Bitwise CIO lists three reasons why Ethereum will hit record after ETF launch

0

0

With spot Ether exchange-traded products set to hit markets next Tuesday, one expert says Ethereum will hit a new all-time high soon after.

Matt Hougan, Bitwise’s chief investment officer, said there are three reasons why Ethereum will rise above $5,000 after the ETFs start trading.

Unlike Bitcoin, Ethereum’s slow supply growth, lack of miners, and staking will pay serious dividends and enable the new ETFs to outperform Bitcoin funds, Hougan said in a new investor note.

He has previously estimated that investors will pour $15 billion into spot Ethereum ETFs in their first 18 months of trading.

Ethereum supply slows

Most cryptocurrencies are inflationary, meaning more are created and sold on the market over time.

Bitcoin does this, but the amount that will ever exist is capped at 21 million.

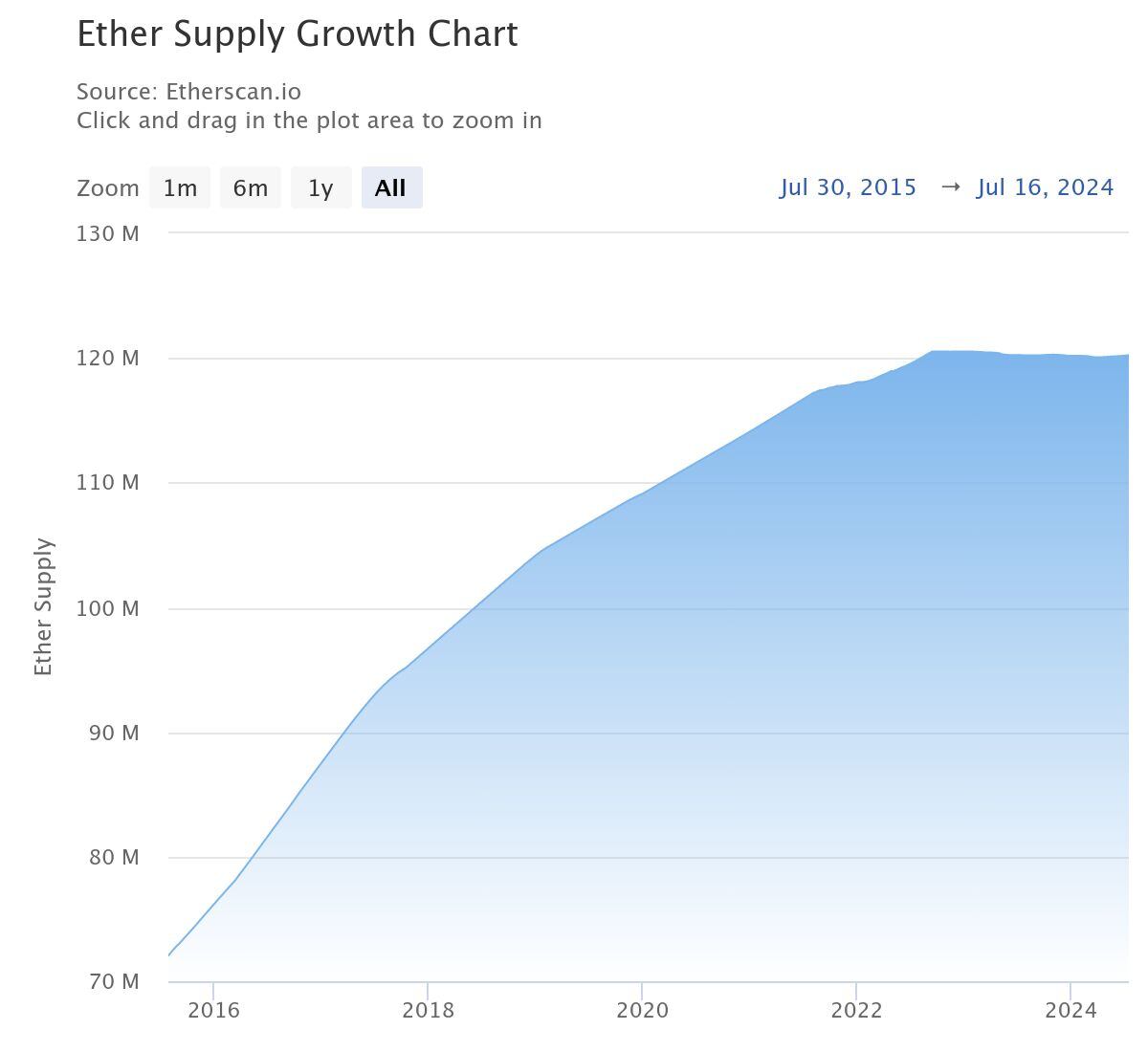

Ethereum is also inflationary, but a technical feature that slows this process was added three years ago.

The burn feature destroys a small portion of Ether with every transaction.

When people swap, trade, or lend on the Ethereum network more frequently, more Ether can be destroyed than produced.

According to data from Etherscan, the net amount of Ether hitting the market has been nearly zero as of September 2022.

The network produces an equal amount of Ether as the burn feature destroys.

Hougan said this slowed growth and the launch of a new demand source will increase Ethereum’s price.

There’s less Ethereum on the market, and with the launch of Ethereum ETFs, many Wall Street firms will start buying it for their products.

More demand translates to higher prices.

Miners aren’t stakers

Bitcoin mining is an industry that demands enormous resources, from electricity costs to high-end machines. Miners regularly sell the Bitcoin they mine to pay these costs.

This isn’t the case with Ethereum stakers.

Ethereum operates a proof-of-stake consensus algorithm. This means it doesn’t require an industrial-grade mining operation to keep it secure.

Instead, users must lock up 32 Ether, which is worth roughly $111,000 today, and become validators who secure the network.

Validators are paid in newly created Ethereum to prevent fraudulent transactions on the network.

Running a validator is far less expensive than running a profitable mining outfit. This means there is less need to sell Ethereum to continue operating.

“In the short term, there is simply less forced selling each day in Ethereum than in Bitcoin,” said Hougan.

Staked and off the market

More than 33 million Ether are staked today, nearly 28% of the entire cryptocurrency’s supply, according to a Dune dashboard by analyst Hildobby.

More importantly, says Hougan, this is Ether that’s not moving soon either, as they are locked up for a set period, meaning it cannot be withdrawn or sold.

“Currently, 28% of all ETH is staked, meaning it is effectively off the market,” Hougan said

The combination of low inflation, fewer sellers in Ether stakers, and millions of Ether off the market make the proposition of an ETH ETF especially bullish, said Hougan.

“If the ETPs are as successful as I expect — and given the dynamics above — it’s hard to imagine ETH not challenging its old record.”

Crypto market movers

- Bitcoin is up 3% over the past 24 hours to trade at $65,000.

- Ethereum is up 1.8% to $3,476.

What we’re reading

- Solana project Sanctum will double airdrop rewards for ‘long-term aligned’ users — DL News

- Hong Kong shares list of seven suspicious crypto exchanges — Milk Road

- LI.FI drained of more than $10 million via wallets with infinite approval settings — Unchained

- FTX and CFTC reach landmark $12.7bn settlement — Milk Road

- Binance exec Tigran Gambaryan’s case won’t resume until October as judge goes on holiday — DL News

Liam Kelly is a DeFi correspondent at DL News. Got a tip? Email at liam@dlnews.com.

0

0

从同一位置管理所有加密资产、NFT 和 DeFi 资产

从同一位置管理所有加密资产、NFT 和 DeFi 资产安全地关联您正在使用的投资组合,以开始交易。