Is WLFI’s $0.20 Support Strong Enough to Stop the Bleeding?

0

0

World Liberty Financial (WLFI) has managed to hold the important $0.20 support level after a sharp decline to $0.19 earlier this week. The rebound offered short-term relief, but sentiment stays cautious as selling pressure dominates.

World Liberty Financial (WLFI) Price Holds Near $0.20

At the time of reporting, World Liberty Financial was trading at $0.200, reflecting a modest daily gain of 0.92%. Despite this minor recovery, the token has lost nearly 36% of its value in the past month.

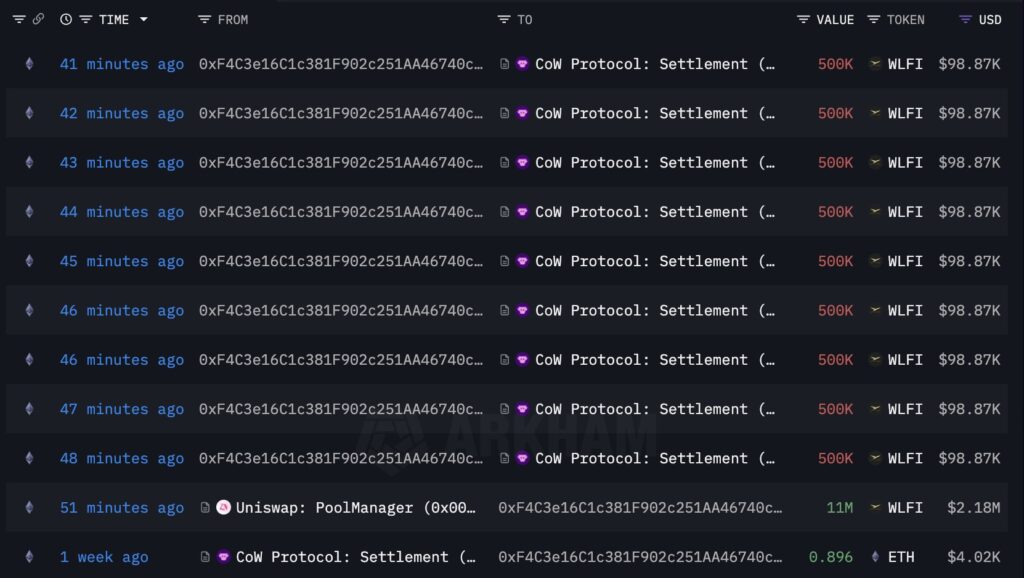

Concerns deepened when a major whale offloaded 11 million WLFI, valued at $2.15 million, in exchange for 521 Ethereum. Such large-scale sales often reflect wavering confidence and can create ripple effects across retail markets.

Whales Show Mixed Behavior

While one whale’s sell-off alarmed many traders, other large investors took a different approach. According to Nansen data, whales have accumulated 61 million World Liberty Financial tokens over the last three days.

Also Read: WLFI Voters Approve Full Fee-to-Burn Plan With On-Chain Proof

This behavior suggests that while some holders are exiting, others remain convinced of the token’s long-term value. The mixed activity highlights the uncertainty that currently surrounds WLFI.

Futures Market Reflects Weakness

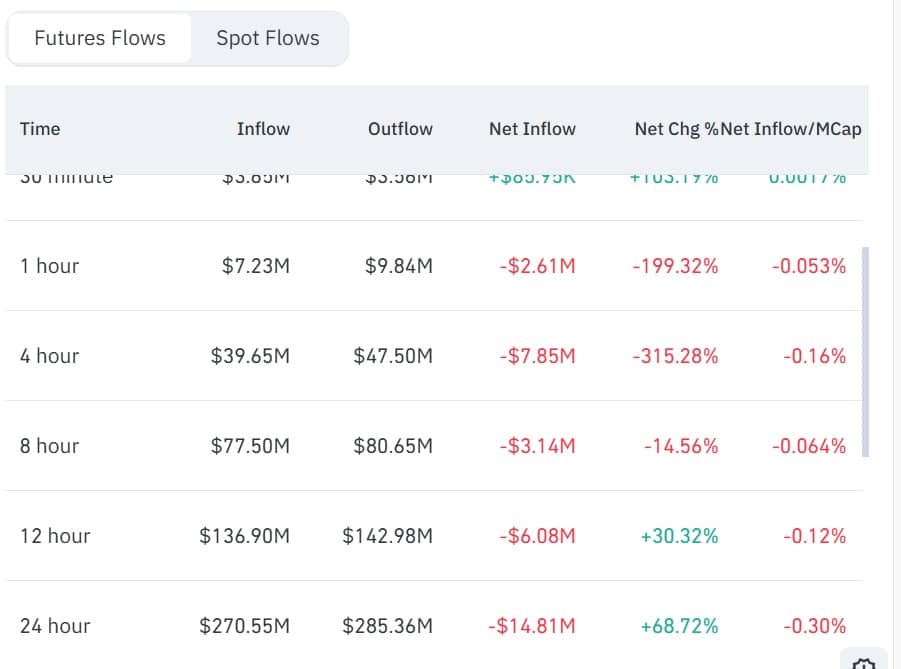

The derivatives market also points to caution. CoinGlass data shows futures inflows falling to $270.55 million, while outflows increased to $285.36 million. This resulted in a negative netflow of -$14.81 million, marking a steep 68% decline.

