El Salvador Halts Public Sector Bitcoin Purchases to Comply with IMF Loan Terms

0

0

Highlights:

- El Salvador halts public sector Bitcoin purchases following the $1.4 billion IMF loan agreement.

- The IMF agreement forces to stop Bitcoin accumulation and related activities in the country.

- El Salvador stops public sector Bitcoin purchases but increases holdings through other methods.

In a recent press briefing, the International Monetary Fund (IMF) Western Hemisphere Department disclosed that El Salvador has ceased using public sector funds for Bitcoin (BTC) acquisitions. This decision follows an agreement made in December between El Salvador and the IMF.

The agreement, which includes a $1.4 billion loan, requires the government to withdraw Bitcoin’s legal tender status. It also mandates the cessation of further BTC purchases by the government. Although President Nayib Bukele first pushed back, Rodrigo Valdes said the government is now following the agreement.

Initially, President Nayib Bukele resisted the IMF’s conditions. However, recent developments suggest that the administration has now agreed to these requirements.

Valdes said:

“In terms of El Salvador, let me say that I can confirm that they continue to comply with their commitment of non-accumulation of bitcoin by the overall fiscal sector, which is the performance criteria that we have.”

Valdes pointed out that this is a key issue in El Salvador’s discussion. The program goes beyond Bitcoin, focusing on reforms, governance, and transparency. Along with halting public sector Bitcoin purchases, the IMF highlights that El Salvador is fulfilling fiscal transparency requirements. The country is also making progress with structural reforms.

The IMF said El Salvador remains in compliance with its pledge to stop Bitcoin accumulation in the public sector, a key performance target. It added that broader reforms in areas like governance, fiscal transparency, and structural changes are also progressing.…

— Wu Blockchain (@WuBlockchain) April 27, 2025

IMF Calls for Reduced Public Sector BTC Involvement

On March 3, the IMF proposed a new extended arrangement for El Salvador as part of its $1.4 billion fund. The memorandum advised that the public sector should not voluntarily accumulate Bitcoin. It also recommended avoiding Bitcoin-related debt or tokens that create financial obligations.

El Salvador Continues Bitcoin Purchases Despite Stopping Public Sector Purchases

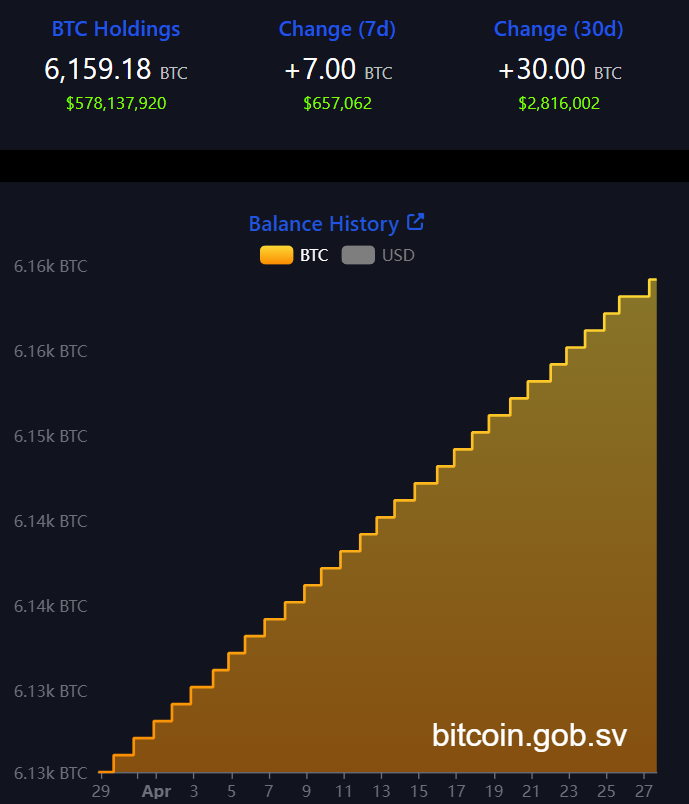

Although public-sector Bitcoin purchases have stopped, blockchain data reveals that El Salvador is still increasing its Bitcoin holdings through alternative methods. As of now, the country holds nearly 6,159 Bitcoin, an increase from around 6,055 Bitcoin in February.

El Salvador’s treasury acquired 7 Bitcoins, worth over $650,000, in the seven days leading up to April 27.

As interest in digital assets grows, this strategy could benefit the country in the long run. Forecasts like Ark Invest’s prediction of Bitcoin reaching $2.4 million by 2030 strengthen confidence in this plan. Bitcoin is currently priced at $93,932 with a 0.35% increase in the last 24 hours, according to CoinMarketCap. The cryptocurrency recently surpassed Silver and Amazon, securing its position as the sixth most valuable asset worldwide.

The government continues its strategy of acquiring about one Bitcoin daily. However, the IMF has confirmed these purchases no longer use public funds tied to the IMF agreement. El Salvador now holds the sixth-largest Bitcoin reserve, following the US, China, the UK, Ukraine, and Bhutan, according to BitBo’s Bitcoin Treasuries data.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.