WLFI Price Nosedives—Traders Bet on Fresh Lows Amid Waning Demand

0

0

World Liberty Financial’s WLFI, a Donald Trump–linked token, has plunged nearly 10% over the past 24 hours, fueling concerns of deeper losses ahead.

On-chain indicators point to sustained weakness, suggesting the altcoin could face more declines in the coming sessions if demand fails to recover.

WLFI Under Pressure as Traders Exit Positions and Bet on New Lows

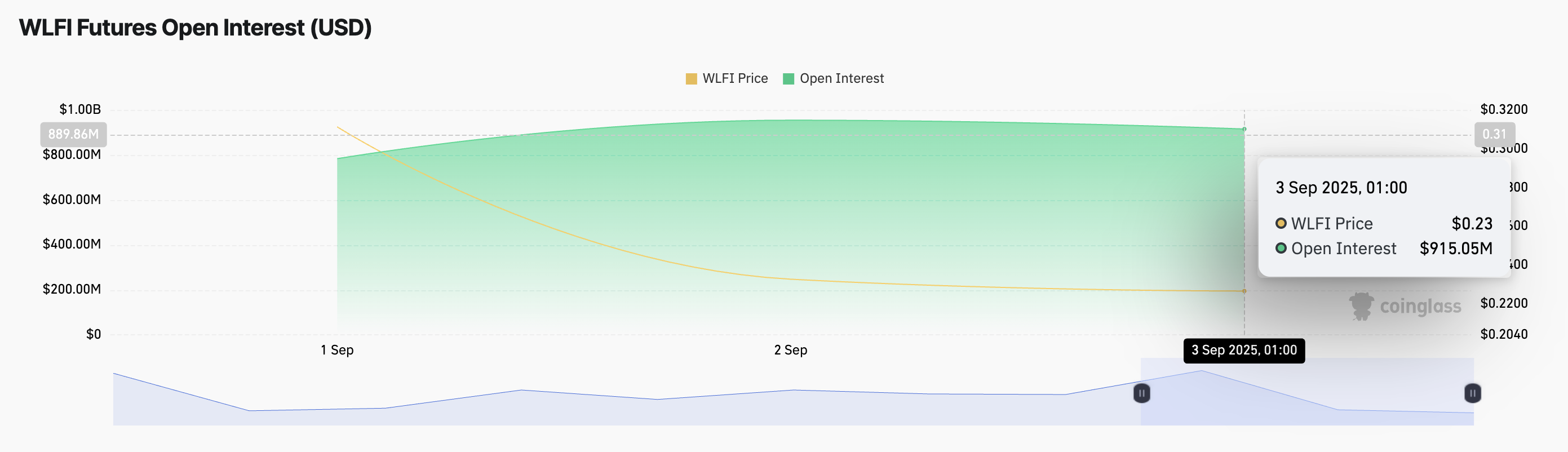

WLFI’s price dip in the past day has been accompanied by a decline in its futures open interest, confirming the retreat in market participation. Currently at $915.05 million, this has plunged by 4% in the past 24 hours, per Coinglass data.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

WLFI Futures Open Interest. Source: Coinglass

WLFI Futures Open Interest. Source: Coinglass

Open interest refers to the total number of outstanding futures or options contracts that have not yet been settled. It is used to gauge market participation and capital flow into an asset.

When an asset’s price falls alongside a drop in its futures open interest, traders are closing out their positions rather than initiating new ones. This trend reflects waning confidence in WLFI and suggests that its ongoing selloff is being driven more by investors exiting the market.

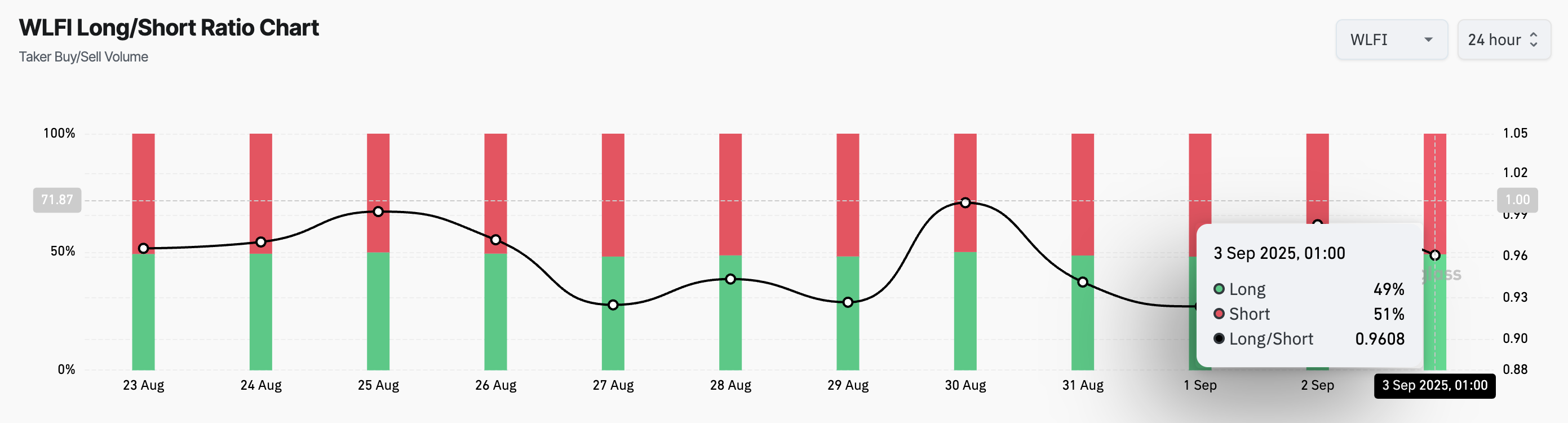

In addition, on-chain data shows WLFI’s long/short ratio leaning heavily toward shorts, indicating that traders are increasingly betting against the token. As of this writing, the metric stands at 0.96.

