PancakeSwap Tokenomics Vote Reveals Hidden Power Players

0

0

The PancakeSwap team recently shared a new $CAKE tokenomics proposal on the project’s governance forum, and it has stirred up a lot of discussion in the community. This would be the second major tokenomics update, replacing the veTokenomics system that is currently in place.

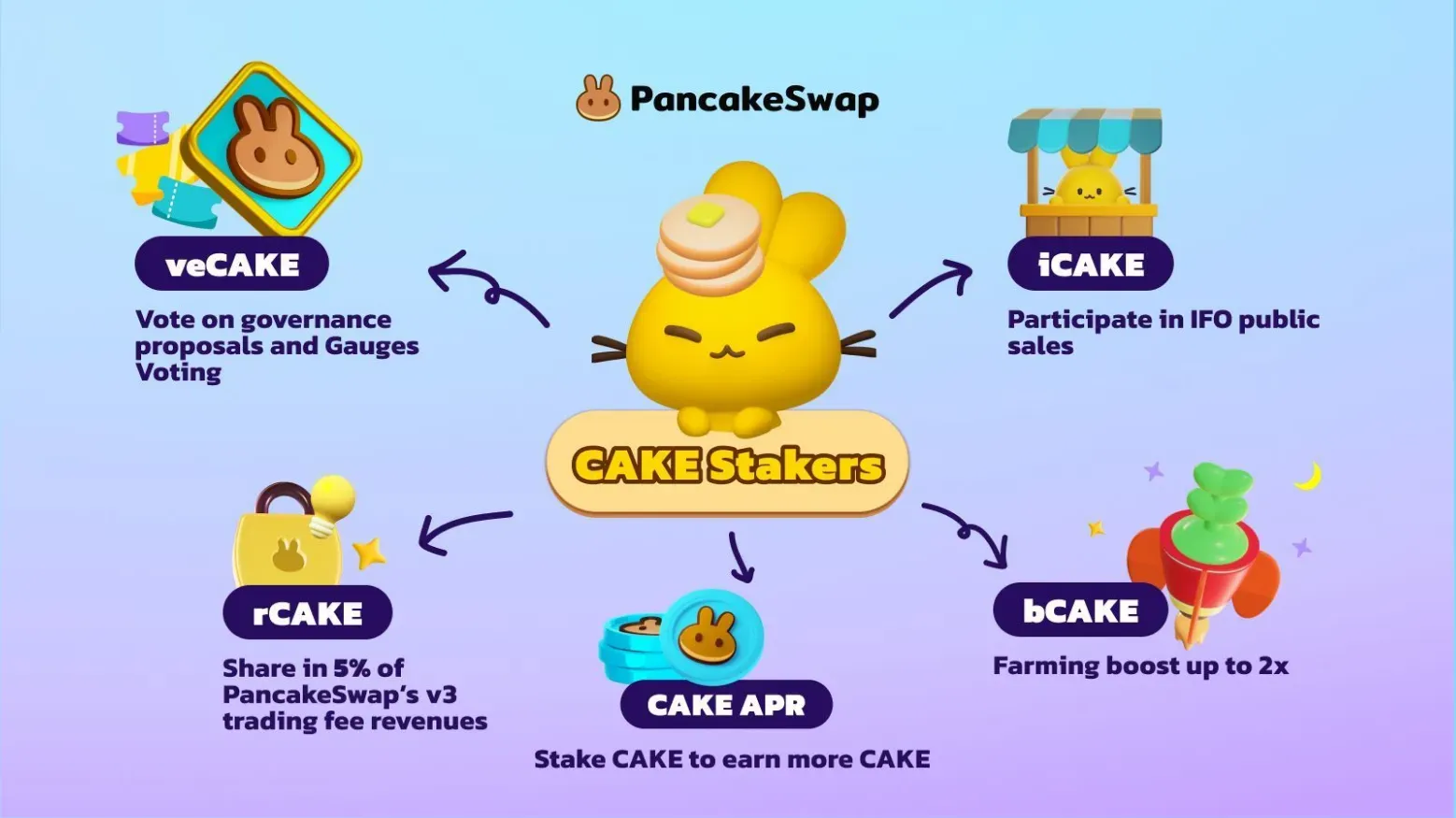

Right now, $CAKE holders can stake for up to four years to take part in governance and earn rewards through $CAKE staking and revenue sharing.

However, this new proposal brings significant changes. First, it would immediately unlock all currently staked $veCAKE tokens, allowing users to access their $CAKE without penalty. It would also eliminate revenue sharing entirely, using all protocol revenue for token burns. Daily $CAKE emissions would decrease from approximately 40,000 to 22,500.

The main goal is to reduce total $CAKE supply by 20% over the next five years, targeting a 4% annual deflation rate. On paper, it sounds like a bold, positive step. But not everyone is convinced.

In fact, a lot of long-term $veCAKE holders are pushing back hard. One major concern is that unlocking all staked $veCAKE at once could flood the market with up to 79 million $CAKE—about 27% of the current circulating supply. That much sweet is not good for any token price graph.

There is also frustration that PancakeSwap has now changed its tokenomics structure multiple times. The first version (V1) in 2021 introduced emission rewards and token burn mechanics. In 2022, V2 added a supply cap and expanded CAKE’s utility with features like weighted voting, boosted farm yields, and enhanced IFO allocations. V2.5, launched in 2023, brought veTokenomics and staking.

When the rules change this often, it is hard for long-term investors to feel confident.

