After $19B Meltdown: How Cardano and Dogecoin Spark Market’s Emotional Comeback

0

0

The crypto market has always been a stage for drama, but the last few days tested even the boldest traders. A sudden $19 billion liquidation wave, triggered by tariff threats between Washington and Beijing, sent shockwaves through global exchanges.

Yet, within 48 hours, the mood flipped. Cardano and Dogecoin have emerged as surprise heroes, fueling an emotional but determined comeback.

From Panic to Poise

Friday’s panic began when fresh U.S. tariff remarks rattled investors. Bitcoin briefly plunged below $110,000, dragging altcoins into chaos. Over $19 billion in leveraged positions evaporated, a record-breaking purge of overconfident longs. It looked like another capitulation event, the kind that leaves retail traders licking their wounds.

But by Sunday, the tone shifted. “This felt like a massive emotional reset,” said Justin d’Anethan of Keyrock. “Everyone got punished, but the structure remains solid.” His point echoed across trading desks: beneath the noise, institutional flows remain firm, exchange reserves low, and sentiment surprisingly resilient.

The Altcoin Awakening

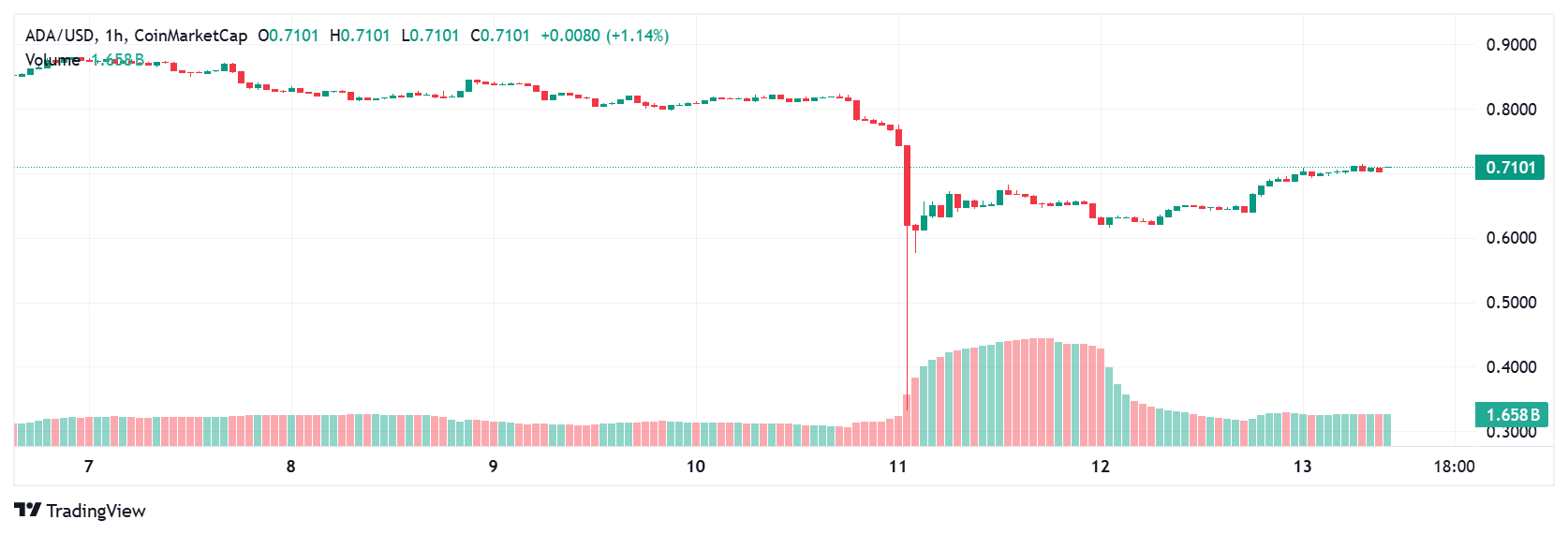

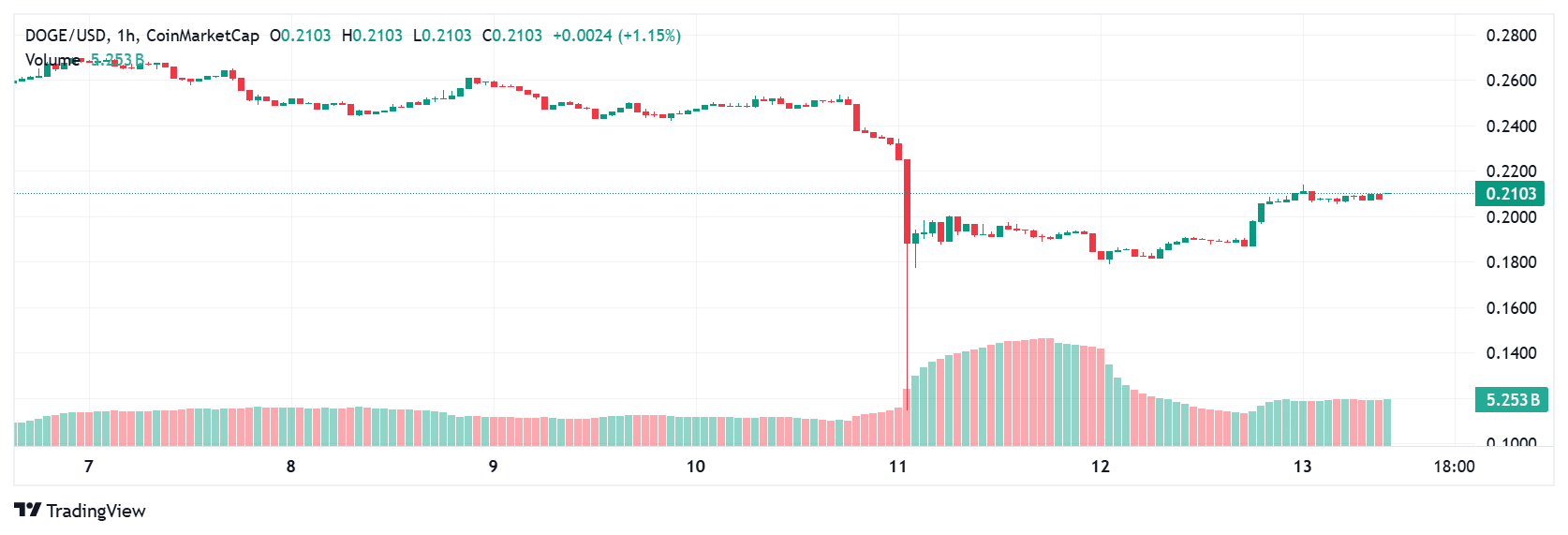

Cardano and Dogecoin led the charge out of the ashes. ADA rose nearly 10%, trading near $0.70, while DOGE climbed above $0.20. Both tokens benefited from their community-driven momentum and a wave of opportunistic buying. Ethereum and BNB followed, surging 8% and 12% respectively, while XRP and Solana posted steady 6–7% gains.

The recovery wasn’t just mechanical. On-chain data revealed strong inflows to wallets holding ADA and DOGE, hinting at retail re-entry. Analysts described this as “a psychological turning point,” where investors stopped reacting and started anticipating again.

The Role of Sentiment and ETF Inflows

ETF inflows continue to paint a supportive backdrop. According to recent data, net positive inflows into Bitcoin and Ethereum products have persisted despite volatility. These inflows suggest institutional conviction hasn’t cracked.

Meanwhile, derivative funding rates, a measure of leverage bias, flipped from heavily long to neutral, cooling speculative heat. It’s the kind of setup traders interpret as “healthy reset,” one that clears the field before a potential next leg up.

Why Cardano and Dogecoin Matter

It’s easy to dismiss ADA and DOGE as retail darlings, but their behavior often reflects crowd psychology. Cardano’s methodical ecosystem updates, such as its scaling roadmap and growing DeFi participation, have given investors something to hold onto. Dogecoin, on the other hand, thrives on sentiment and cultural recognition.

