ETH Overtakes BTC in Futures Volume: Arthur Hayes Says $10K Is Just the Beginning

0

0

As Bitcoin starts to make news, Ethereum is silently taking big steps. The Ethereum price has cracked over the $3,000 mark, fuelling a bullish mood in the crypto sphere. Analysts now estimate a massive breakout, with Bitcoin and former BitMEX CEO Arthur Hayes predicting that a rally to the $10,000 level is possible.

Ethereum Price Surge Backed by Big Bets and Bigger Money

Ethereum is growing on a series of bullish forces. At press time, ETH is trading at $3,010 and in the last 24 hours, it has increased by 8.28%. Ethereum crossed another major psychological barrier of over $2,780 as well.

Arthur Hayes has further insisted in his prediction that Ethereum can surge by between $10,000-$15,000 due to changes in the macroeconomics and changes in investor sentiments.

Ethereum is also experiencing an amount of capital inflow on the institutional front. Over $211 million flowed in Ethereum ETFs on a single day, with BlackRock itself overtaking a staggering amount of $158.6 million.

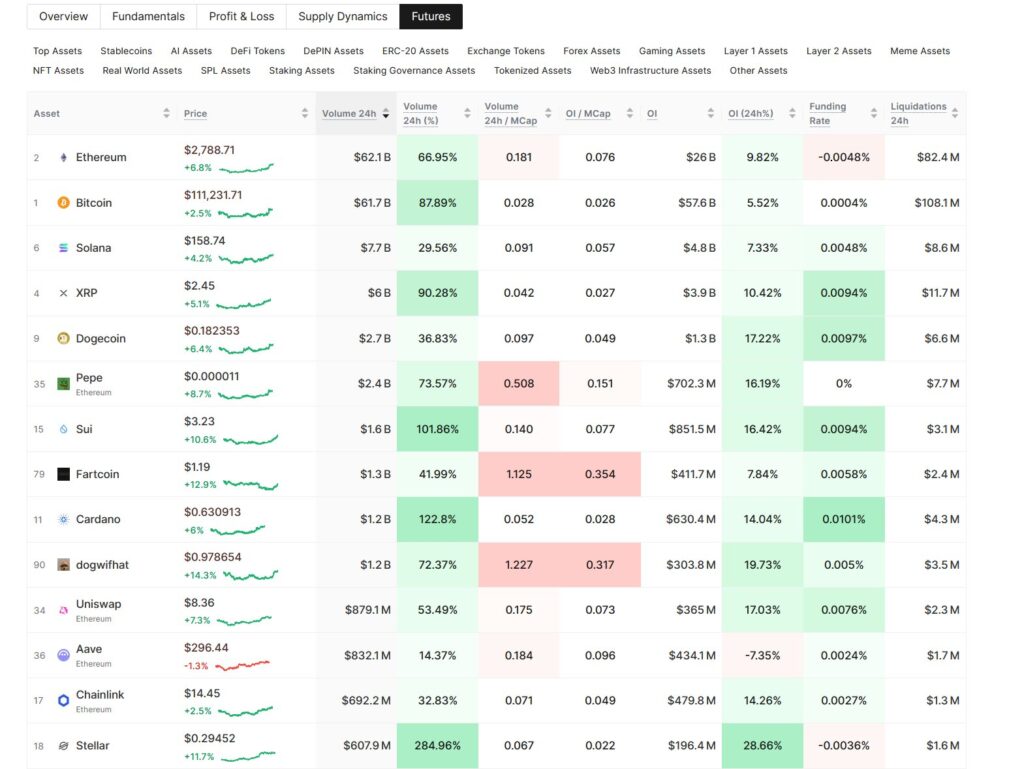

In the same vein, Glassnode has shown that Ethereum has surpassed Bitcoin in volume of futures traded with ETH reaching $62.1 billion against $61.7 billion collected by BTC. The value of open interest in Ethereum CME futures stood at a three-month high of $3.27 billion, which is an indicator of increased investor trust by institutions.

Arthur Hayes’ Bold Ethereum Price Forecast

Arthur Hayes, one of the most prominent people in the crypto community, has shared his bullish sentiment concerning Ethereum publicly. Hayes also revealed his estimate of Ethereum reaching $10,000 or even $15,000 in a recent Bankless podcast by arguing that in future the world will have more liquidity than now and stricter capital controls in the world.

The main point made by him was that the true power of Ethereum is associated with its increasing number of uses and decentralized finance (DeFi) leadership. Hayes also put a spotlight on ETH/BTC ratio that has made a crawl up in the recent past to 0.025 BTC, which was previously the bounce level at 0.02 BTC.

Institutional Inflows Drive Ethereum Higher

Ethereum is not the only coin that is experiencing a price rally. The interest in institutions is picking up pace. ETFs of Ethereum recorded inflows of more than $211 million on a single trading day. It exemplifies the confidence of the leading financial organizations as the share of BlackRock in that is $158.6 million.

There was also an upsurge in whale activity in Ethereum in June with an increase in the holdings by 36%. Moreover, approximately 1 million ETH was deposited to the liquid staking protocols, which is also an indication of a long-term investment in the success of the network.

Ethereum Price Outpaces Bitcoin in Futures Market

Ethereum has posted an impressive turnaround in surpassing Bitcoin in futures trading. According to Glassnode data, Ethereum futures volume, at $62.1 billion, has surpassed that of Bitcoin by just a margin of 0.4 billion. This is an unusual occurrence giving an indication that traders are turning their attention more towards Ethereum.

