Analysts Warn: Bitcoin Volatility Squeeze Could Trigger the Biggest Breakout Since 2016

0

0

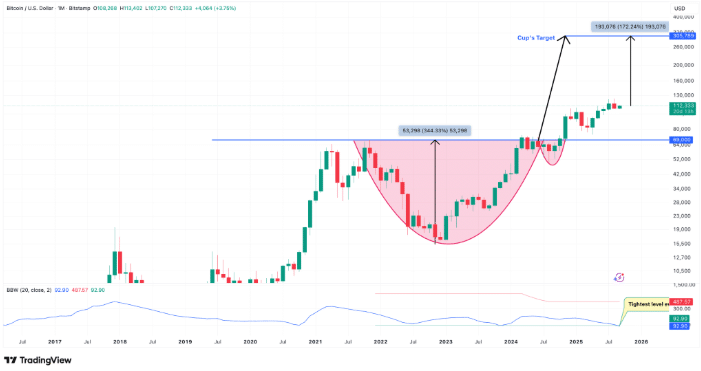

A closely monitored Bitcoin (BTC) volatility indicator has reached its tightest level in history, signaling the potential for a dramatic Bitcoin breakout in the coming months, according to several prominent traders and analysts.

Bollinger Bands Signal Strong Bitcoin Breakout

The crypto trader Matthew Hyland pointed out that the Bollinger Bands of Bitcoin on the monthly chart have narrowed to the tightest point since the cryptocurrency was introduced in 2009.

Bollinger Bands, a popular indicator of momentum and volatility, have the propensity to contract before a big move in the market and have usually been used to predict a large Bitcoin breakout.

#BTC Monthly Bollinger Bands now at the most extreme level in its entire history: pic.twitter.com/Lxhe7JYRYu

— Matthew Hyland (@MatthewHyland_) September 8, 2025

The observations of Hyland were echoed by other analysts. Market commentator Crypto Ceasar said that the Bitcoin Bollinger Bands on the 1M (monthly) are at their tightest. This has in the past resulted in high volatility in the upward direction. He added:

“This has previously led to heavy volatility to the upside. Bitcoin could be in for a spicy Q4.”

The Bollinger Bands on the 1M (monthly) are at historical tightness. This has previously led to heavy volatility to the upside (see chart).

Bitcoin could be in for a spicy Q4 🐂🫡 pic.twitter.com/sOmeLIYPgT

— 👑Crypto Caesar👑™️ (@crypto_caesar1) September 6, 2025

Also read: Analysts See Bitcoin Hitting $100K After Classic Cup and Handle Pattern Emerges

Institutional demand fuels Bitcoin ETF inflows

They are optimistic based on historical precedents. There were great rallies after similar contractions in 2012, 2016 and 2020. Investor Giannis Andreou remarked that the existing arrangement is tighter than ever. This may be the largest breakout of Bitcoin we have ever witnessed. He said:

“Huge volatility ahead!”

🚨#BITCOIN MONTHLY BOLLINGER BANDWIDTH ALERT!

We are witnessing something unprecedented in Bitcoin’s history:

📉 The Bollinger Bandwidth (BBW) on the monthly timeframe has compressed to its tightest levels ever.

What does this mean?

🔸Bollinger Bands measure volatility. When… pic.twitter.com/l2ml9DwZZp

— Giannis Andreou (@gandreou007) September 3, 2025

The technical squeeze is not the sole bullish element that analysts are observing. Spot Bitcoin exchange-traded funds (ETFs) inflows have become positive again this week and this demonstrates increased institutional demand. According to market intelligence platform Santiment, money is moving back into Bitcoin ETFs at an accelerated pace as retailers hasten to abandon crypto adding:

“Previous crypto rallies were boosted by inflow spikes like this.”

💸 Money is moving back into Bitcoin ETF's at a rapid rate as retailers impatiently drop out of crypto. Previous crypto rallies were boosted by inflow spikes like this.

