US banks target GENIUS Act yield gap — what it means for USDC and Bitcoin

23h ago•

bullish:

0

bearish:

0

Share

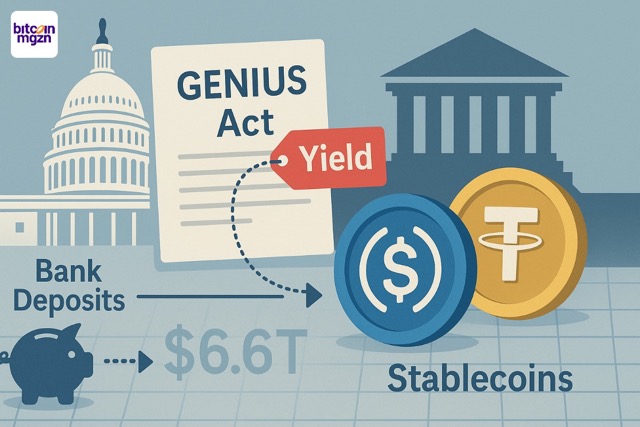

The Bank Policy Institute, leading a collaborative letter alongside the American Bankers Association, Consumer Bankers Association, Independent Community Bankers of America, and the Financial Services Forum, has urged regulators to close a loophole in the GENIUS Act that allows stablecoin issuers to use affiliates or exchanges to pay yield on holdings.

This gap, they argue, poses significant risks, including potential deposit outflows from banks amounting to up to $6.6 trillion. While the GENIUS Act, signed into law on July 18, explicitly bans stablecoin issuers from paying interest directly, it does not address affiliates, enabling current practices where exchanges like Coinbase and Kraken reward users for holding stablecoins such as USDC.

As of the end of June, the stablecoin market totals $280.2 billion, dwarfed by the U.S. money supply of $22 trillion, with Tether commanding $165 billion and USDC $66.4 billion, together capturing over 80% of the market share. Looking ahead, the Treasury projects that stablecoins could expand to $2 trillion by 2028, underscoring the urgency of addressing these regulatory inconsistencies.

The letter

U.S. bank groups asked Congress to block indirect yield on payment stablecoins. They say issuers can route yield through affiliates or exchange partners and avoid the ban in the law. The groups argue this could pull deposits out of banks and cut credit to households and firms.

The GENIUS Act bars issuers from paying interest or yield on the token. It does not extend that bar to affiliates or to exchanges. Rewards on exchange balances are one path. Issuers can benefit if partners market those rewards.

Why banks worry

Banks fund loans with deposits. Rewards on stablecoins can draw deposits away from bank accounts. The letter cites a Treasury estimate that up to $6.6T could move if yield on payment stablecoins is allowed.

The groups warn this would raise funding costs, reduce loan supply, and add stress in volatile periods.

Market context

Stablecoins stand at $280.2B in market value. The U.S. money supply is $22T. Tether is $165B and USDC is $66.4B. Rewards are a key user acquisition tool in the sector.

Treasury expects the market to reach $2T by 2028.

Policy backdrop

The GENIUS Act set a federal framework for dollar-pegged payment stablecoins. Analysts say the law supports use of dollar tokens and may reinforce the dollar’s role in global payments.

The open question is whether Congress will bar yield through affiliates and partners.

Why this is relevant for Bitcoin

Liquidity rails: payment stablecoins route fiat into and across crypto venues. Rules on yield can change flows and trading costs that touch Bitcoin.

Bank funding vs. on-chain dollars: if deposits migrate to token balances, bank credit and rates can shift. That can move risk appetite and Bitcoin demand.

Issuer economics: if yields are limited, issuers may adjust fees and programs. That can change stablecoin growth and the depth of BTC pairs.

Growth path: a market that moves toward $2T expands on-chain dollar liquidity, which can raise spot and derivatives activity around Bitcoin.

What to watch

Congressional action to extend the yield ban to affiliates and exchanges.

Treasury and agency guidance on rewards, sweep programs, and disclosures.

Exchange reward offers for USDC and other payment tokens.

Shifts in USDT vs USDC market share and any bank deposit data on outflows.

Bottom line

Banks want Congress to stop indirect yield on payment stablecoins. The decision will shape stablecoin growth, bank funding, and the flow of dollars across crypto. Bitcoin will feel the result through liquidity and policy.

Het bericht US banks target GENIUS Act yield gap — what it means for USDC and Bitcoin is geschreven door Immanuel Rodulfo en verscheen als eerst op Bitcoinmagazine.nl.

23h ago•

bullish:

0

bearish:

0

Share

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.