Ethereum Layer-2 in Crisis: Kinto Token Crashes 90% After Smart Contract Hack

0

0

According to the source, the Kinto token crash has shaken the Ethereum Layer 2 community. The project announced its shutdown after a devastating exploit that drained funds and triggered a loss of investor confidence. The fall of this token is not just about price but also about how one vulnerability can wipe out years of effort.

How the Hack Sparked the Collapse

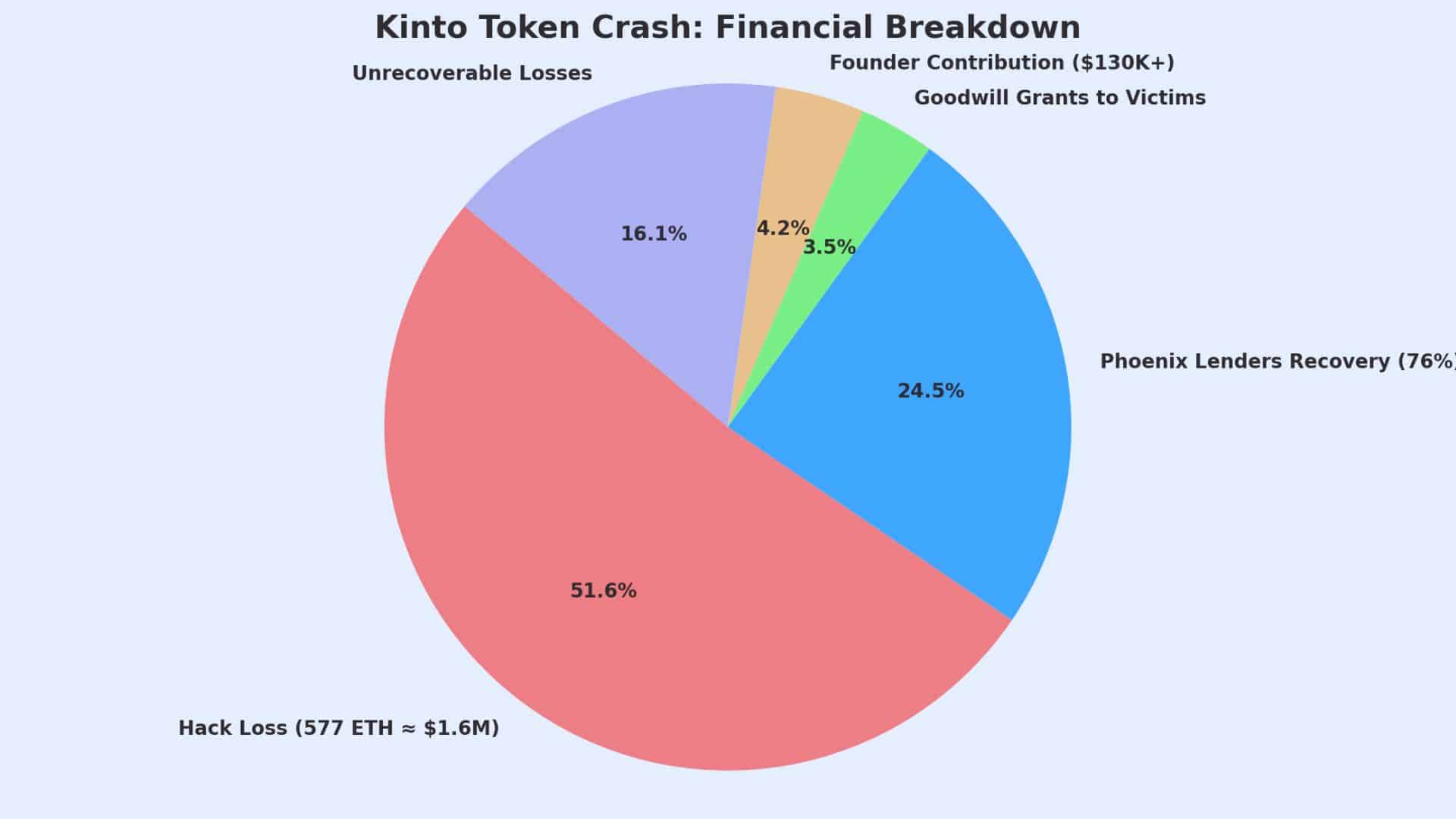

In July, attackers exploited a flaw in the ERC-1967 Proxy standard and stole about 577 ETH (around $1.6 million), according to reports. This was the first domino in what became a larger downfall. Within minutes, the Kinto token price collapsed by nearly 90 percent.

The exploit created a panic sell-off that deepened after a significant tranche of investor tokens was unlocked. This sequence of shocks caused the Kinto token to crash, one of the most severe in recent Ethereum L2 history.

Screenshots shared on X showed the sudden price drop, and trading platforms displayed heavy outflows. Charts from market trackers illustrated how quickly the crash spread across liquidity pools.

Also read: Bitcoin and Ethereum Calm Before the Storm: Expert Predictions for 2025

The Shutdown and User Impact

The team confirmed that the project will close by September 30, 2025, and users are asked to withdraw their funds before that date. Lenders from the Phoenix program are expected to recover 76 percent of their principal. In addition, a goodwill fund has been set up to grant $1,100 to each wallet impacted by the exploit.

According to public statements, the founder personally contributed more than $130,000 to this grant. This attempt at partial compensation may soften the blow for some, but it highlights how fragile token ecosystems can be.

A community post noted, “We did our best to relaunch, but the financial burden left us no choice but to close operations”.

This underlined the emotional strain as much as the financial hit.

Lessons for the Market

The Kinto token crash shows how fragile decentralized finance can be. A single smart contract flaw can erase trust instantly. Projects need stronger audits and clear token release schedules to protect investors.

