Altcoin Market Set to Explode? Why This Analyst Is Bullish As BTC Hits New ATH

0

0

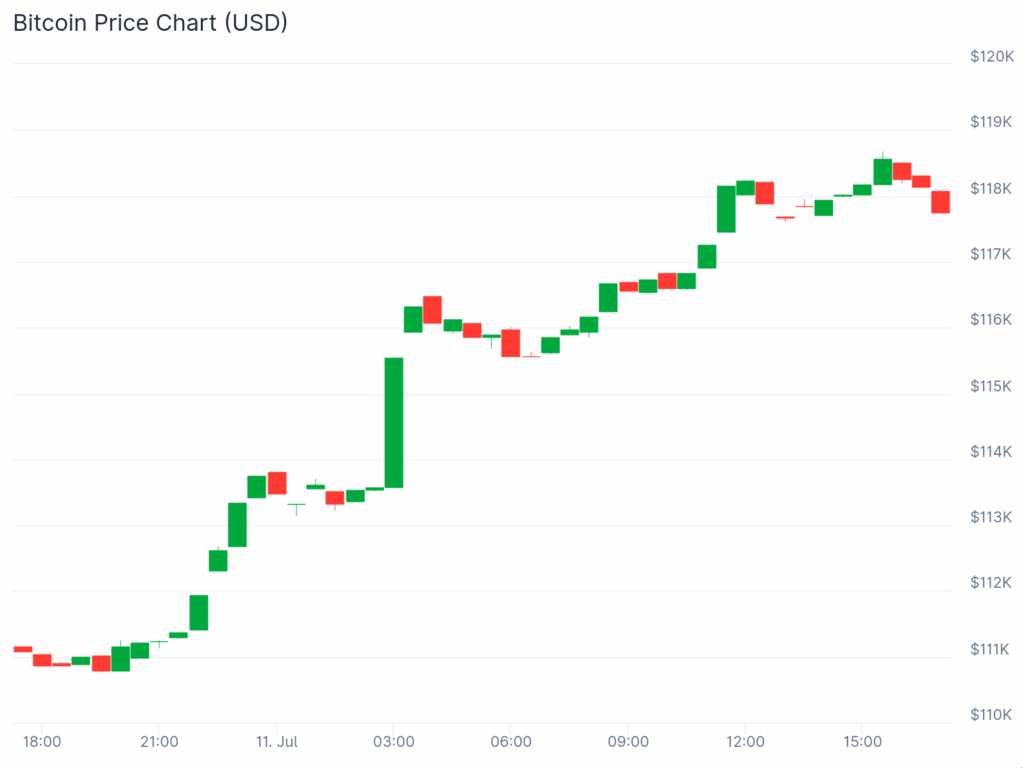

Bitcoin (BTC USD) broke through the inverse head and shoulders neckline while reaching new all-time highs. Analyst Dan Gambardello explains why this creates a perfect setup for an altcoin pump.

Bitcoin dominance falls on weekly charts as regulatory clarity improves. Next week brings crypto tax policy hearings and potential legislative breakthroughs supporting market confidence.

Bitcoin Breaks Key Technical Patterns Amid Regulatory Breakthroughs

Bitcoin broke through inverse head and shoulders neckline patterns tracked across multiple timeframes. The multi-year inverse head and shoulders targets range from $130,000 to $300,000.

A smaller inverse head and shoulders pattern targets $150,000 to $160,000 levels.

The weekly chart shows Bitcoin breaking above key resistance with potential neckline retest.

Gambardello stated that continuation requires separation from the neckline before moving toward target zones. Bitcoin achieved new all-time highs while completing these technical formations simultaneously.

US Treasury removed crypto broker reporting rules, including Form 1099-DA requirements. This move sparks market confidence towards a potential rally in BTC as well as altcoins.

The rules required crypto brokers and DeFi platforms to report transactions.

Next week brings crypto week with multiple legislative developments planned across Congress. The House Ways and Means Oversight Committee rescheduled crypto tax policy hearings.

Banking GOP plans to drop the market structure discussion draft following refinements.

The House plans full votes on FIT21 legislation. Anti-CBDC surveillance state act also faces voting during crypto week activities. FIT21 passage sends legislation to President Trump’s desk for final approval.

According to Gambardello, these regulatory developments create favorable conditions for crypto market expansion.

Bitcoin Dominance Falls as Altcoin Season Setup Develops

Bitcoin dominance falls on weekly charts while Bitcoin reaches new all-time highs. The pattern mirrors November conditions when Bitcoin broke a multi-month structure simultaneously.

Bitcoin dominance started falling in November as altcoins began breaking out. Current conditions show Bitcoin breaking multi-month structure toward new all-time highs.

Bitcoin dominance hits the upper end of lower high Fibonacci levels. The 786 line from last cycle’s swing high creates potential resistance.

“Bitcoin dominance is falling right now,” analyst Dan Gambardello notes regarding current market dynamics. Weekly charts show dominance potentially topping at current Fibonacci levels.

November’s altcoin run coincided with Bitcoin dominance decline and new highs. A similar setup is developing now with Bitcoin breaking all-time highs again. The pattern suggests altcoin season preparation as dominance weakens consistently.

Ethereum shows early breakout signs from multi-year symmetrical triangle patterns. Ethereum needs separation above the trend line for confirmed breakout signals.

The busted pattern scenario involves triangle breakdown, apex pullback, then upward blast. Multi-year symmetrical triangle break creates foundation for altcoin bull market.

Ethereum sits at the beginning stages of a potential busted pattern formation.

Altcoin Markets Approach Key Breakout Levels

Altcoin markets target breaking the $1.25 trillion market cap resistance area. Weekly wicks cluster around this level, creating multi-touch resistance zones. Breaking above this area triggers new trends of higher highs.

The move establishes nice reversal patterns for altcoin markets, excluding Bitcoin. The previous November breakout showed solid upward movement from similar levels. The next target sits around $1.6 trillion market cap for altcoins.

Consolidation may occur at $1.6 trillion before further upward movement. Breaking through this level triggers altcoin season headlines across the media. Markets trend above larger pattern formations seeking breakout confirmation.

Cardano tests the bottom of the bull market doors around 64 cents. The 200-week moving average creates massive multi-cycle resistance at current levels. Breaking above this area with the moving average flips confirms bullish territory.

According to Gambardello, the setup creates perfect conditions for altcoin season development across markets.

The post Altcoin Market Set to Explode? Why This Analyst Is Bullish As BTC Hits New ATH appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.