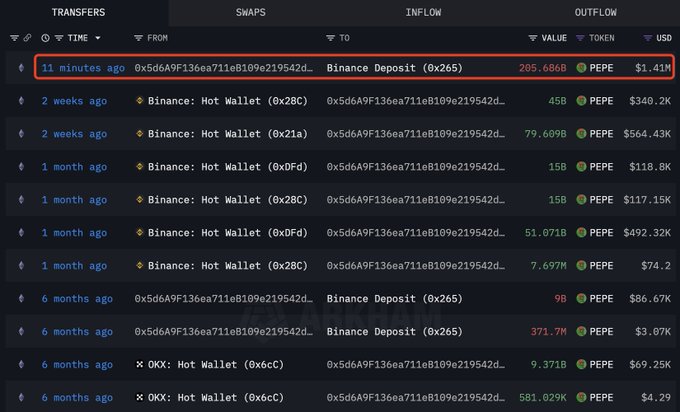

Analytics platform Lookonchain highlighted a key transaction involving the meme token Pepe.

Details show a crypto whale offloaded around 438 billion PEPE coins, worth approximately $3.01 million, incurring $434,000 in losses.

The investor’s decision to sell despite staggering losses has sparked debate about Pepe’s short-term trajectory.

Has the investor reduced exposure to prevent magnified losses as PEPE heads for further dips?

Cryptocurrency whales are entities holding massive amounts of digital assets.

They influence market trends with their transactions.

Meanwhile, enthusiasts use their movements to predict potential price directions.

Meanwhile, whales often dump assets with less profitability and switch to lucrative options.

Thus, the immense PEPE dump grabbed analysts’ and investors’ attention.

The massive transactions underscore faded confidence by large-scale investors.

That indicates a weakness in PEPE’s near-term price performance.

Other potential reasons for the significant sell-offs could be portfolio rebalancing or collecting liquidity for a different investment opportunity.

Impact on PEPE

Massive sell-offs often catalyze panic among retail players, magnifying volatility.

The considerable whale dump might exert bearish pressure in the near term.

The substantial supply will likely outpace the current demand, especially with the existing broad-based downtrends.

Nevertheless, the degree of impact will depend on whether other whales will follow suit.

Buy-side interest might absorb the selling momentum to prevent short-term effects.

Also, some players could view the dump as an opportunity to buy PEPE, expecting significant rebounds during recoveries.

PEPE price outlook

Pepe trades at $0.000007007 after a slight 1.25% surge in the past 24 hours.

However, PEPE lost over 8% in the past week.

The downtrend has likely forced top players to adjust their holdings, explaining the whale sell-offs.

A technical analysis hints at more PEPE declines.

The frog-themed token plummeted from $0.00000927 – the peak it hit after breaching a descending trendline.

PEPE tries to secure the $0.00000698 support (0.50 FIB level).

Stability above this foothold could catalyze bounce-backs to $0.00000811, opening the gates to $0.00000927.

However, failure to sustain the 0.50 FIB zone could trigger intense sell-offs.

Such trends might see PEPE revising $0.00000653 (0.618 FIB) and $0.00000593 (0.786).

That would mean an approximately 18% decline from Pepe’s current price.

The 1D Moving Average Convergence Divergence reflects waning momentum, indicating an impending bear takeover.

The indecisive broad market adds to PEPE’s uncertainty.

Michael van de Poppe highlights this week as crucial for digital assets, with Trump’s new tariffs taking effect.

Meanwhile, gold rallies continue as altcoin struggles, indicating investor shift to safe-haven assets.

The crypto market remains on the edge, with economic and geopolitical factors influencing trading strategies.

The post Pepe whale dumps billions of tokens at a loss: what’s next for PEPE price? appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.