Breaking: XRP Lawsuit Ends – Is an XRP ETF Next?

0

0

XRP Lawsuit Ends: A Landmark Decision for Crypto Clarity

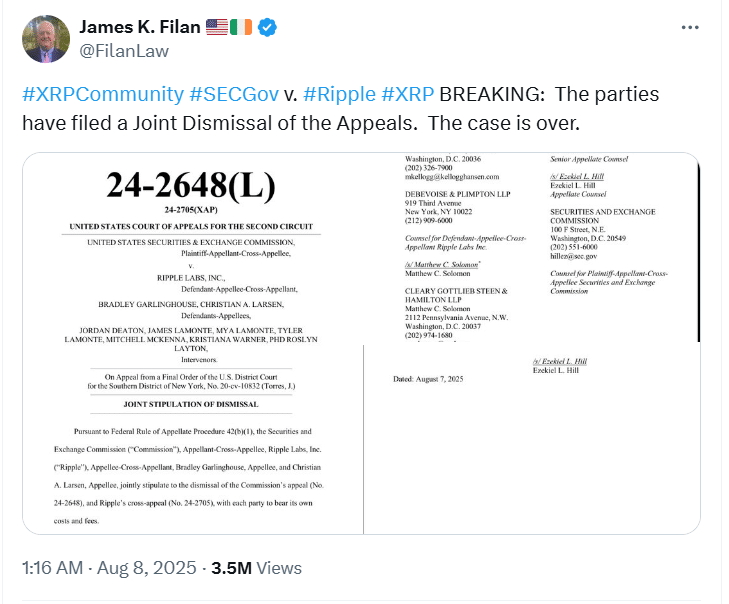

The long-running legal battle between Ripple and the United States Securities and Exchange Commission has been resolved. In a significant step for the cryptocurrency industry, both sides have agreed to withdraw all outstanding appeals, effectively concluding a five-year court struggle that has determined the future of digital asset regulation in the United States.

The top Google-searchable phrase “XRP lawsuit ends” has increased in popularity since the news broke, suggesting fresh hope in the XRP ecosystem and the larger crypto community. As Ripple leaves the courtroom, observers believe the next chapter will be written in the markets and regulatory boardrooms.

The final chapter: Ripple and SEC mutually drop appeals

On August 7, 2025, Ripple and the SEC submitted a move to dismiss their respective appeals in the lawsuit, which began in 2020. This arrangement implies that Judge Analisa Torres’ 2023 judgment will remain without further challenge. In that decision, it was determined that XRP is not a security when offered on exchanges to ordinary investors, but is a security when sold directly to institutions.

By withdrawing appeals, both parties have virtually accepted the mixed ruling. Legal experts see this as a smart compromise: Ripple avoids the prospect of a total loss, while the SEC obtains some precedent-setting wording on institutional sales. One former SEC official commented, “This resolves the uncertainty—at least for XRP. “This is a watershed moment for the cryptocurrency industry.”

XRP Price Rises as Investors React to Clarity

Following the news, XRP had a substantial price gain, rising by more than 13% and remaining stable at $3.36. As investors scrambled to comprehend the consequences, the phrase “XRP lawsuit ends” was frequently googled. The increase in value reflects the elimination of a substantial regulatory overhang that has previously hampered institutional and retail engagement in the token for years.

Market experts are already forecasting an increase in institutional interest. Some feel that legal clarity paves the way for new investment instruments. “We’re expecting an XRP ETF application very soon,” said a digital asset strategist. “The SEC no longer has the same ammunition to oppose it.”

Focus on ETF Approval and Global Adoption

With the XRP case officially over, many analysts anticipate a US-based spot XRP ETF might be approved within months. Analysts believe the chances of approval are now more than 90%, especially given the SEC’s decision not to appeal the 2023 verdict. This would place XRP alongside Bitcoin and Ethereum as institutional-grade cryptocurrency investment choices.

Ripple’s leadership has also hinted at a revitalized growth strategy. With legal issues resolved, the corporation is apparently seeking to increase its focus on foreign collaborations and infrastructure development. “This chapter is closed,” stated a firm representative, “and we’re looking ahead with confidence.”

Legal closure has an industry-wide impact

The outcome of the XRP case benefits more than simply Ripple; it establishes an important precedent for how authorities will view digital assets going forward. The ruling distinguishes between public and institutional token sales, providing a legal framework that future projects may use to manage compliance.

Crypto lawyers increasingly look to the XRP lawsuit as a watershed moment in token classification. This clarification might have an impact on current proceedings against other companies, as well as future legislation. The search “XRP lawsuit ends” is still trending as legal experts, investors, and developers consider its broader ramifications.

Conclusion

The completion of the XRP litigation represents a watershed moment in cryptocurrency history. As Ripple and the SEC withdraw their challenges, the sector gains a rare moment of clarity. XRP’s price momentum and increasing institutional interest indicate renewed confidence in one of the most robust digital assets. With better regulatory guidelines, prospective ETF clearance, and worldwide expansion on the way, XRP is poised for a daring new age.

FAQs

What does the end of the XRP lawsuit mean for investors?

It removes legal uncertainty, potentially opening the door for ETFs and institutional adoption.

Why did the SEC and Ripple drop their appeals?

Both sides appear to have accepted the 2023 ruling as a workable compromise.

Will there be an XRP ETF now?

Analysts believe there’s now a high chance of a spot XRP ETF being approved within months.

Is XRP now considered a security?

Only in institutional sales. Retail XRP transactions are not classified as securities per the standing court ruling.

Glossary

XRP – A cryptocurrency developed by Ripple Labs used for cross-border payments.

SEC – The U.S. Securities and Exchange Commission, the federal agency regulating financial markets.

Appeal – A legal process where a case is reviewed by a higher court for possible reversal of a lower court’s decision.

ETF (Exchange-Traded Fund) – A fund traded on stock exchanges, which holds assets such as stocks or crypto.

Institutional Investors – Large entities like banks or hedge funds that invest significant sums.

Token Classification – The legal status of a digital token, often debated between being a security or commodity.

Sources/References

Read More: Breaking: XRP Lawsuit Ends – Is an XRP ETF Next?">Breaking: XRP Lawsuit Ends – Is an XRP ETF Next?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.