Bitcoin ETFs See Outflows as Ethereum ETFs Benefit from ETH Price Rally

0

0

Highlights:

- BTC ETFs see no inflows as Bitcoin struggles with $105,000 resistance.

- Bitcoin’s realized market cap rises, which indicates better sentiment and less selling pressure.

- Ethereum funds saw $13.5 million in inflows as ETH price surged to $2,700.

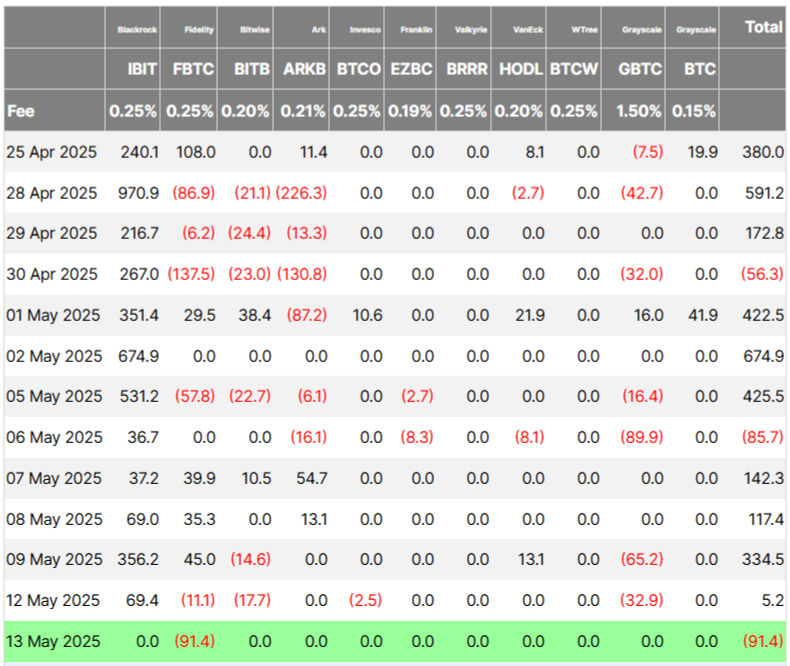

U.S.-based spot Bitcoin (BTC) ETFs experienced $96.14 million in outflows on May 13. Fidelity Wise Origin Bitcoin Fund (FBTC) recorded $91.39 million in outflows, according to Farside data. Yesterday’s outflows came after a record $41.18 billion in cumulative net inflows for the spot BTC ETFs on May 12.

None of the twelve active BTC ETFs saw net inflows on Tuesday. This pause followed Bitcoin’s failure to maintain momentum above the $105,000 resistance, despite positive news on U.S.-China trade talks. Consumer Price Index (CPI) increased by 0.2%, which brought its annual inflation to 2.3%. Presto Research analysts said the crypto rally’s length may mostly depend on U.S.-China trade talks and tariff impacts on the economy.

ETH ETFs See $13.5 Million Inflows as Price Soars

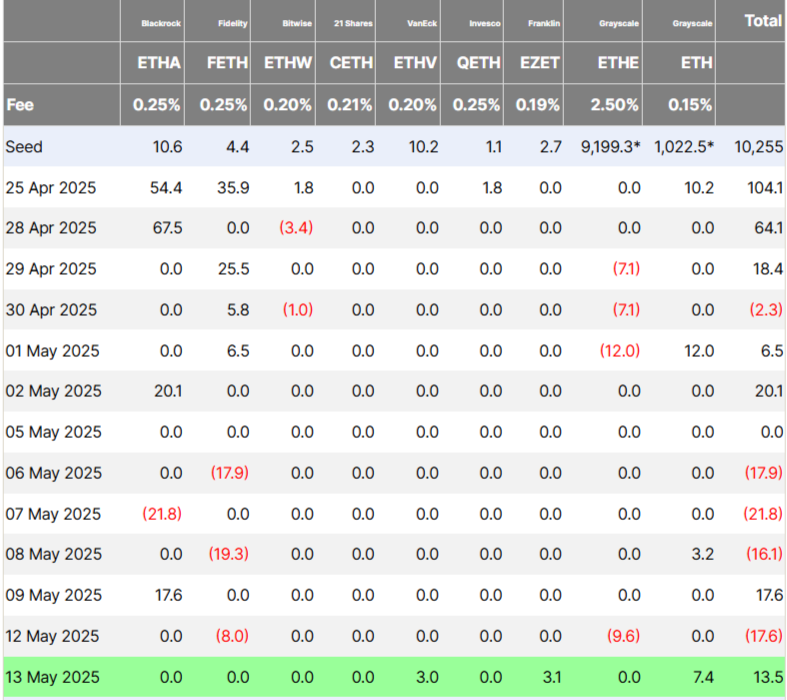

On Tuesday, ETH funds recorded $13.5 million in inflows. Grayscale Ethereum Mini Trust (ETH) led with $7.4 million. Vaneck Ethereum ETF (ETHV) followed with $3.0 million, and Franklin Ethereum ETF (EZET) with $3.1 million.

Ethereum price soared 8% to $2,600 in the last 24 hours. Its daily trading volume also surged by 14% to $37.46 billion which shows strong market interest. According to Coinglass data, ETH futures open interest rose 10%, reaching over$30 billion.

Crypto analyst Rekt Capital noted that Ethereum has closed its Daily CME gaps around $2,530 and $2,630. If ETF inflows continue, a close above these levels could turn the gaps into support and will pave the way for further gains. Ether may next fill the gap at $2,900-$3,033, with a potential rally to $3,200.

Ethereum has completely filled the ~$2530 & ~$2630 Daily CME Gap (green box)

Daily Close above green and Ethereum will try to reclaim this CME Gap into a new dynamic support from which #ETH would be able to springboard into additional trend continuation#Crypto #Ethereum https://t.co/es73AH2CA8 pic.twitter.com/nShPsJudX3

— Rekt Capital (@rektcapital) May 13, 2025

BTC Sees Strong Trading Activity and Positive Market Sentiment

At the time of writing, BTC was trading at $103,647, reflecting a 0.81% drop in the last 24 hours. The rally occurs due to a steady increase in trading activity over the past day. This is clearly evident in the futures market, where Bitcoin’s open interest currently stands at $67.47 billion, marking a 1% rise in the past 24 hours. The increase in open interest suggests traders are re-entering with new positions as they are expecting more gains.

BTC is showing new strength as on-chain data and market conditions support a positive outlook. A Tuesday post from Bitfinex Alpha highlighted that Bitcoin’s realized market capitalization reached $889 billion, up 2.1% in the past month. The realized market cap values coins at their last price, unlike the regular market cap, which uses the current price. On-chain data shows fewer coins are at a loss, with over 3 million BTC now in profit. This suggests better market sentiment and less selling pressure.

The company stated:

“On-chain data also shows a sharp decline in BTC holdings at a loss, with over 3 million BTC returning to profit. Combined with rising trading volumes and institutional-led ETF inflows, Bitcoin is now on solid footing.”

Bitcoin fell 32% from its peak earlier this year. It has now rebounded, crossing the $100,000 mark after three months. Bitfinex analysts said easing global trade tensions and the Federal Reserve’s softer policy helped boost investor confidence.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.