Crypto market sheds $605 million in 24 hours as whales react to volatility

0

0

A massive market correction wiped out over $605.5 million in crypto positions within 24 hours, affecting more than 210,000 investors.

Most of the liquidations were on long positions, according to CoinGlass, with $582 million in leveraged longs flushed out amid a rapid downturn.

Bitcoin fell to $103,553.47, while Ethereum slipped 0.80% to $2,531.82 and Solana declined 1% to $174.56.

The scale and speed of the correction point to a broader shift in sentiment, particularly among large investors who are now rebalancing portfolios with caution.

The drop follows an overheated rally last week that saw Bitcoin surge past $100,000 and Ethereum spike 40% to $2,500.

The crypto Fear & Greed Index touched 70, signalling strong investor exuberance.

But with key assets now retracing, whales are beginning to shift strategies—moving from profit-taking on earlier long bets to opening shorts and adjusting for possible further downside.

Whales exit longs, flip bearish

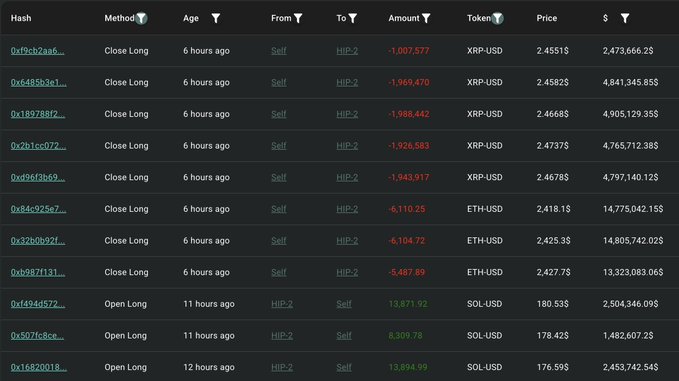

Lookonchain revealed that multiple high-value wallets closed long positions and repositioned for a bearish scenario.

One whale locked in $7.5 million in gains by closing 17,702 ETH (valued at $14.8 million) and 9.83 million XRP (worth $24.2 million).

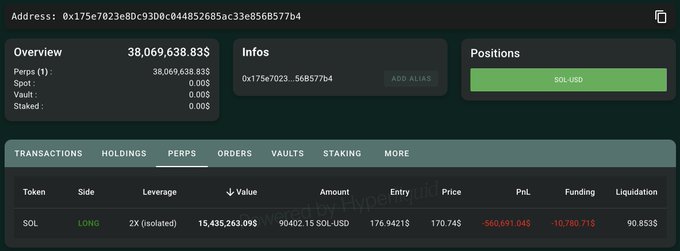

The same wallet then redeployed capital into 13,871 SOL tokens ($2.5 million), although this trade is now facing an unrealised loss of $560,000.

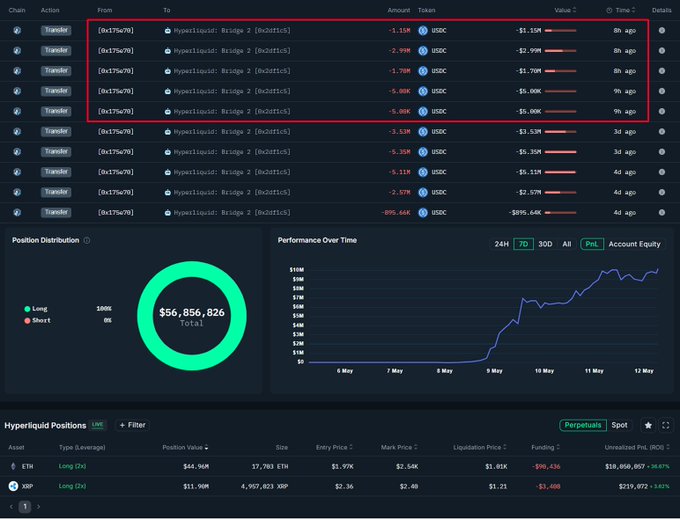

On May 12, OnchainLens tracked a separate transaction where the same whale deposited 5.84 million USDC into Hyperliquid to open a 2x leveraged long position in XRP.

Another wallet that recorded a $5.73 million loss on ETH in February 2025 recently recovered $4.71 million in profits, highlighting the timing advantage and deep liquidity available to large players.

Some whales shifted completely to short positions. An address tagged “Hyperliquid 50x Address” reversed a short on the same day and captured $1.18 million in profits before immediately closing out.

Another whale then deposited 10 million USDC to boost short exposure on BTC, ETH, and SOL, with trades totalling $14.8 million (BTC), $13.3 million (ETH), and $2.5 million (SOL). These positions reflect a widespread expectation among whales of a continued short-term dip.

Rally fades, caution returns

The abrupt correction follows a week of exuberant buying as crypto assets broke multi-month highs.

Market sentiment had been skewed by the rapid appreciation of Bitcoin and Ethereum, prompting retail traders to pile into long positions.

However, the resulting liquidation wave underscored how quickly sentiment can shift in the crypto space.

Though the selloff appears to be technical, driven by over-leveraged positions and elevated greed levels, it has reintroduced short-term uncertainty.

The moves by whales suggest a more conservative stance as volatility returns to the market.

Analysts see long-term support

Despite the short-term selloff, some analysts continue to believe that crypto remains on a broader upward trajectory.

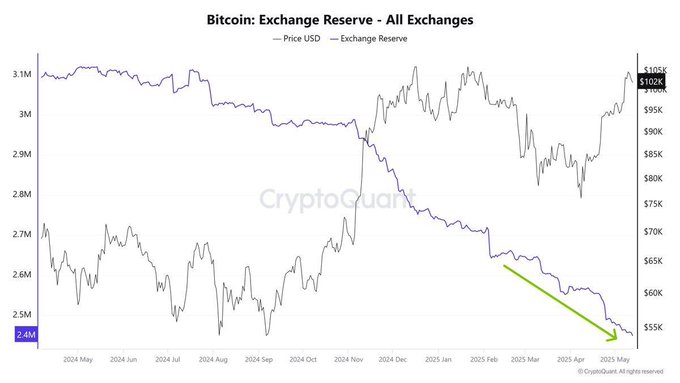

Davinci Jeremie noted that Bitcoin supply on exchanges is declining, pointing to a possible future supply shock.

Merlijn The Trader posted a technical analysis suggesting Bitcoin has exited its “accumulation cylinder”—a pattern that historically precedes sharp upward moves.

Merlijn’s chart indicates that if history repeats, Bitcoin could be poised for an eventual move to $500,000.

Meanwhile, analyst Michaël van de Poppe believes that Bitcoin dominance has peaked, a signal that may mark the end of the altcoin bear market.

He noted a bearish divergence on the weekly timeframe that supports this theory.

While macroeconomic factors and regulatory uncertainties continue to cloud the outlook, the on-chain behaviour of whales and long-term accumulation patterns suggest a cautiously optimistic outlook for investors who can withstand near-term volatility.

The post Crypto market sheds $605 million in 24 hours as whales react to volatility appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.