Max Keiser Warns of US Debt Risk Amid $2 Trillion Stablecoin Projection | US Crypto News

0

0

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab a coffee for an intriguing dive into what experts say about growing stablecoin adoption. With dollar-pegged digital assets demonstrating significant growth, the threat is real, enough for the US Treasury to take notice.

Crypto News of the Day: Stablecoin Market To Reach $2 Trillion by 2028, US Treasury Projects

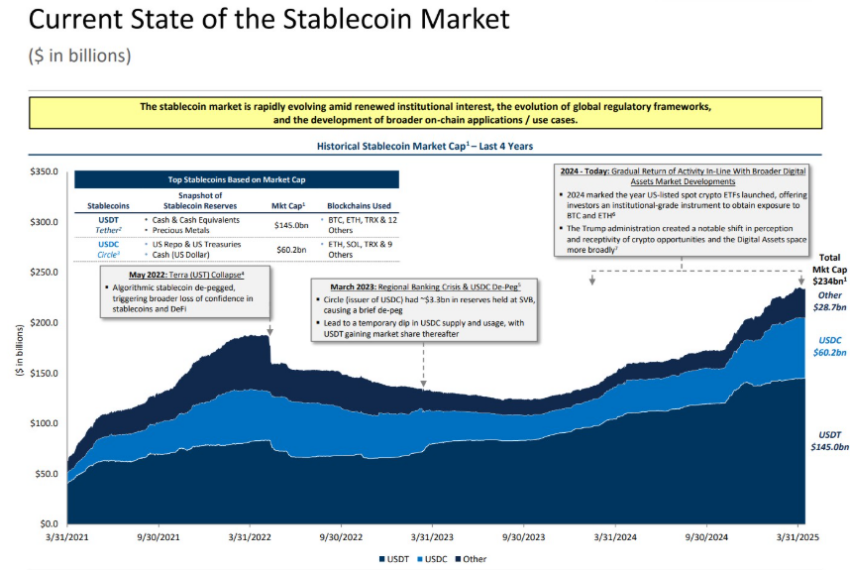

In its Q1 2025 report, the US Treasury Borrowing Advisory Committee (TBAC) projected that stablecoins could attain a market capitalization of $2 trillion by 2028.

“Evolving market dynamics, structures, and incentives have the potential to accelerate stablecoins’ trajectory to reach ~$2 trillion in market cap by 2028,” read an excerpt in the report.

As BeInCrypto reported, this would constitute a eightfold increase from its current level of approximately $234 billion, with USD-pegged stablecoins dominating (99%) the market.

MEXC exchange COO Tracy Jin agrees, adding that the milestone may be achieved as soon as 2026.

The US Treasury acknowledged that stablecoin issuers would be required to hold [short-dated] T-bills under new regulations. They said this would strengthen the correlation between US Treasury bill demand and stablecoin adoption.

Current state of the stablecoin market. Source: US Treasury

Current state of the stablecoin market. Source: US Treasury

However, the US Treasury also pointed out that stablecoin growth could compel retail banks to pay higher interest rates to depositors.

Against this backdrop, BeInCrypto contacted Max Keiser, who warned about the growing stablecoin market. The Bitcoin pioneer suggested it could exacerbate US debt levels and undermine the dollar’s value.

“Stablecoins are a financial hospice where fiat money like the US dollar goes to die,” Keiser told BeInCrypto.

Keiser argued that increased stablecoin usage dilutes the dollar’s value. In his opinion, the expansion and growth of stablecoin usage will eventually “work the US dollar to death.”

Can Stablecoins Supplant the US Dollar’s Reign? Standard Chartered Weighs In

Keiser linked the rise of stablecoins to increasing national debt, countering political promises of debt reduction.

“It also means that US indebtedness goes up, not down, as Trump has promised,” he added.

BeInCrypto also contacted Standard Chartered Head of Digital Assets Research Geoff Kendrick, who noted the Treasury’s adoption of their $2 trillion stablecoin forecast.

“US Treasury is using our $2 trillion stablecoin forecast for their own projection, as per this TBAC Presentation. The tail is really wagging the dog now,” Kendrick told BeInCrypto.

Kendrick anticipates a surge in stablecoin issuance following upcoming US legislation. While he agrees with the US Treasury’s forecast, there is a caveat, with Kendrick citing implications for the US Treasury bill (T-bill) market.

“Specifically, I think stablecoins will go from $230 billion to $2 trillion by the end of 2028. That growth will require an extra $1.6 trillion of US T-bills to be held as reserves, and that is all of the planned new T-bill issuance over that period,” he added.

Meanwhile, amidst these projects, Tether, the issuer of the world’s largest stablecoin USDT, is considering launching a US-only stablecoin by late 2025 or early 2026.

