Ripple Partners With Franklin Templeton and DBS on Institutional Token Lending

0

0

According to new reports, Ripple, DBS Bank, and Franklin Templeton have signed a memorandum of understanding to expand the use of tokenized funds. The agreement brings Franklin Templeton’s tokenized money market product, Ripple’s RLUSD stablecoin, and DBS Digital Exchange into one ecosystem.

The plan aims to provide institutional investors with direct access to yield, liquidity, and borrowing options using blockchain-based assets.

What the Partnership Brings

- sgBENJI token: Franklin Templeton will issue sgBENJI, a tokenized version of its U.S. dollar short-term money market fund, on the XRP Ledger.

- DBS listing: DBS will list sgBENJI alongside Ripple’s RLUSD on its regulated exchange, allowing clients to swap between a stablecoin and a yield-bearing token.

- Collateral role: DBS plans to let clients use sgBENJI as collateral in repurchase agreements or through third-party lending platforms, with DBS acting as collateral agent.

Also Read: Why the SEC’s Franklin XRP ETF Delay Might Be Bullish for Ripple Investors

Why Tokenized Funds Matter

Tokenized funds make traditional investment products more flexible. They settle trades in seconds, record movements on blockchain for transparency, and give investors tools to rebalance portfolios without friction.

Institutions gain stronger liquidity, while investors can hold tokens that both earn yield and serve as collateral. Analysts view tokenized assets as a practical bridge between money markets and digital finance.

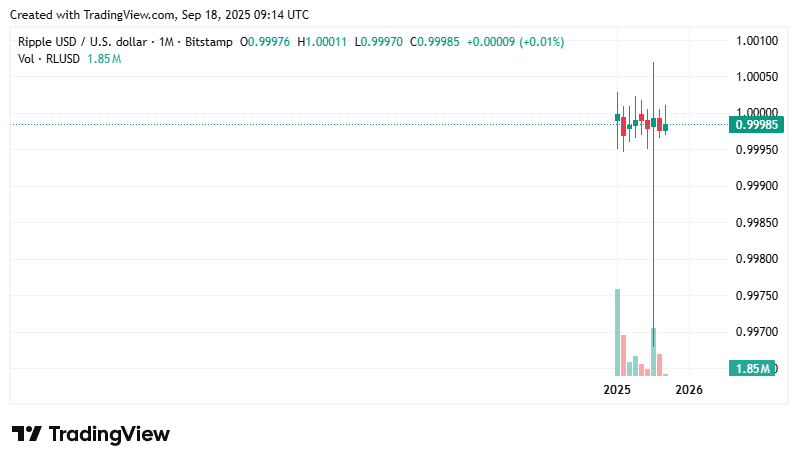

RLUSD Snapshot

- Market cap: About US$729 million in September 2025, more than ten times higher than at the start of the year.

- Price: RLUSD trades close to $0.9997, holding its peg to the U.S. dollar.

- Volume: Daily turnover ranges between US$49 million and US$89 million across exchanges.

Quotes

“This initiative strengthens our leadership in digital assets and gives our clients trusted tools to build their portfolios,” said the CEO of DBS Digital Exchange.

“Allowing repo trades for a tokenized money market fund with RLUSD lets investors shift smoothly between stablecoins and yield assets in one ecosystem,” said Ripple’s head of trading and markets.

How Investors Can Use Tokenized Funds

| Use Case | Advantage |

|---|---|

| Yield | Earn returns by holding sgBENJI. |

| Collateral | Borrow funds with sgBENJI as collateral. |

| Rebalancing | Switch between RLUSD (stable) and sgBENJI (yield). |

| Efficiency | Lower costs and faster settlement. |

Conclusion

Based on the latest research, tokenized funds now show real value. Ripple, DBS, and Franklin Templeton combine RLUSD and sgBENJI in ways that support trading, lending, and collateral use on regulated platforms.

Tokenized funds bring liquidity, yield, and efficiency together, giving investors more than theory. They stand as a sign that blockchain finance is moving from pilot projects to everyday tools for institutions and, in time, broader markets.

Also Read: How Ripple Plans to Dominate as Tokenized Assets Set to Hit $18.9 Trillion by 2033

Summary

Ripple, DBS, and Franklin Templeton are reshaping finance with tokenized funds. The plan links Ripple’s RLUSD stablecoin with Franklin Templeton’s sgBENJI token on DBS Digital Exchange, offering trading, yield, and collateral features.

RLUSD holds close to $1.00 with a US$729 million market cap, while sgBENJI gives direct exposure to money market returns. Tokenized funds now combine safety and flexibility, setting a new standard for institutional investors.

Glossary of Key Terms

Tokenized funds: Investment funds issued as digital tokens on a blockchain.

RLUSD: Ripple’s stablecoin is pegged to the U.S. dollar.

sgBENJI: Tokenized version of Franklin Templeton’s U.S. dollar short-term money market fund.

Collateral: Asset pledged to secure a loan.

Repo: Short-term transaction where collateral is sold and later repurchased.

FAQs about Tokenized Funds

Q: Who can access these tokenized funds?

A: Accredited and institutional investors first. Retail access may follow with regulatory approval.

Q: Is RLUSD stable?

A: Yes. RLUSD maintains its peg near $1.00 and has a market cap of about US$729 million.

Q: How much has RLUSD grown in 2025?

A: RLUSD’s market cap grew more than tenfold in 2025, reaching US$729 million in September.

Q: What risks do tokenized funds carry?

A: They include regulatory changes, smart contract issues, and liquidity risks during market stress.

Read More: Ripple Partners With Franklin Templeton and DBS on Institutional Token Lending">Ripple Partners With Franklin Templeton and DBS on Institutional Token Lending

0

0

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요

한 곳에서 모든 암호화폐, NFT 및 DeFi 를 관리하세요시작하는 데 사용하는 포트폴리오를 안전하게 연결하세요.