Abraxas Capital Bets $561 Million on ETH, Ditches Bitcoin in Strategic Power Move

0

0

Abraxas Capital is rising as one of the largest whales in the Ethereum (ETH) market, with a total ETH holding value of $561 million over the past week.

The organization’s movements reflect confidence in ETH’s potential and raise questions about its impact on the cryptocurrency market in the near future.

Abraxas Capital Aggressively Accumulates ETH

Over the past week, Abraxas Capital has become a focal point by continuously accumulating ETH on a large scale. According to Lookonchain, on May 14, 2025, the organization purchased 242,652 ETH within 7 days. It is equivalent to $561 million.

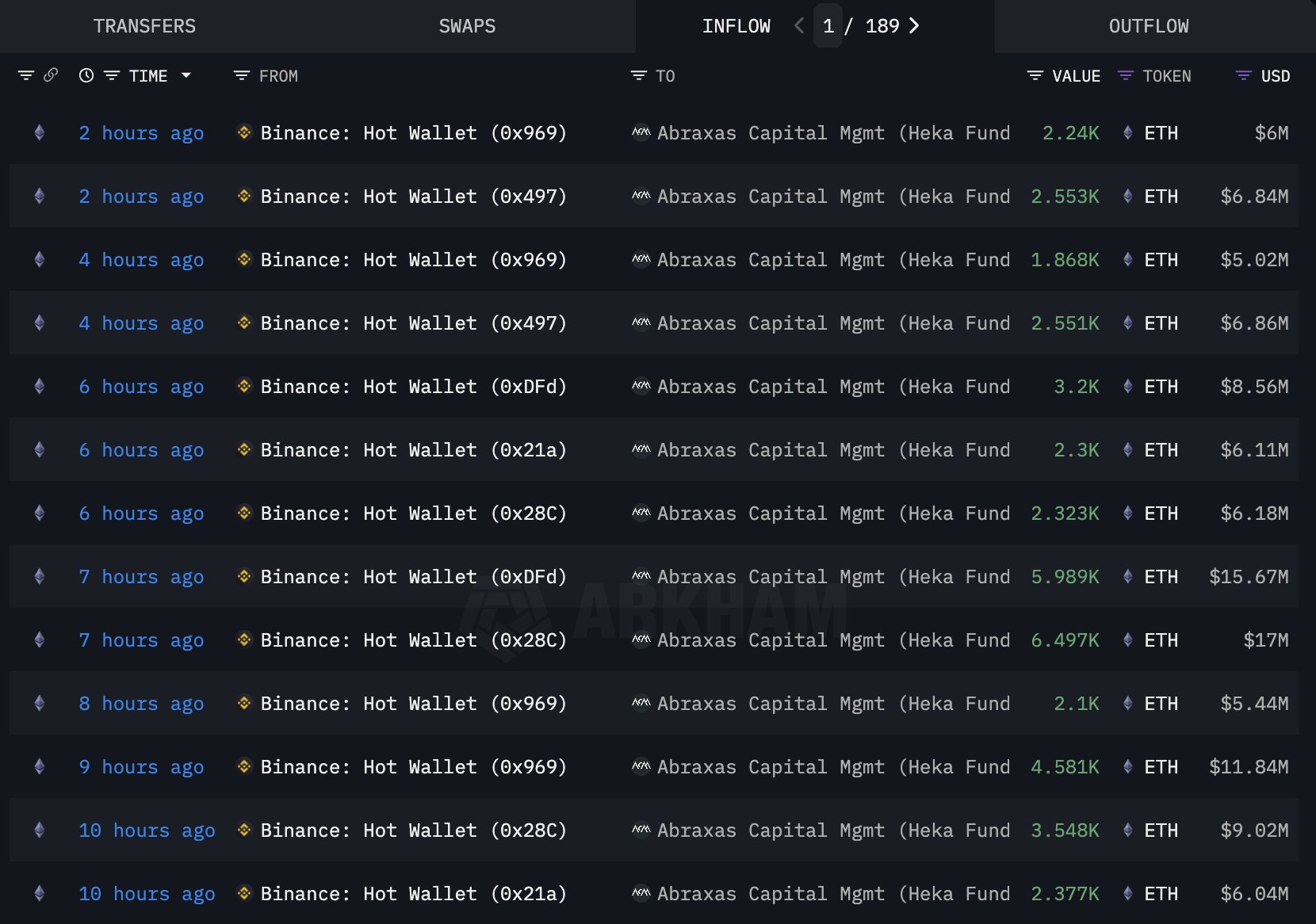

Abraxas Capital Heka Funds’ Transactions. Source: Arkham

Abraxas Capital Heka Funds’ Transactions. Source: Arkham

Data from Arkham Intelligence shows that wallets belonging to Abraxas Capital Heka Funds withdrew ETH from multiple major exchanges, primarily Binance. Transactions ranged from 2,100 to 6,497 ETH per instance, corresponding to values between $5.44 million and $17 million. 189 transactions in 10 hours highlight the organization’s aggressive accumulation strategy.

Abraxas Capital is a major whale with ETH holdings worth $561 million. They could influence ETH price trends in the near future.

Shift from BTC to ETH

Another notable point is Abraxas’s shift from Bitcoin (BTC) to ETH. Lookonchain reported that a wallet linked to the organization withdrew 2,949 BTC, equivalent to $250 million, from several exchanges.

Abraxas Capital’s BTC Transactions. Source: Arkham

Abraxas Capital’s BTC Transactions. Source: Arkham

However, by May 8, 2025, OnchainDataNerd reported that the organization deposited 1,000 BTC to Kraken. They hold only 983 BTC, equivalent to $98 million at current prices. This indicates that Abraxas significantly reduced its BTC position to focus on ETH, with ETH holdings surging to $561 million in the same period.

This shift may reflect Abraxas’s confidence in ETH’s long-term potential, particularly as the Ethereum ecosystem thrives with DeFi and NFT applications. The reduction in BTC holdings and increased investment in ETH suggest they may be preparing for a new growth cycle for Ethereum, especially after ETH recently surpassed the $2,500 mark.

“ETH is a bet on fundamentals. Ethereum dominates on developers, stablecoins, RWAs and NFTs.” A user on X commented

With its potential, analysts believe that Ethereum could soon surpass Bitcoin. By 2026, Ethereum’s strategic reserve is expected to increase to 10 million ETH.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.