Spot Market Shows Strong Selling

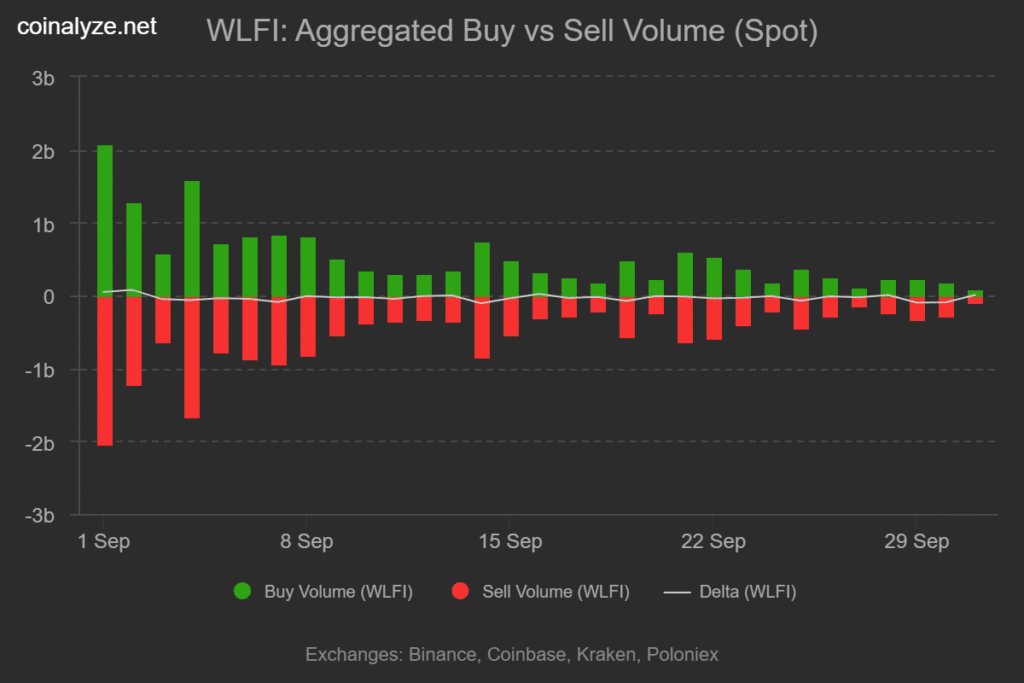

Spot trading activity mirrors the bearish mood. Over the last three sessions, World Liberty Financial has recorded a consistent negative delta. During this period, sell volume reached 685.25 million, compared to buy volume of 495.81 million.

The imbalance created a buy-sell delta of -192.44 million. This shows that retail traders are selling much faster than they are buying.

Exchange Inflows Keep Rising

Exchange inflows have added to the selling pressure. For the first time in two weeks, CoinGlass reported that World Liberty Financial spot netflow turned positive, with inflows of $507k.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Oct 2025 | $ 0.144321 | $ 0.164021 | $ 0.206642 |

0.06%

|

| Nov 2025 | $ 0.156736 | $ 0.162213 | $ 0.167668 |

18.91%

|

| Dec 2025 | $ 0.154332 | $ 0.15963 | $ 0.166393 |

19.53%

|

This movement suggests that more tokens are being transferred onto exchanges, often a precursor to higher sell activity. Historically, such surges in inflows have been linked to continued downward pressure on asset prices.

Technical Indicators Signal Weakness

Technical analysis confirms the bearish trend. The Stochastic RSI for World Liberty Financial dropped to 28, placing the asset in oversold territory. At the same time, the Relative Strength Index slipped to 44, further reinforcing the weakness.

If sellers maintain control, WLFI may fall below $0.20 and retest support at $0.186. However, if bulls defend the current level, the token could make a move toward $0.224 in the short term.

Market Outlook Stays Uncertain

Overall sentiment in the market remains divided. Retail traders are aggressively selling, while selective whale accumulation provides some balance. World Liberty Financial is at a crucial stage where the $0.20 support will likely determine near-term direction.

Conclusion

World Liberty Financial continues to battle heavy selling, with retail traders driving most of the pressure. At the same time, whales remain active on both sides, adding to the uncertainty.

With technical indicators leaning bearish, the outcome at $0.20 will play a decisive role in shaping the token’s next move. If support fails, $0.186 becomes the critical level to watch; if it holds, $0.224 may be the next target.

Also Read: WLFI Price Surges 10% as Traders Bet on Buyback-and-Burn Plan

Summary

World Liberty Financial (WLFI) defended its $0.20 support after dipping to $0.19, despite strong selling from retail traders. While one whale sold 11 million tokens, others accumulated 61 million WLFI, signaling mixed sentiment.

Spot markets showed a negative buy-sell delta, and futures netflows turned sharply negative. Technical indicators remain bearish, with support at $0.186 and resistance at $0.224.

Appendix: Glossary of Key Terms

World Liberty Financial (WLFI) – A cryptocurrency token under heavy market pressure.

Whales – Large holders who influence token prices through bulk trades.

Support Level – A price point where buying interest prevents further decline.

Resistance Level – A price point where selling pressure blocks upward movement.

Delta – The difference between buy and sell volume.

Netflow – Token inflow and outflow on exchanges, used to gauge selling or buying pressure.

Frequently Asked Questions About World Liberty Financial

1- What is World Liberty Financial?

It is a cryptocurrency token known for its sharp price swings and volatile trading behavior.

2- Why has WLFI dropped recently?

The token declined due to heavy retail selling and a whale offloading 11 million WLFI, which unsettled market sentiment.

3- Are whales buying WLFI?

Yes. While one whale sold, others accumulated 61 million tokens in the past three days, showing mixed outlooks.

4- What does the futures market show?

Futures data indicates traders are closing positions, as netflows have turned negative and inflows have declined.

Read More: Is WLFI’s $0.20 Support Strong Enough to Stop the Bleeding?">Is WLFI’s $0.20 Support Strong Enough to Stop the Bleeding?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.