Bitcoin and Ethereum Sink as US-China Trade War Escalates — Is Crypto Still a Safe Haven?

0

0

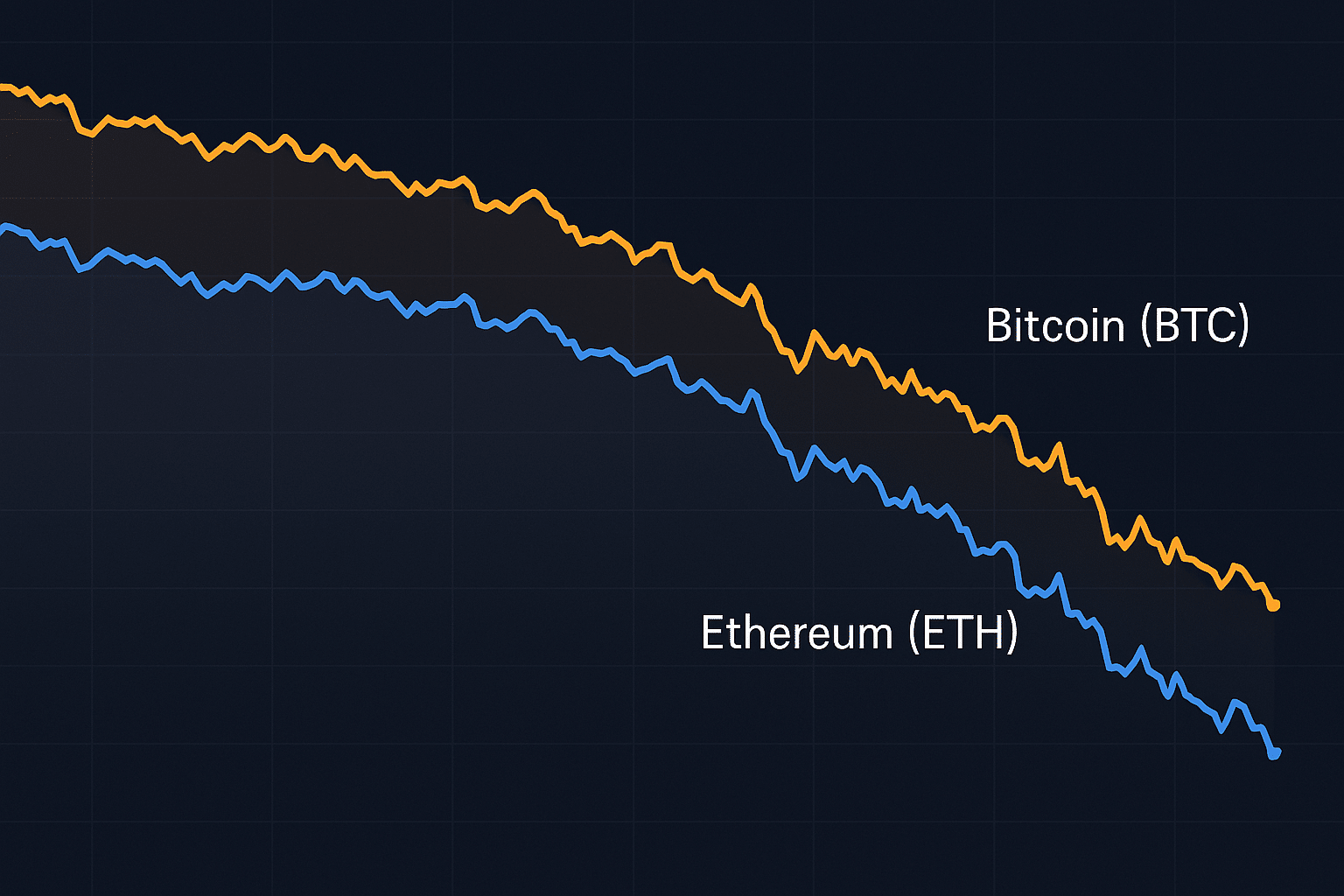

As geopolitical sparks fly between Washington and Beijing, the crypto market is feeling the burn. Prices of Bitcoin and Ethereum fell sharply this week, rattled by heightened trade tensions and a flurry of mixed signals from U.S. policymakers.

The slump comes just days after former President Donald Trump confirmed an aggressive tariff package on Chinese goods, sending shockwaves across global financial markets — including digital assets.

Crypto Markets React to US-China Tensions

On April 7, Bitcoin dropped more than 5%, plunging to $61,800 — its lowest level in over two months. Ethereum mirrored the decline, slipping below $3,050 after briefly holding support near $3,200. The market-wide selloff intensified as Trump reaffirmed his administration’s intention to impose a 104% blanket tariff on all Chinese imports starting April 9.

