Trump Tariff News Causes Market Chaos: Bitcoin Follows Wall Street’s Lead

0

0

The post Trump Tariff News Causes Market Chaos: Bitcoin Follows Wall Street’s Lead appeared first on Coinpedia Fintech News

A fake headline about a temporary pause in Trump’s tariff war with China sent shockwaves through the US stock market. As the news turned out to be false, volatility surged. It is time to analyse how the Bitcoin market has responded to the development. Dive in!

US Market Swing: What Triggered It

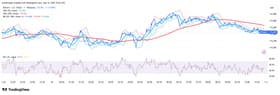

At around 10:15 AM (UTC-4) on April 7, a fake report stated that US President Donald Trump was considering ceasing his tariff war against China for the next 90 days. Shortly after the report’s release, the S&P 500 climbed to a peak of $5,249.28. Between 9:30 AM and 10:30 AM (UST-4) alone, the S&P surged by over 3.36%.

Interestingly, the Bitcoin market followed the same trend. The fake news pushed the BTC market above the level of $81,251. Between 9:30 AM and 10:30 AM (UST-4), the market grew by at least 2.79%.

How US Market Responded to the White House’s Denial

Soon after the market spike, the White House came out strongly against the fake news, denouncing the claims made in the news report regarding the US government’s intention to pause its tariff plan against China.

In the 30-minutes chart of the S&P 500 index, at 11 AM (UTC-4), a strong red candlestick was formed, showing a drop from $5,076.52 to $4,956.34.

Likewise, during the same time, the BTC price slipped from $79,025.10 to $78,016.40.

Why the Market Rebounded Despite Worsening Conditions

However, at the close of April 7, the S&P market was at least 4.67% above the lowest point of the day – at least 226.08 points over the low.

Similarly, yesterday, the Bitcoin market witnessed a rise of approximately 0.91%. At the close, the market was around 6.24% over the lowest point of the day – nearly 4,652.13 points above the low.

This suggests that investors are eager to get back into the market, even in the middle of bad news. There is a strong belief that any drop might be a buying opportunity.

Reports indicate that oversold conditions, like in March 2020, are drawing money back into the market quickly.

It appears that sentiment is currently driving prices, not just fundamentals.

What Does It Mean for the Crypto Market?

This event reveals that Bitcoin and the broader crypto market are tightly tracking macroeconomic sentiment and traditional markets. The sharp reaction to fake news shows how sensitive crypto prices are to political developments. However, the quick rebound suggests that investor interest in crypto remains strong, especially during volatility. As long as traditional markets swing wildly on sentiment, crypto may continue to mirror those moves – offering both risks and opportunities for traders.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.