Algorand Leads Tokenized Stocks, But Is It Already Losing The Race?

0

0

Key Insights:

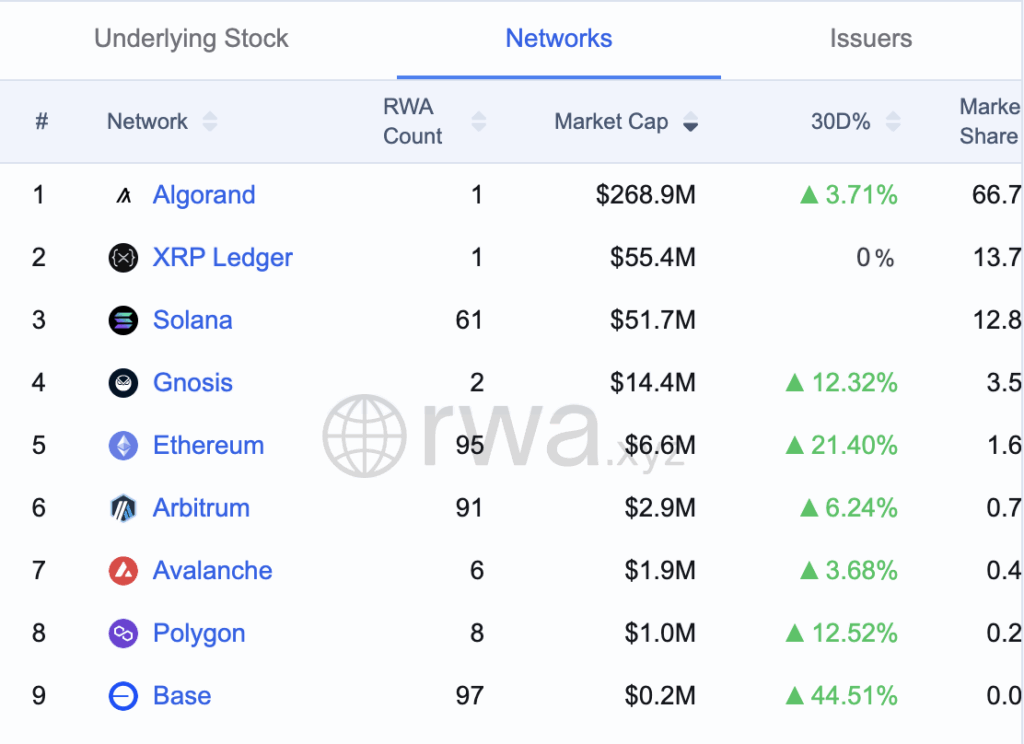

- Algorand controls over 77% of the tokenized stock market, thanks to one major asset: EXOD.

- Ethereum, Base, and Arbitrum are growing faster, with dozens of new assets launched.

- If Algorand doesn’t diversify soon, it could fall behind in the tokenized stocks race.

Tokenized stocks are becoming one of the hottest new trends in crypto. Chains are racing to bring traditional assets like equities and ETFs onto the blockchain, promising faster trades and round-the-clock access. And while Algorand was one of the first to take the lead, new data suggests that the lead may already be slipping.

Algorand’s Big Lead is Built on a Single Asset

Algorand currently has the biggest share of the tokenized stock market. Over 77% of the entire value is hosted on its network, and most of that is just one stock: EXOD, from Exodus, tokenized by Securitize. It was one of the first major examples of tokenizing traditional finance (TradFi) onto a blockchain. This helped Algorand take the lead early in the Real World Asset (RWA) space.

But here’s the issue: since that launch, no other tokenized stock has been added to the Algorand network.

For nearly a year, it has remained a one-token chain when it comes to stocks. This makes its large market share look more like a pie snapshot in time than a real lead.

Tokenized stocks refer to blockchain-based representations of traditional equities like Apple, Tesla, or ETFs. These can be traded 24/7 on-chain, opening up global access to equity markets.

Ethereum and Others Are Catching Up Fast

While Algorand sits on one stock, other networks are moving fast. Chains like Ethereum, Base, and Arbitrum now support dozens of tokenized assets; in some cases, over 90.

The growth isn’t just about numbers. These networks are onboarding big players like Robinhood, Coinbase, and even Kraken, who are now offering fractional stock tokens to EU users.

