Elon Musk’s Post Sparks PNUT Price Buzz, But On-Chain Data Tells a Different Story

0

0

Peanut the Squirrel (PNUT) surged over 12% following a vague Elon Musk tweet that set crypto speculation on fire.

While the tweet made no direct mention of the coin, degens and meme-hunters were quick to draw connections and buy in. But beneath the hype, on-chain indicators tell a very different story. From inflows and funding rate flips to Chaikin divergence, the real PNUT price move seems to have belonged to early folks, not retail.

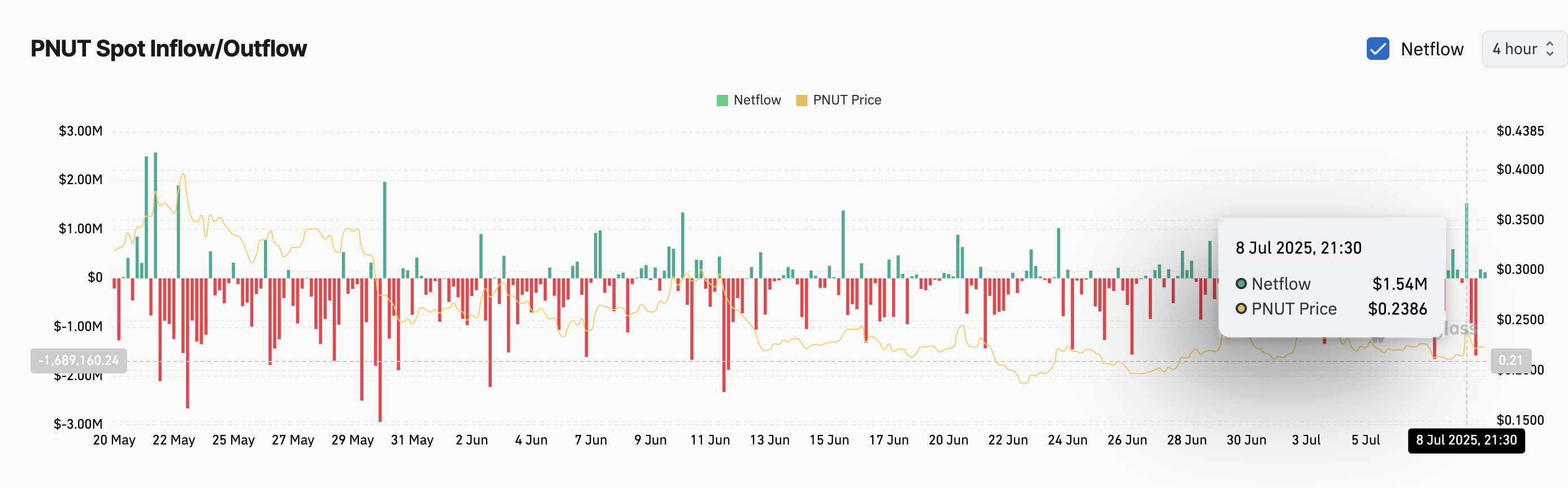

Netflows Flipped After Tweet, But Retail Sold the Top

The first signs of movement came before Musk’s tweet, not after it.

On July 8, the exchange netflows flipped positive, with $1.54 million worth of PNUT moving onto exchanges, likely traders positioning for a sell.

That was hours before the price peaked.

Four hours later, as PNUT hit $0.2398 (up from $0.2136), outflows spiked again, with nearly $920,000 in tokens withdrawn. The pattern is clear: early players moved in before the tweet, while retail likely bought the top and exited late.