Tether CEO Paolo Ardoino revealed that discussions are ongoing as the Trump administration aims to position stablecoins as strategic financial tools and make the US a global crypto leader.

“We are just exporters of what we believe to be the best product the United States ever created — that is, the US dollar,” Ardoino said in an interview.

With growing stablecoin adoption expected to give more legitimacy to crypto, Bitcoin (BTC) could benefit from the resultant liquidity. Institutional investors are already pivoting to crypto over traditional assets, as a recent US Crypto News publication indicates.

Chart of the Day

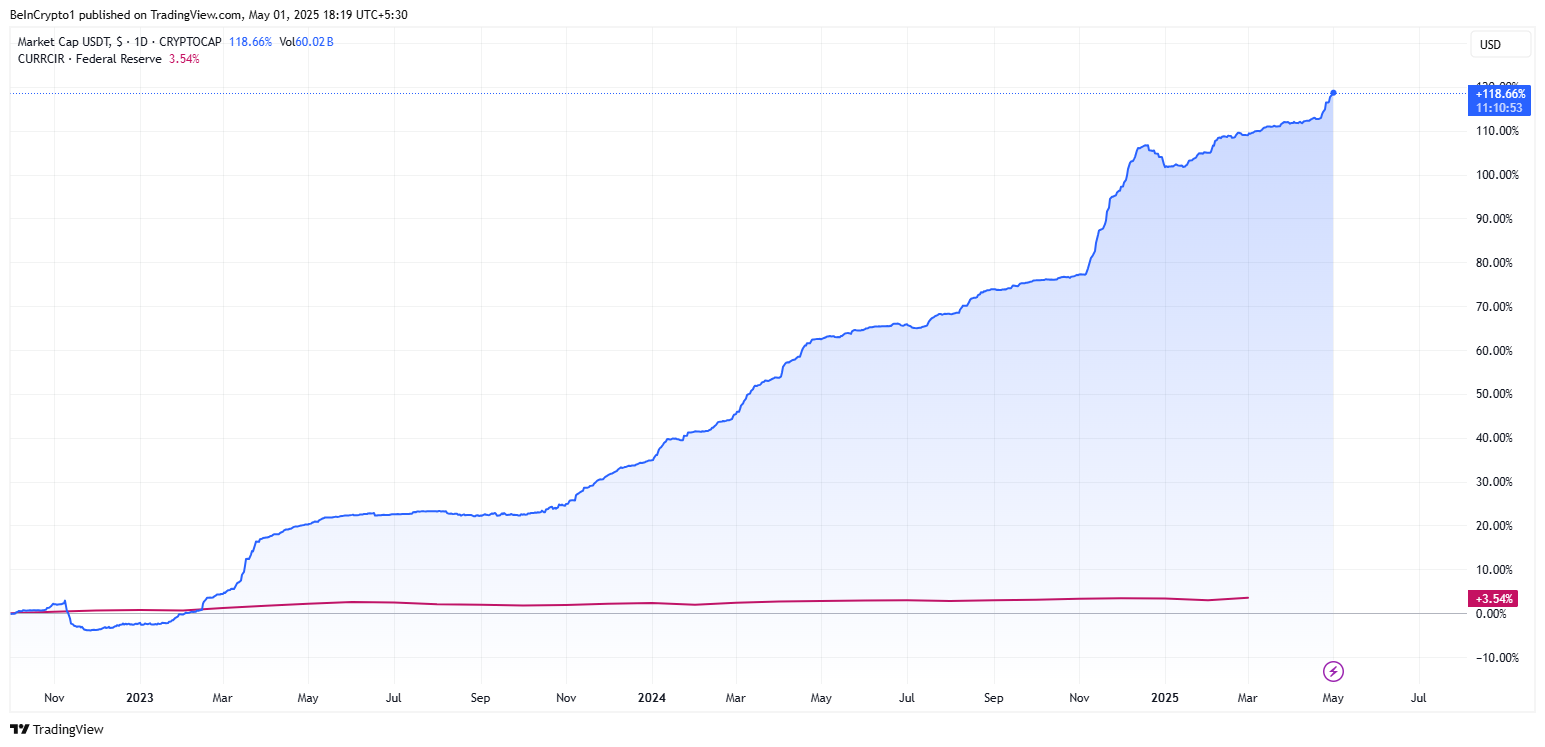

USDT stablecoin market cap vs. USD in circulation. Source: TradingView

USDT stablecoin market cap vs. USD in circulation. Source: TradingView

The chart shows the market cap of USDT (blue), which accounts for over 60% of the total stablecoin market cap. It has grown significantly since November 2023 compared to the Federal Reserve’s currency in circulation (red), which remains almost flat.

This illustrates the rapid rise of stablecoins relative to the US dollar, highlighting their increasing dominance in the market.

Here’s a summary of more crypto news to follow today:

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.