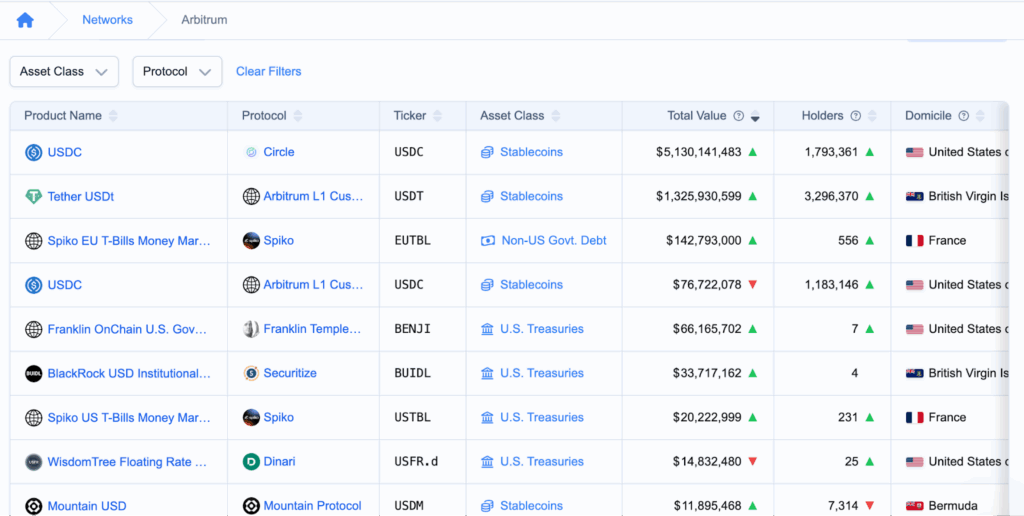

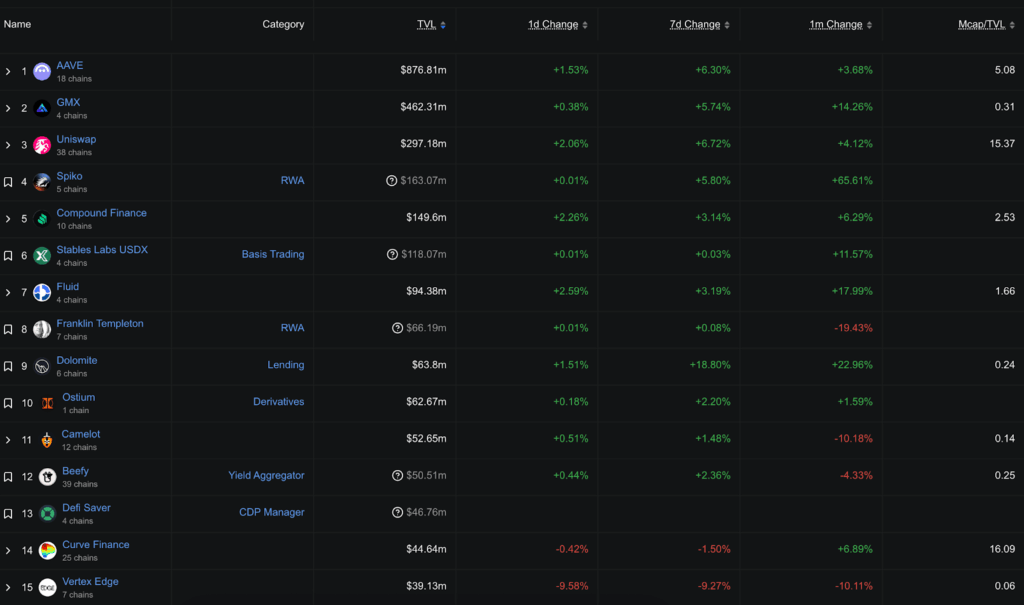

For example, Robinhood’s new tokenized stock rollout uses Arbitrum as a settlement layer. They’ve listed over 200 stock tokens, including Apple, Nvidia, and major ETFs. Meanwhile, Base and Ethereum have also become homes to these assets.

Kraken has launched its own tokenized products under the name xStocks, hosted on Solana.

The tokenized equity sector is expanding across multiple chains. And most of them are adding assets faster than Algorand, which hasn’t added a second stock yet.

Algorand’s Edge is Slipping?

Despite leading in total value, data now warns that Algorand is losing ground. Its early dominance came from being first, but being first isn’t the same as staying ahead.

Most institutions want more than one stock. They want a broader platform, more asset diversity, and proven liquidity. Right now, Ethereum and Arbitrum are checking those boxes.

Arbitrum’s Real World Asset TVL has surged 32% in the last month, thanks to tokenized stock activity. Algorand, by comparison, has seen little traction beyond EXOD.

First-mover advantage is important. But without follow-up development and asset expansion, it turns into a missed opportunity.

Can Algorand Bounce Back?

Algorand still has strong foundations. It’s fast, low-cost, and known for being more regulatory-friendly than many other chains. These traits make it a good fit for institutional use cases like tokenizing stocks. But now it needs to act.

To stay in the lead, Algorand must expand beyond a single stock. Adding more tokenized equities, or even ETFs and bonds, could help restore its edge. Otherwise, its 77% market share will start to shrink as other chains keep launching new assets every month.

The tokenized stock race is heating up fast. The future may still be on-chain, but Algorand needs to prove it’s more than just EXOD.

The post Algorand Leads Tokenized Stocks, But Is It Already Losing The Race? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.