WLFI Long/Short Ratio. Source: Coinglass

WLFI Long/Short Ratio. Source: Coinglass

The long/short ratio measures the proportion of long bets to short ones in an asset’s futures market. A ratio above one signals more long positions than short ones. This indicates a bullish sentiment, as most traders expect the asset’s value to rise.

However, as with WLFI, a ratio below one means there are more short than long positions in the market. This reflects the prevalent bearish sentiment against WLFI, with its futures traders overwhelmingly betting on the asset’s price to decline rather than rise.

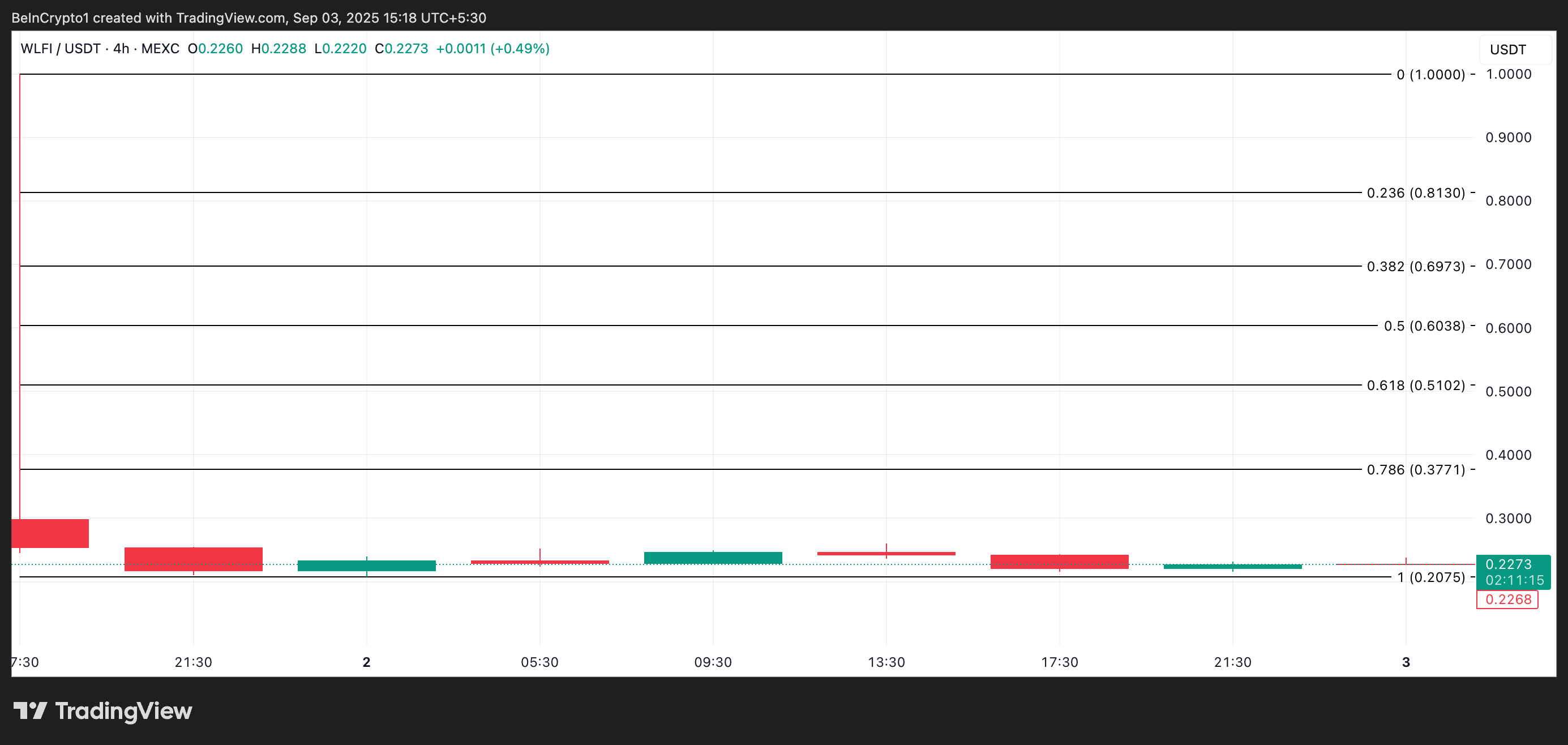

WLFI’s Next Target Could Be $0.2075 or $0.3771

Without renewed buyer interest, WLFI risks sliding further. If demand continues to lean, its price could fall to $0.2075.

WLFI Price Analysis. Source: TradingView

WLFI Price Analysis. Source: TradingView

On the other hand, an uptick in buy-side pressure could prevent this. If new buyers enter the market, they could trigger a rebound toward $0.3771.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.