🔗 Visit the FREE Bitcoin ETF dashboard any time, brought to you by @santimentfeed: https://t.co/21UX8IA1p6 pic.twitter.com/J3yXcW9di3

— Santiment (@santimentfeed) September 10, 2025

Cup-and-handle breakout trend remains valid

Bitcoin could also be supported by Macroeconomic conditions. As the Federal Reserve rate cuts and gold-like rally are anticipated, traders opine that Bitcoin can resume its upward trend to reach as high as $185,000 and even higher. This is viewed by many as prelude to another massive Bitcoin breakout during this bull run.

According to charting, Bitcoin remains legitimate to a cup-and-handle breakout trend that started at the $69,000 neckline in late 2024. Assuming that the trend continues to run its course, analysts is estimating a long-term target of close to $305,000 by 2026 an increase of over 170% compared to the present level. This pattern of chart further justifies a continued Bitcoin breakout into new highs.

Historical Trends Indicate Strong Bitcoin Breakout

Still, some caution remains. According to studies conducted by technical analyst Thomas Bulkowski, only approximately 61 percent of cup-and-handle formations achieve their estimated goals, allowing failed breakouts.

Also, Bitcoin is already in a classic post-all-time-high correction stage, which may take the price back to $104,000 before climbing higher. These kinds of pullbacks are quite common in the process leading to a stronger Bitcoin breakout.

Regardless of these dangers, there is an opinion among the main analysts that Bitcoin is on the verge of a decisive moment. As traders are bracing for volatility and many are betting that it will lead to a historic Bitcoin breakout, the monthly Bollinger Bands have never been tighter than they have ever been.

Also read: Bitcoin Price Prediction: Triangle Breakout Looms After $123K Rejection

Conclusion

Based on the latest research, Bitcoin appears to be approaching a decisive phase, with Bollinger Bands signaling unprecedented volatility. While risks remain, analysts agree that historical trends, institutional inflows, and macroeconomic catalysts could fuel the next major Bitcoin breakout, potentially redefining the market’s trajectory over the coming years.

Stay up to date with expert analysis and price predictions by visiting our crypto news platform.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

Summary

Bollinger Bands in Bitcoin have never been as tight as it is currently in a monthly range since 2009 which is an indication of a significant price shift. Analysts such as Matthew Hyland and Crypto Ceasar cite historical examples of how such contractions resulted in explosive rallies. Institutional ETF inflows, optimistic macroeconomic indicators, and cup-and-handle breakout configuration on the play, traders expect a substantial Bitcoin breakout. Nonetheless, the risks are present because corrections and unsuccessful patterns may slow or restrict upside momentum.

Glossary of Key Terms

Bitcoin (BTC): The first decentralized cryptocurrency, launched in 2009.

Bollinger Bands: A tool showing market volatility using price bands.

Volatility: How much and how quickly prices change.

Cup-and-Handle Pattern: A bullish chart shape that signals breakout.

Breakout: Strong price move beyond resistance or pattern.

ETF (Exchange-Traded Fund): A tradable fund that tracks Bitcoin’s price.

On-chain Metrics: Blockchain data used to gauge market trends.

Resistance Level: A price ceiling where selling pressure appears.

Bull Cycle: A market phase of rising prices.

FAQs for Bitcoin Breakout

1. What do Bitcoin’s Bollinger Bands show?

They’re at their tightest since 2009, hinting at a major Bitcoin breakout.

2. Have past contractions led to rallies?

Yes, similar setups in 2012, 2016, and 2020 triggered big price surges.

3. What targets are analysts predicting?

Bitcoin could rise toward $185,000, with long-term goals near $305,000.

4. What risks should traders consider?

Corrections to $104,000 are possible, and chart patterns don’t always play out.

Read More: Analysts Warn: Bitcoin Volatility Squeeze Could Trigger the Biggest Breakout Since 2016">Analysts Warn: Bitcoin Volatility Squeeze Could Trigger the Biggest Breakout Since 2016

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.