While cryptocurrencies are often hailed as hedges against macro uncertainty, the data tells a different story this time.

“Investors are moving into defense mode,” said Chloe Harding, an analyst at CryptoCompare. “Tariff uncertainty affects everything from liquidity flows to investor sentiment — and right now, the appetite for risk is shrinking.”

Bitcoin and Ethereum Prices (as of April 14, 2025)

| Asset | Current Price | 24h Change | 7-Day Change | YTD Performance |

|---|---|---|---|---|

| Bitcoin (BTC) | $61,820 | -5.1% | -8.4% | +22.5% |

| Ethereum (ETH) | $3,045 | -4.6% | -7.2% | +19.8% |

Tariffs, Trade Uncertainty, and Market Fragility

The U.S.-China trade relationship has long served as a pressure valve for global markets — and crypto is no exception. The newly announced tariffs, alongside China’s expected retaliatory measures, have cast a long shadow over investor confidence.

According to a report from Decrypt, even though Trump’s tariff policy isn’t directly targeted at the crypto sector, the resulting macro instability is spooking investors.

“This isn’t just about China or tariffs. It’s about uncertainty,” said Kevin Douglass, macro strategist at ChainLens. “Markets hate uncertainty — and crypto, being a high-beta asset, reacts the fastest and often the harshest.”

Safe Haven Myth? Crypto’s Fragile Status Exposed

Historically, Bitcoin has occasionally been viewed as “digital gold” — a sanctuary in times of fiat turmoil. But the current market response suggests a different narrative is playing out. As traditional equities also reel from tariff fears, crypto has failed to break out as a counter-cyclical asset.

Instead, institutional investors are rotating into U.S. Treasury bonds and the dollar index (DXY), leaving the digital asset sector exposed to drawdowns.

“Bitcoin might still be a long-term hedge against monetary debasement,” argued Harding. “But in the short-term, it’s trading like a risk asset — and that matters.”

Looking Ahead: Can Crypto Regain Its Footing?

While the pullback has prompted concern, not all signals are bearish. On-chain data shows that Bitcoin holders are not panicking. Exchange outflows are still increasing, suggesting accumulation at lower levels. Similarly, Ethereum’s staking metrics have shown a slow but steady rise in locked tokens.

If U.S.-China negotiations find middle ground or the tariff escalation eases, crypto could bounce back quickly.

“The market is likely overreacting in the short term,” said an unnamed analyst at Glassnode. “Fundamentals haven’t changed. The macro backdrop is cloudy, but long-term adoption trends remain intact.”

Conclusion

The drop in Bitcoin and Ethereum reflects the ripple effects of global economic policy — particularly the evolving U.S.-China trade saga. While crypto remains a volatile and sentiment-driven market, the coming weeks may offer clarity on whether this downturn is a correction or the beginning of a broader slide.

For now, investors should keep a close eye on trade negotiations, global liquidity signals, and institutional inflows to navigate what promises to be a turbulent quarter for digital assets.

FAQs

What triggered the drop in Bitcoin and Ethereum prices?

The fall was triggered by Trump’s announcement of 104% tariffs on Chinese imports, fueling fears of a renewed trade war and broader risk-off sentiment.

Is this a good time to buy Bitcoin or Ethereum?

It depends on your risk appetite. Some investors view the dip as a buying opportunity, but macroeconomic risks remain elevated.

Are crypto assets still considered safe havens?

Not in the short term. Bitcoin and Ethereum are currently reacting like risk assets amid global uncertainty.

What’s next for crypto if trade tensions worsen?

Further declines are possible if U.S.-China hostilities escalate. However, long-term adoption and institutional interest may provide a price floor.

Glossary of key Terms

Tariff: A government-imposed tax on imports or exports that often leads to changes in trade dynamics and economic growth forecasts.

Trade War: A situation where countries retaliate against each other by increasing tariffs or other trade barriers.

Macro Uncertainty: Economic conditions influenced by global politics, inflation, interest rates, and international relations.

On-chain Data: Blockchain-based metrics that offer insights into user behavior, liquidity, and long-term sentiment.

Safe Haven Asset: A financial instrument that retains or increases value during times of market turbulence.

Sources

UN Trade and Development (UNCTAD)

Read More: Bitcoin and Ethereum Sink as US-China Trade War Escalates — Is Crypto Still a Safe Haven?">Bitcoin and Ethereum Sink as US-China Trade War Escalates — Is Crypto Still a Safe Haven?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.