Price charts reveal how quickly liquidity dried up, while repayment tables confirm that only part of the losses will be recovered. The Kinto hack now serves as a warning for both developers and investors.

Conclusion

Based on the latest research, the Kinto token crash signals a turning point for Ethereum Layer-2 projects. A mix of weak security, rising debt, and failed fundraising left shutdown as the only option.

Some users may recover part of their funds, but the damage to trust has been severe. For the crypto community, this collapse highlights the need for stronger safeguards and responsible token management.

Also read: Altcoins Price Prediction 2025: Why Ethereum, Solana, and Cardano Are the Ones to Watch

Summary

The Kinto token crash followed a hack that drained funds and forced the Ethereum Layer-2 project to announce its shutdown. Token value fell by over 90 percent, investors faced heavy losses, and users now have until September 30, 2025, to withdraw.

Partial compensation includes a goodwill grant and recovery of some principal for lenders. The crash serves as a warning about the risks associated with weak security and token management.

Glossary of Key Terms

ERC-1967 Proxy: A contract standard on Ethereum that allows upgrades but became the root of the exploit.

Layer-2 (L2): A scaling solution built on top of Ethereum to speed up transactions and reduce fees.

Liquidity Pool: A collection of funds locked in a smart contract used for decentralized trading.

FAQs for Kinto Token Crash

Q1. What caused the Kinto token crash?

A security exploit in the ERC-1967 Proxy standard allowed attackers to steal funds, leading to panic selling.

Q2. Can users still withdraw funds?

Yes. Withdrawals remain open until September 30, 2025.

Q3. Will all investors get compensation?

No. Phoenix lenders will recover about 76 percent of their principal, while hack victims receive a $1,100 goodwill grant.

Q4. How much value was lost in the hack?

Around 577 ETH, worth about $1.6 million at the time.

Read More: Ethereum Layer-2 in Crisis: Kinto Token Crashes 90% After Smart Contract Hack">Ethereum Layer-2 in Crisis: Kinto Token Crashes 90% After Smart Contract Hack

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.