Expert Analyzes XRP Path to $23, Says it is Ready

0

0

- Popular analyst Dark Defender says XRP is primed for a major bullish breakout.

- Fibonacci extension levels suggest potential long-term price targets of $5.85, $18.22, and $23.

- Renewed institutional interest in XRP products adds credibility to the bullish technical setup.

Ripple’s native cryptocurrency, XRP, could be on the verge of a significant price shift as a multi-year technical formation nears completion, according to widely followed market analyst Dark Defender.

The analysis suggests that the asset is primed for a breakout with long-term bullish potential, supported by both historical chart structures and Fibonacci projections.

Chart Signals Long-Term Bullish Setup

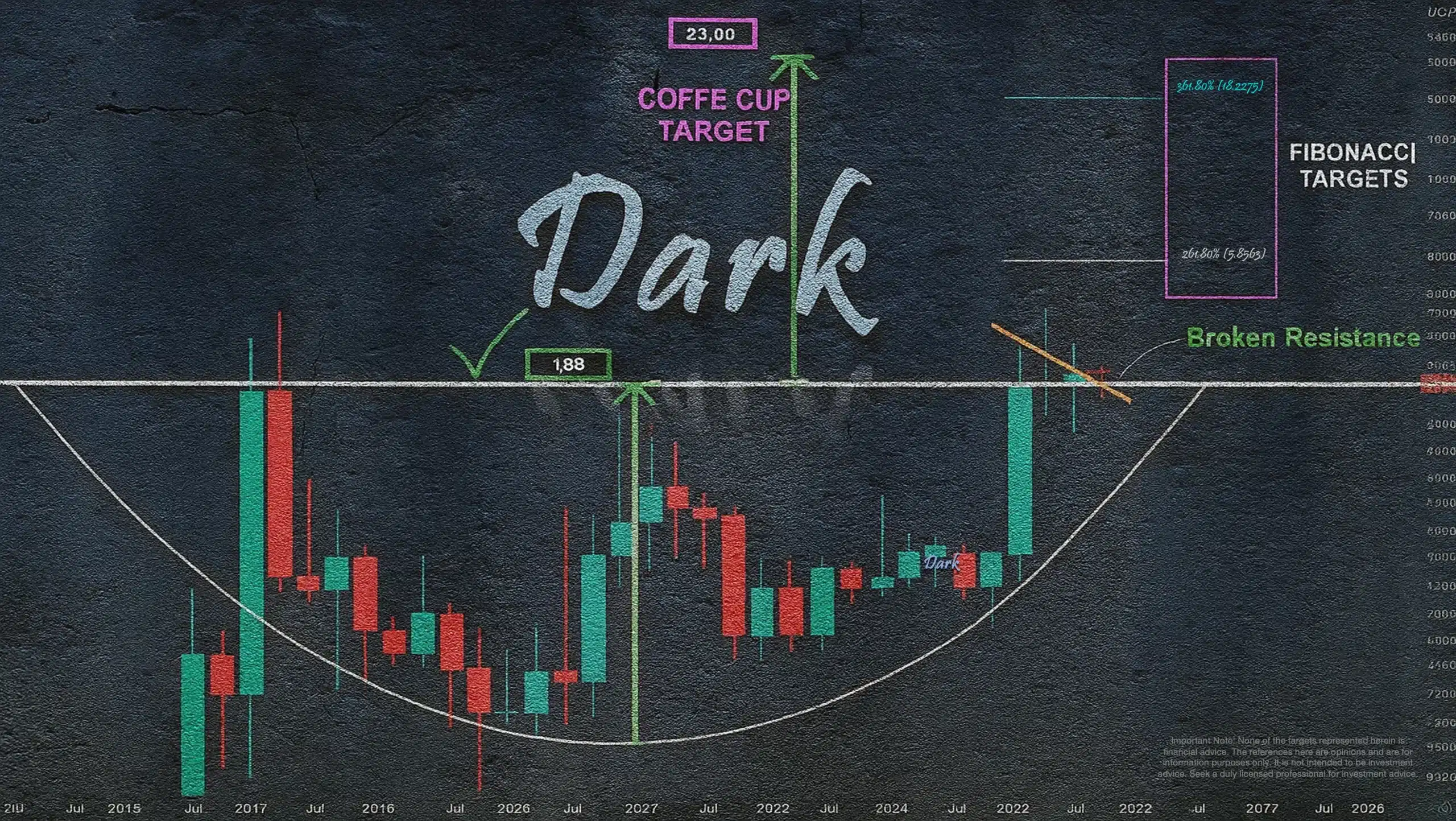

In a detailed update shared with his followers, Dark Defender presented a monthly XRP chart highlighting a large technical pattern resembling a cup-with-handle formation, a structure that traditionally indicates bullish continuation if confirmed.

According to his analysis, the price target between the base of the cup and rim suggests a surge from $1.88 to about $23.

The analyst described the setup as “writing on the wall” for XRP, emphasizing that the convergence of multiple technical signals points to a major upside resolution.

I carved this writing on my wall.$XRP is ready. pic.twitter.com/13AS4OrSve

— Dark Defender (@DefendDark) July 5, 2025

Also Read: Ripple (XRP) vs SEC Lawsuit Update: Where the Case Stands as of July 6, 2025

The analysis notes that XRP recently broke through a key downward trendline, marked in orange on the chart. A decisive break of this neckline resistance, if sustained, could unlock the pressure needed to drive prices significantly higher, toward the $23 mark.

Fibonacci Levels Suggest Significant Upside Potential

Central to Dark Defender’s thesis are Fibonacci extension levels, which he used to identify potential price targets based on XRP’s historical trading patterns. The analysis specifies Fibonacci levels at 261.8% and 361.8% extensions, corresponding to potential price targets of $5.85 and $18.22, respectively.

Fibonacci extensions are a common tool in technical analysis, designed to forecast possible areas of resistance or support during trending markets.

According to research from TradingView, assets that respect Fibonacci levels during corrections often continue along established trends when those levels are breached, lending further credibility to the analyst’s targets.

Source: Dark Defender/X

Analysts Caution on Confirmation and Volatility

While Dark Defender’s analysis lays out a compelling technical roadmap, some analysts urge caution. “Breakouts need confirmation with volume and follow-through,” said Josh Olszewicz, a crypto market analyst at Valkyrie Investments, in a recent podcast. “Until we see sustained trading above resistance with strong participation, the risk of a failed breakout remains.”

Additionally, XRP’s historical volatility means price swings can be abrupt, and traders should prepare for sharp retracements even within an overall bullish trend.

XRP Holds Key Levels as Market Watches

At the time of writing, XRP trades near $2.26, holding just above its recent breakout point. If buyers maintain control and the asset stays above the trendline, Dark Defender’s Fibonacci targets could become realistic mid- to long-term objectives.

Whether XRP will deliver on this bullish technical promise will likely depend on broader crypto market sentiment, Ripple’s ongoing regulatory clarity, and confirmation of the breakout with higher trading volume.

Also Read: Ripple Could Drain XRP Escrow in 6 Years as Release Strategy Shifts Fast

The post Expert Analyzes XRP Path to $23, Says it is Ready appeared first on 36Crypto.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.