Asian Brokerage Giants Let Clients Trade Stocks with USDT and USDC

0

0

Several traditional financial companies worldwide have been moving toward testing crypto trading.

These developments reflect the growing acceptance of cryptocurrencies and herald a new integration era between traditional and digital finance.

Integrating Cryptocurrencies into Stock Trading

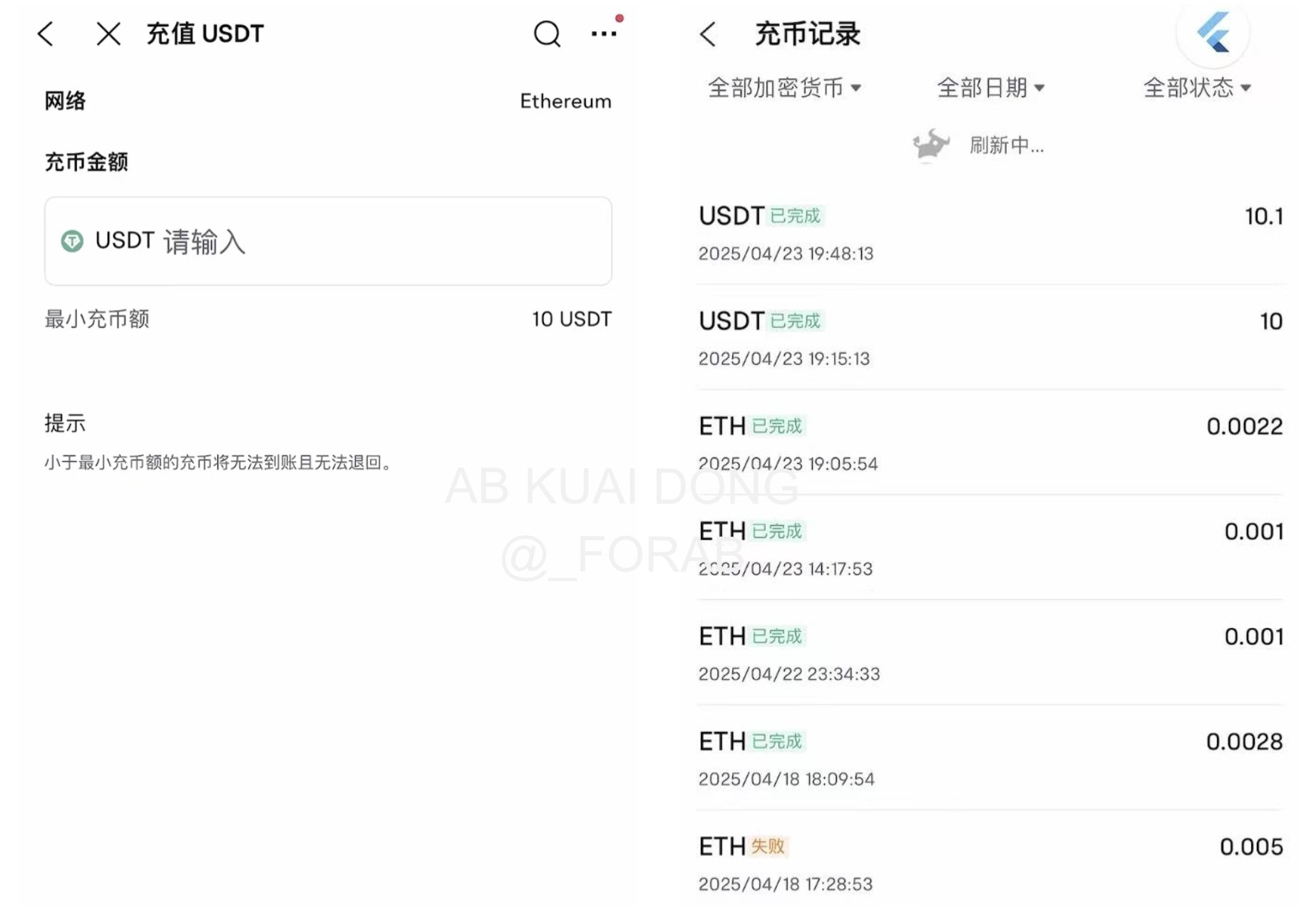

Futu Securities, a leading technology-driven securities firm in Hong Kong, is currently testing a cryptocurrency deposit feature. The company now supports Bitcoin (BTC), Ethereum (ETH), and USDT, allowing users to trade stocks in the US, Hong Kong, and Japan markets using USDT and USDC.

Crypto Deposit Page on Futu Securities. Source: _FORAB

Crypto Deposit Page on Futu Securities. Source: _FORAB

“Internet securities dealers are counting down to their large-scale entry into the cryptocurrency world and access to stablecoins,” X user _FORAB shared.

Techcombank Securities (TCBS) is also taking pioneering steps to tap into the cryptocurrency market in Vietnam. TCBS has integrated a cryptocurrency price board into its platform as part of its strategy to prepare for Vietnam’s largest-ever IPO by the end of 2025.

Newly Integrated Crypto Price Board on TCBS. Source: TCBS

Newly Integrated Crypto Price Board on TCBS. Source: TCBS

Although TCBS has not yet enabled cryptocurrency trading in Vietnam, this move has garnered attention from investors interested in digital assets. It also demonstrates the company’s agility in capturing global financial trends.

Crypto Ownership Rate in Vietnam. Source: Triple-A

Crypto Ownership Rate in Vietnam. Source: Triple-A

According to Triple-A, Vietnam remains among the top countries for cryptocurrency adoption, with over 21% of internet users owning digital assets. By integrating a crypto price board, TCBS leverages this trend to enhance its brand value and attract investors ahead of its IPO.

Significance of the Crypto Trading Trial Wave

The wave of cryptocurrency trading trials among traditional financial firms carries significant implications for the global market. First, it signals that cryptocurrencies are increasingly recognized as a legitimate asset class within the economic system.

Second, testing crypto trading allows financial firms to attract a large pool of new customers, particularly younger generations drawn to blockchain technology. In Hong Kong, Futu Securities capitalizes on this opportunity to expand its market share. At the same time, TCBS in Vietnam uses its crypto price board to boost appeal ahead of its IPO.

Third, these initiatives reflect a shift in how financial institutions perceive the risks and potential of cryptocurrencies. Previously, traditional financial firms were often wary of cryptocurrency volatility. Still, they are now mitigating risks by integrating stablecoins like USDT, which are less volatile than BTC or ETH.

Evidence of this trend can be seen in recent moves by traditional financial companies to adopt stablecoins to enhance payment efficiency and minimize risks. For example, Visa has partnered with stablecoin infrastructure company Bridge to issue Visa cards linked to stablecoins. Similarly, Bank of America, Standard Chartered, PayPal, Revolut, and Stripe are entering the stablecoin market to seize opportunities in cross-border payments and meet the growing demand for cryptocurrency transactions.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.