XRP Futures Set Open Interest Record at CME, With $3.70 Eyed Next

3h ago•

bullish:

0

bearish:

0

Share

News Background

- CME Group said its crypto futures suite has surpassed $30 billion in notional open interest for the first time, with SOL and XRP futures each crossing $1 billion. XRP became the fastest contract to hit the milestone, doing so in just over three months.

- The development is viewed as a signal of market maturity and new institutional capital entering derivatives.

- Broader crypto markets remained firm into late August, though regulatory overhang in the U.S. has continued to pressure XRP relative to peers.

- Corporate adoption trends and pilot remittance programs keep XRP in focus for treasury desks, even as volatility spikes test investor conviction.

Price Action Summary

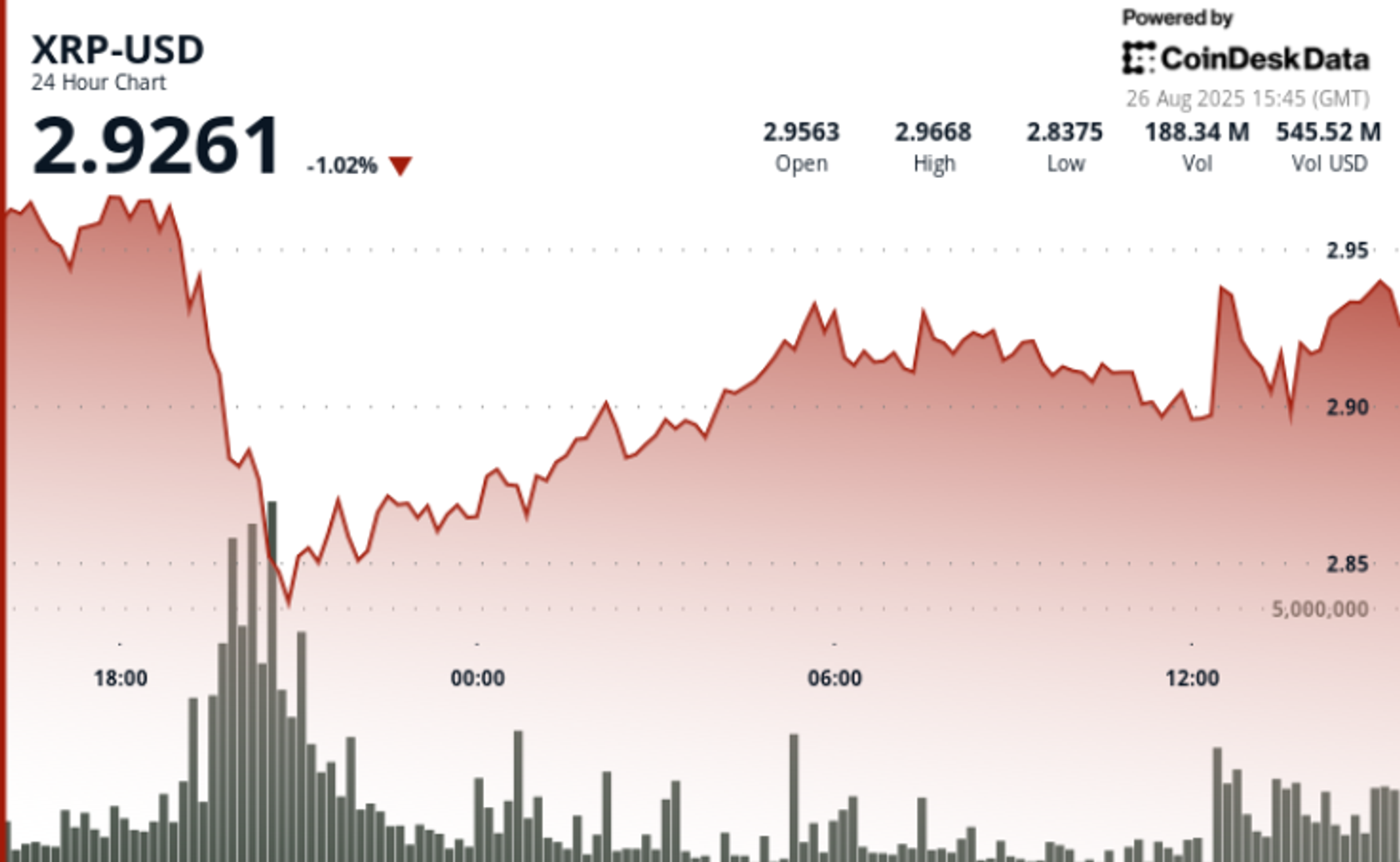

- XRP traded through a 5% range between $2.98 and $2.84 in the 24-hour session ending August 26 at 14:00.

- The steepest move occurred on August 25 during evening hours, when XRP dropped from $2.96 to $2.84 on 217.58 million tokens — triple its 72.45 million daily average.

- The token rebounded to $2.92, with the $2.84 level emerging as critical support as institutional flows stepped in.

- In the final hour of trading, XRP rose 0.7% from $2.90 to $2.92 on more than 5.7 million volume, signaling fresh corporate and fund participation.

Technical Analysis

- Support confirmed at $2.84 with high-volume absorption of sell pressure.

- Resistance remains at $2.94–$2.95, with repeated profit-taking capping upside attempts.

- RSI climbed from oversold 42 back into mid-50s, suggesting stabilizing momentum.

- MACD histogram tightening, indicative of potential bullish crossover in coming sessions.

- Weekly momentum divergence patterns point to compressed volatility, setting up for a directional breakout.

- Order books show concentrated institutional bids above $3.60, signaling strategic positioning ahead of regulatory catalysts.

What Traders Are Watching

- Bulls see $3.70 as the next upside target if $2.90–$2.92 base holds.

- Bears flag $2.80 as the downside trigger, with a break below support likely to accelerate losses.

- Derivatives flows now dominate the backdrop: CME’s $1B open interest in XRP futures will be a key barometer of institutional conviction.

3h ago•

bullish:

0

bearish:

0

Share

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.