Microsoft Backs SUI as Whales Bet $18M on Altcoin Rally

1

0

SUI gets Microsoft integration, a $300M whale pivot, and urgent security upgrade—raising both investor interest and decentralization concerns as the token’s influence continues to grow across crypto markets.

Enterprise Spotlight With Microsoft’s Support

SUI surged into the spotlight this week after Microsoft integrated the token alongside Bitcoin and Ethereum on its analytics platform. The announcement surfaced on X via Kyle Chassé, who highlighted the update, framing it as validation of SUI’s growing role in the blockchain ecosystem.

The integration arrives on the back of strong metrics. SUI’s decentralized exchange (DEX) volume hit 4.1 billion, while stablecoin inflows reached $83.4 million. These figures suggest rising user activity and liquidity flowing into the ecosystem, likely increasing institutional visibility.

Whale Moves $300M From BTC to SUI, ETH Longs

More interestingly, whale tracking revealed a sharp repositioning among large holders. According to data posted by Cas Abbé, one wallet reduced its $1.1 billion Bitcoin long by $300 million in the past 24 hours. The same wallet then opened leveraged long positions on Ethereum and SUI.

The whale’s Ethereum long was worth $60 million using 25x leverage. Meanwhile, the SUI position stood at $18 million with 10x leverage. These trades suggest a tactical bet on altcoins outpacing Bitcoin soon, especially following the broader market’s rotation from majors to mid-cap tokens.

Such whale movements often front-run broader institutional flows, making this shift toward SUI a critical data point. Combined with Microsoft’s backing, market participants may now view SUI as a growing contender among infrastructure blockchains.

SUI Activates Whitelist Bypass Amid Security Concerns

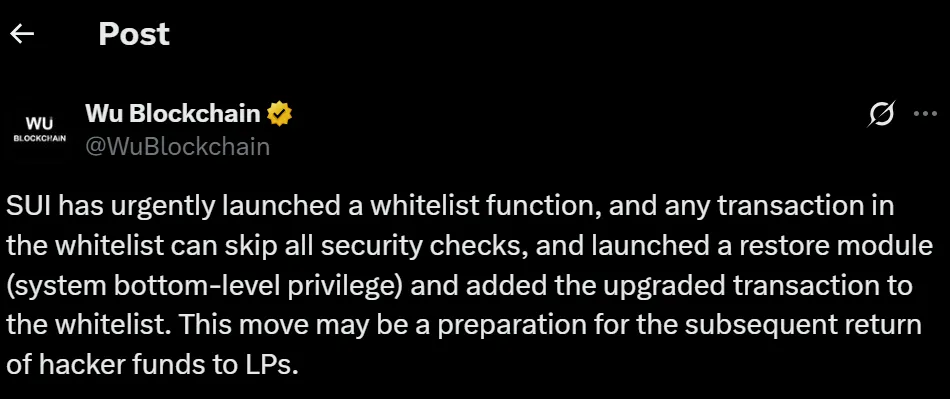

Meanwhile, SUI’s development team has rolled out an urgent security update on the protocol side that raised some eyebrows. As reported by Wu Blockchain, SUI introduced a whitelist function allowing certain transactions to bypass all security checks.

The new system also includes a “restore module” that grants bottom-level system privileges. The update added the upgraded transaction function to the whitelist, essentially allowing developers to execute protocol-level recovery and fund rerouting if needed.

Wu noted that this feature may be preparation for the return of funds following a hack. However, no official disclosure has been made. Security experts have not yet commented publicly on the change, although the transparency of this move may spark debate around backdoor functionality and centralization risks.

Traders Split as Ecosystem Expands Rapidly

Some traders see the whitelist update as a necessary tool to manage unexpected exploits or support recovery mechanisms. Others view it as an excessive override that could undermine decentralization principles.

At the same time, SUI’s growing DEX volumes and stablecoin activity offer a contrasting picture—suggesting end users remain bullish on the ecosystem’s utility. The security module may be considered a proactive measure without a public exploit.

In response, developers have yet to issue a full technical breakdown or timeline for disabling or modifying the whitelist function. Until then, whether this tool is a temporary patch or a longer-term feature remains unclear.

What Next

SUI now finds itself at the center of two major narratives: strategic endorsement from Microsoft and whale accumulation, and protocol-level governance concerns over security bypasses.

Both developments signal increased relevance—but also heightened scrutiny. As SUI matures, its trajectory may depend on how the ecosystem balances innovation with transparency and decentralization.

The post Microsoft Backs SUI as Whales Bet $18M on Altcoin Rally appeared first on The Coin Republic.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.