The open interest of Ethereum futures at CME increased to $3.27 billion, which is the highest value in five months. It is a commonly accepted indicator of institutional participation, which furthers convictions that Ethereum is on an upward trajectory.

Developers, Companies, and Smart Contracts Converge on ETH

Ethereum’s ecosystem continues to expand at an impressive pace. A recent Fidelity report found that Ethereum outperforms all other chains—including Solana—in developer activity, total value locked (TVL), and stablecoin utilization.

Companies are also beginning to treat Ethereum as a treasury reserve asset. This new use case mirrors the way corporations adopted Bitcoin during the 2020–2021 bull cycle. As Ethereum continues to integrate with enterprise-grade applications, its intrinsic value proposition strengthens.

Ethereum Price Mirrors Bitcoin’s 2020 Rally Pattern

Market analyst Ted Pillows has noticed that the price of Ethereum is creating a pattern that resembles quite closely the one Bitcoin had in the year 2020 when it broke out. According to Pillows, Ethereum is building a solid foundation.It has seen a degree of inflow in terms of institutions, accumulating by whales, and increasing volumes on both trading platforms.

| Month | Min. Price | Avg. Price | Max. Price | Potential ROI |

|---|---|---|---|---|

| Jul 2025 | $ 2,997.52 | $ 3,281.22 | $ 3,588.50 |

19.22%

|

| Aug 2025 | $ 3,154.63 | $ 3,756.75 | $ 4,473.65 |

48.62%

|

| Sep 2025 | $ 4,113.86 | $ 4,652.75 | $ 4,937.84 |

64.04%

|

| Oct 2025 | $ 4,362.67 | $ 4,980.17 | $ 5,561.57 |

84.76%

|

| Nov 2025 | $ 4,261.42 | $ 4,581.48 | $ 4,984.20 |

65.58%

|

| Dec 2025 | $ 3,748.63 | $ 4,062.48 | $ 4,647.65 |

54.40%

|

In his opinion, the silent accumulation of Ethereum by smart money is awaiting a sharp move within the next few months. Pillows reckoned that since the Ethereum chart at the moment indicates that a breakout would be of the price, it may reach the milestone of $10,000 sooner than expected.

Network Upgrades Fuel Optimism

Ethereum’s recent technical upgrades are further strengthening its case. The implementation of scalability solutions and staking enhancements has helped drive network efficiency and reduce gas fees.

These improvements played a role in the recent 50% surge in the Ethereum price, as they increased both developer adoption and user activity. With the network now more scalable and cost-efficient, Ethereum is better positioned to support the next wave of decentralized applications.

Conclusion

The Ethereum price crossing $3,000 is more than a technical milestone—it’s a reflection of increasing investor confidence, institutional participation, and ecosystem growth. With Arthur Hayes and other experts calling for a breakout toward $10,000, all eyes are now on Ethereum. If current trends persist, ETH could very well be the asset that leads the next phase of the crypto bull run.

Summary

Ethereum is quietly gaining strength as the Ethereum price breaks above $3,000, backed by major institutional inflows and rising investor confidence. Arthur Hayes predicts a surge to $10,000, fueled by macro shifts, ETH/BTC recovery, and a booming futures market that has overtaken Bitcoin.

With $211 million funnelled into Ethereum ETFs in a single day and BlackRock leading the charge, institutional interest is peaking. Meanwhile, upgrades to the Ethereum network and a growing DeFi ecosystem are reinforcing ETH’s role as the backbone of Web3.

Frequently Asked Questions (FAQ)

1- Why is the Ethereum price rising?

The surge is driven by institutional inflows, whale accumulation, futures market interest, and recent network upgrades.

2- Who predicts Ethereum will reach $10,000?

Arthur Hayes, former BitMEX CEO, has predicted Ethereum may reach $10,000–$15,000 in this market cycle.

3- Are institutions buying Ethereum?

Yes. BlackRock recently purchased over $158 million worth of ETH, and Ethereum ETFs saw over $211 million in inflows in one day.

4- Has Ethereum overtaken Bitcoin in trading volume?

Yes. Ethereum futures volume has surpassed Bitcoin’s, signaling a shift in trader focus.

Appendix: Glossary of Key Terms

Ethereum Price – The current market value of Ether, influenced by demand, investor sentiment, and global crypto trends.

ETH/BTC Pair – A trading metric showing how Ethereum performs relative to Bitcoin, often used to gauge market rotation.

Futures Trading – A contract to buy or sell Ethereum at a future date for a set price, commonly used by traders for speculation or risk management.

ETF (Exchange-Traded Fund) – A regulated investment fund that allows exposure to Ethereum price movements without directly owning the asset.

Whale Wallets – Crypto addresses holding large quantities of Ethereum, often capable of influencing price through major transactions.

CME Futures – Institutional-grade Ethereum futures contracts traded on the Chicago Mercantile Exchange, signaling mainstream investor interest.

Total Value Locked (TVL) – The total amount of crypto assets locked in Ethereum-based DeFi protocols, reflecting ecosystem health and usage.

Reference

CoinPedia – coinpedia.com

Read More: ETH Overtakes BTC in Futures Volume: Arthur Hayes Says $10K Is Just the Beginning">ETH Overtakes BTC in Futures Volume: Arthur Hayes Says $10K Is Just the Beginning

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.