And for DAOs like CakePie and Stake DAO, which have built entire business models around accumulating veTokens, this proposal could wipe them out entirely.

Supporters of the new plan say the current setup is too complicated for regular users. Between $vCAKE, $bCAKE, $cCAKE, and everything else, it is easy for newcomers to feel lost. As one community member put it:

“I just want to hold CAKE. Not vCAKE, bCAKE, cCAKE or whatever. Just CAKE, please. I see a lot of people talking about CakePie… what even is that? Why should third parties be feeding off our ecosystem?”

VeTokenomics Without Veto Power

So opinions split between long-term $veCAKE holders, who have staked for years and are happy with the rewards, and $CAKE holders who want a simpler system and a deflationary model to support token price growth. Under the current system, $veCAKE could easily veto the proposal.

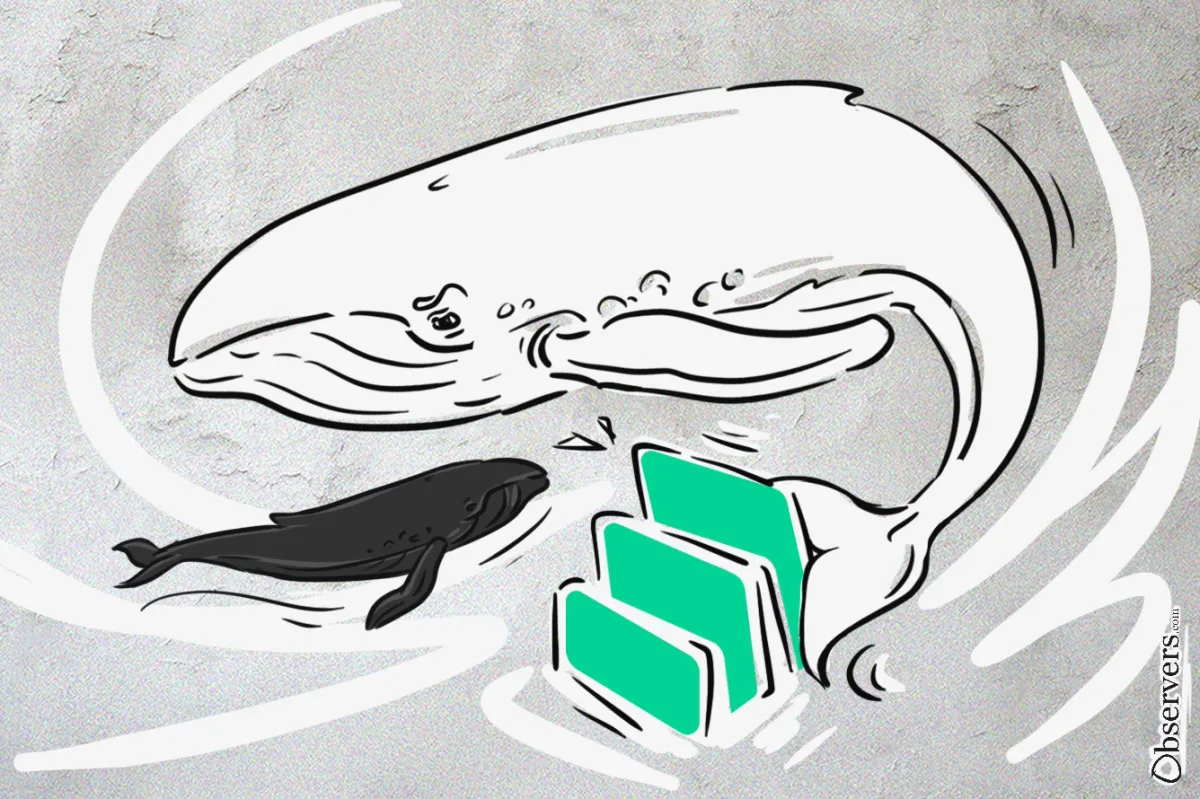

However, a different scenario unfolded immediately after the proposal was released: eight new wallets suddenly locked a combined 25 million $CAKE for four years. That’s a massive amount of voting power, and there’s speculation it could be from the Pancake team linked to Binance insiders. If that is true, it gives them enough clout to override existing stakers and force the proposal through.

People are calling it a governance attack. Even the founder of Curve, one of the biggest DeFi platforms for stablecoins, weighed in, calling it “a governance attack at its finest.” He even warned other projects not to make veGovernance systems upgradable.

As many maybe know, ve-tokenomics reason to exist is to prevent governance attacks, making decision makers take long-term responsibility over their actions.

— Michael Egorov (@newmichwill) April 8, 2025

Can this be bypassed? Yes, if lock rules themselves are upgradable by governance.

Do we have a precedent? Yes, now we do.…

Will this new tokenomics plan help $CAKE in the long run? It's hard to say. It might streamline things and make the token more attractive. But the way it is being pushed through raises serious red flags about the fairness and transparency of PancakeSwap’s governance.

And this isn’t the first time something like this has happened in DeFi. Similar governance attacks have hit big protocols before, like the $24 million one on Compound.

These situations highlight a core issue with DAOs: they are susceptible to manipulation by parties with sufficient capital. The ideals of decentralization are difficult to realize in practice, requiring more time and back-and-forth. This explains why decentralized governance is often overridden by centralized management controls.

As for PancakeSwap, it looks like the proposal will go through. Whoever staked that $25 million likely didn’t do it just to sit around and wait.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.