0

0

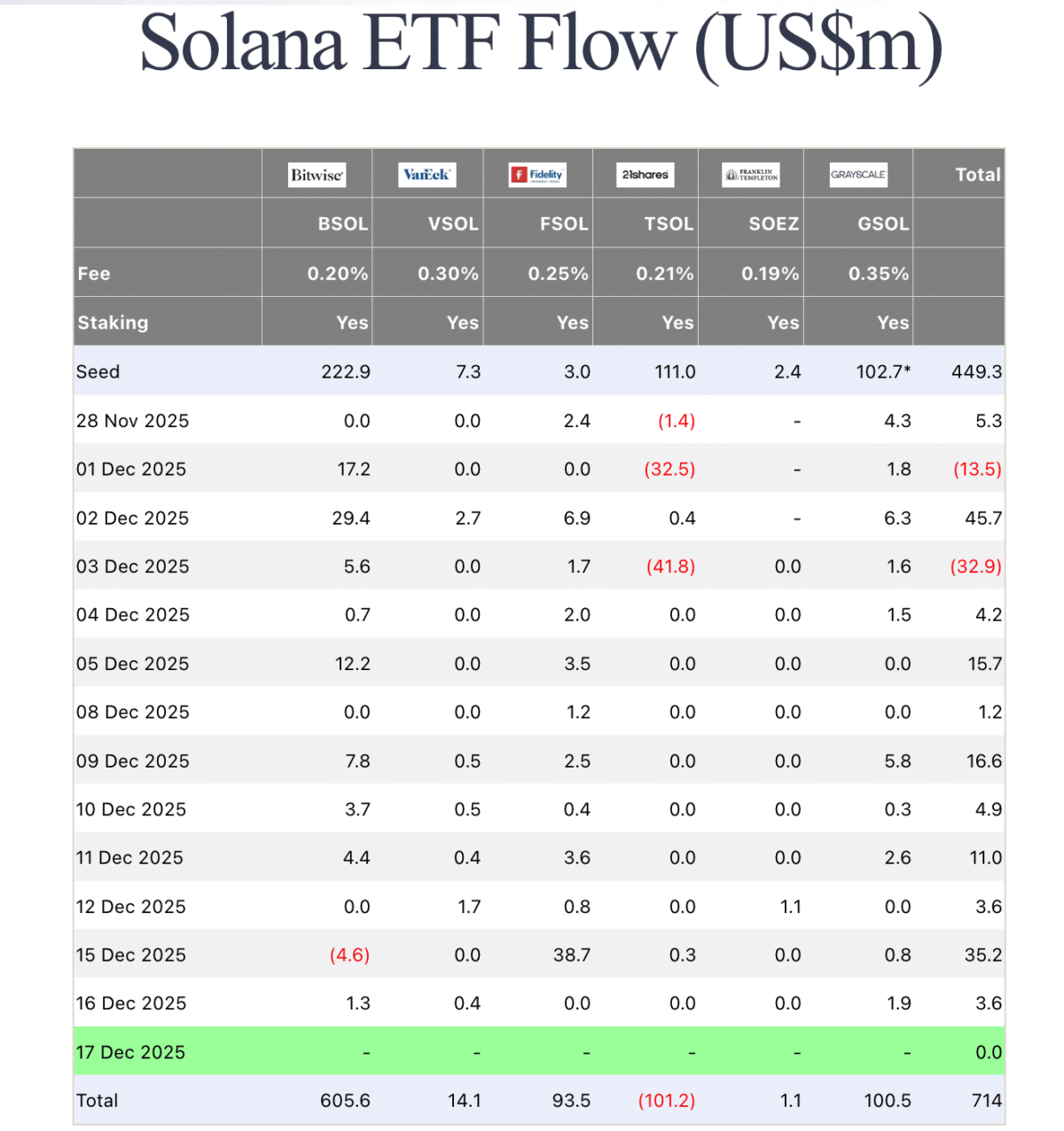

Solana SOL $122.2 24h volatility: 4.3% Market cap: $68.72 B Vol. 24h: $5.82 B ETFs crossed $95.3 million in total net flows in December, according to real-time data from FarsideInvestors. The total net inflow for Solana ETFs in November 2025 was $137.5 million with only three days of net outflows recorded. Solana ETFs are on track to exceed last month’s haul, having now acquired 70% of the total inflows for last month just over mid-way through December.

Rotation towards stablecoins surged this week, as macro bets and volatile institutional flows triggered cascading liquidations in the derivatives crypto markets. However, Solana continues to receive strong institutional demand despite the flat price action in December so far.

Solana ETFs net $95.3 million monthly inflows on Dec 17 | Source: FarsideInvestors

In other positive Solana ecosystem news keeping SOL price resilient, co-founder Anatoly Yakovenko explained his vision for Solana Mobile’s upcoming SKR token. In a post on Tuesday, he said it could give token holders vertical control over the phone, UX, and revenue capture.

Gov token => phone os root certificate manager => vertical control of the UX and revenue capture for the gov token.

skr and sms is enforcement of token holder value capture with cryptography and tees.

Someday everyone will understand this. https://t.co/Gjsb3xpYDS

— toly 🇺🇸 (@aeyakovenko) December 16, 2025

He added that SKR and SMS enforce value capture using cryptography. Additionally, Helium Mobile, a community-powered decentralized network on Solana, has now surpassed 600,000 signed-up users, according to ecosystem news aggregator, SolanaFloor.

Solana price trades near $122 after completing a third local bottom on the 12-hour chart. Each bottom printed near the $120–$124 demand zone, confirming strong buyer defense around this area. This explains why Solana price avoided a breakdown below $120 despite rapid crypto market liquidations this week.

On the upside, Solana’s rebound prospects remain capped below the $145–$148 resistance band, matching the triple-bottom pattern neckline. A decisive close above this level is required to confirm bullish breakout continuation, before approaching the projected upside target near $172, implying a potential 28% recovery from current levels.

Solana (SOL) Technical Analysis | TradingView

RSI on the 14-period timeframe reads near 35, approaching oversold conditions. Previous rebounds from similar RSI levels triggered sharp mean-reversion rallies in SOL. A bullish RSI crossover above 45 would support breakout probability.

Breakout Probability metrics embedded on the chart show a historical profitability rate above 64%, signaling that trades are sitting on profits and decisively opting to hold. However, failure to reclaim $130 in the coming sessions, Solana price risks sharp correction below $120, which would invalidate the triple bottom thesis.

The post Solana ETFs Hit $95.3M Net Inflows in December as Institutional Demand Surges appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.