As one trader on X wrote, “DOGE is more than a meme, it’s a heartbeat of crypto retail. When DOGE moves, it means confidence is coming back.” That pulse appears to be quickening again.

Price Outlook and Market Path Ahead

If Bitcoin continues to hover above $115,000, analysts expect ADA to target $0.78 and DOGE to test $0.23 within the week. Ethereum’s strength above $4,100 could attract more liquidity into altcoins. Still, the market remains cautious. Any renewed tariff tension or macro shock could swiftly unwind gains.

For now, the rebound feels earned, not speculative. It’s a reminder that crypto, despite its theatrics, rewards patience after panic.

Summing Up

The $19 billion liquidation was a brutal reset, but not a fatal one. Cardano and Dogecoin have reminded investors that volatility cuts both ways, pain first, then opportunity. With ETF inflows steady and sentiment thawing, the market seems ready to rebuild on firmer ground.

Whether this marks the start of a sustained rally or just another emotional swing, one thing is clear: crypto’s resilience is alive and well.

Frequently Asked Questions

1. Why did the crypto market crash recently?

The crash was sparked by tariff threats between the U.S. and China, triggering mass liquidations worth nearly $19 billion in leveraged positions.

2. Why are Cardano and Dogecoin leading the recovery?

Both have strong retail communities and lower entry prices, making them attractive during market rebounds.

3. What are ETF inflows and why do they matter?

ETF inflows represent institutional money entering crypto-linked funds, signaling confidence even during volatility.

4. Can this rebound last?

If macro conditions remain stable and ETF inflows continue, the recovery could extend. But renewed policy shocks could reverse momentum.

Glossary of Key Terms

Liquidation: Forced closure of leveraged positions when collateral falls below maintenance margin.

ETF (Exchange-Traded Fund): A financial instrument allowing exposure to crypto assets via traditional markets.

Altcoin: Any cryptocurrency other than Bitcoin.

Funding Rate: A fee paid between traders to balance long and short positions in futures markets.

Read More: After $19B Meltdown: How Cardano and Dogecoin Spark Market’s Emotional Comeback">After $19B Meltdown: How Cardano and Dogecoin Spark Market’s Emotional Comeback

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.