PNUT price and netflow post-tweet: Coinglass

PNUT price and netflow post-tweet: Coinglass

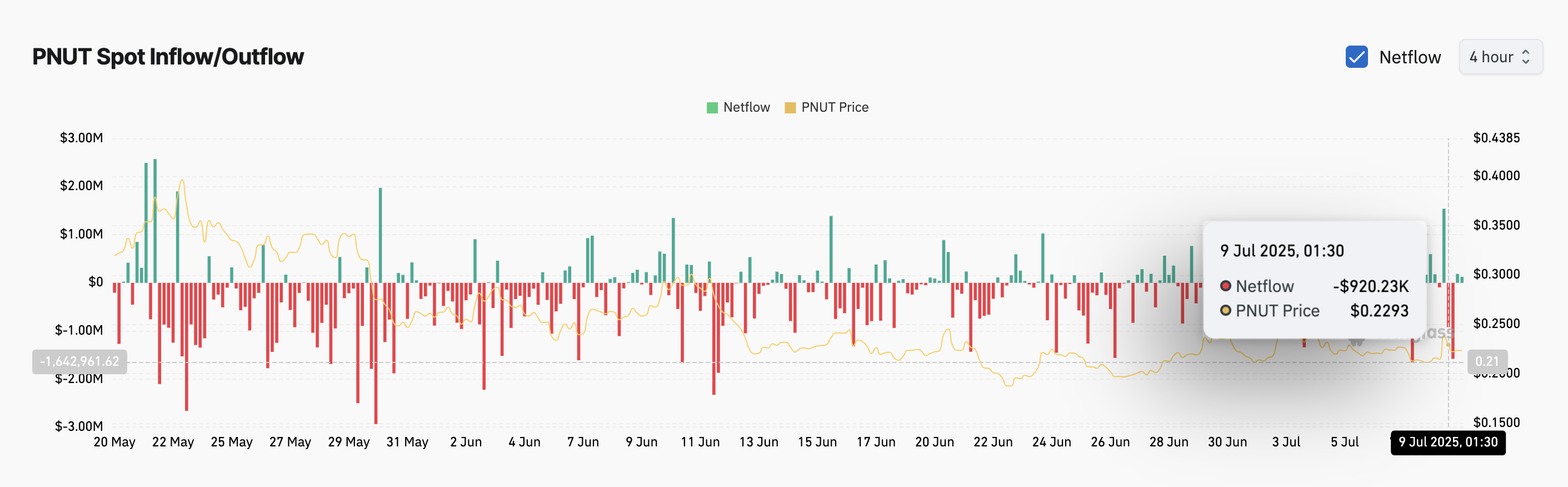

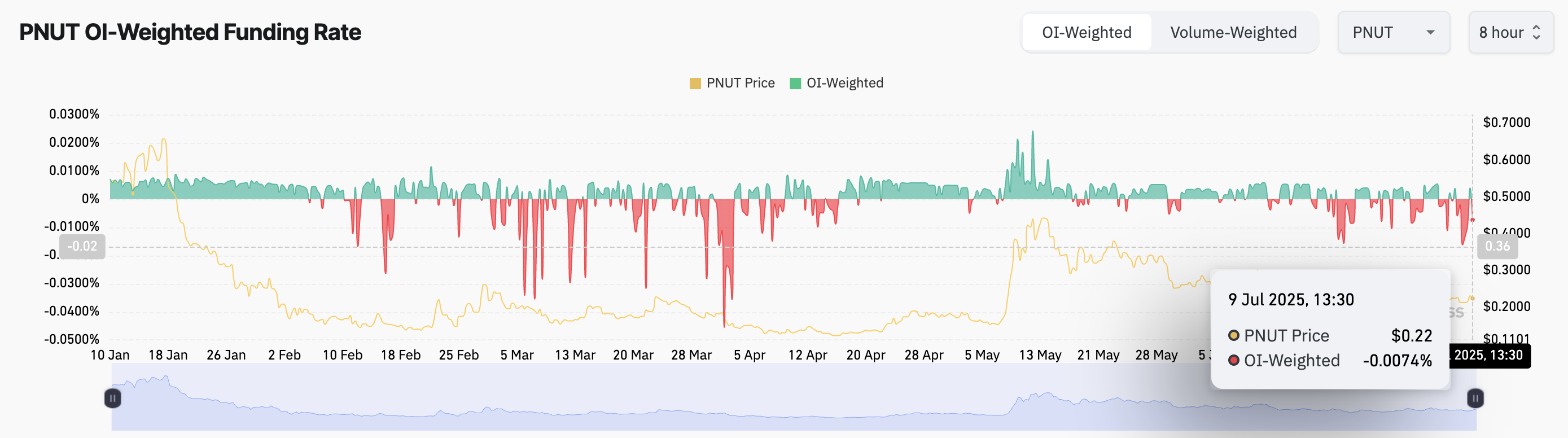

Funding Rate Move Towards Zero for First Time in Weeks

For many days, the funding rate for PNUT stayed negative, showing that more traders were betting on the price to fall. But right after Musk’s tweet on July 8, that changed. The rate moved closer to zero, reaching -0.0074% on July 9.

That means some traders started opening long positions, expecting the price to rise. However, since the rate was still negative, it indicates they aren’t yet confident. They’re testing the trend, not jumping in fully. This shift hints at growing interest, but not a strong bullish signal.

PNUT price and funding rate pre-tweet: Coinglass

PNUT price and funding rate pre-tweet: Coinglass

Funding rates are fees paid between long and short traders. When funding is negative, short traders are dominant. A positive rate means long traders are in control.

PNUT price and funding rate post-tweet: Coinglass

PNUT price and funding rate post-tweet: Coinglass

PNUT Price Faces Fib Resistance, With Invalidation in Sight

The Fibonacci retracement drawn from the previous swing low to high (July 3) shows PNUT price retested the 0.382 Fib level at $0.2386, after momentarily breaching it. That zone, along with $0.245 and $0.256, remains the critical resistance levels. PNUT Price is now back near $0.22 and struggling to reclaim the bullish trend.

PNUT price analysis: TradingView

PNUT price analysis: TradingView

If PNUT price manages to reclaim $0.245 cleanly, a move toward $0.256 is back on the table.

But a drop below $0.216 (key trendline and 0.786 Fib) would break the bullish structure, pushing PNUT lower than the long-holding ascending trendline. This would flip short-term bias bearish.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.