Bitcoin (BTC) Price Is Stuck: Analysts Explain Why

0

0

Despite expectations of a strong rally in October, Bitcoin’s BTC $110 325 24h volatility: 0.8% Market cap: $2.20 T Vol. 24h: $67.36 B price appears stuck, trading flat and struggling to regain momentum.

With only hours left in the month, the largest cryptocurrency records 3.3% monthly drop, hovering just below the $110,000 mark.

If the current trend holds, it will mark the first time in seven years that Bitcoin ends October in the red. According to several leading analysts, multiple factors are contributing to this period of stagnation.

Popular analyst Axel Adler Jr noted on X that long-term holders (LTHs) have been selling since July 1.

Data shows that these investors have distributed roughly 810,000 BTC, reducing their collective holdings from 15.5 million to 14.6 million BTC.

Why is Bitcoin stuck?

One reason is that since July 1, long-term holders have been selling their coins. The distribution volume has already reached 810K BTC, and their total holdings have decreased from 15.5M to 14.6M. Yet even under this selling pressure, Bitcoin has hit new… pic.twitter.com/GcLa4bRKDr

— Axel 💎🙌 Adler Jr (@AxelAdlerJr) October 31, 2025

Despite this selling pressure, Bitcoin has managed to reach new all-time highs twice. This suggests that market demand remains strong enough to absorb much of the supply.

However, Adler Jr explained that as long as long-term holders continue to take profits, Bitcoin’s upside potential will remain limited.

Weak Retail Demand

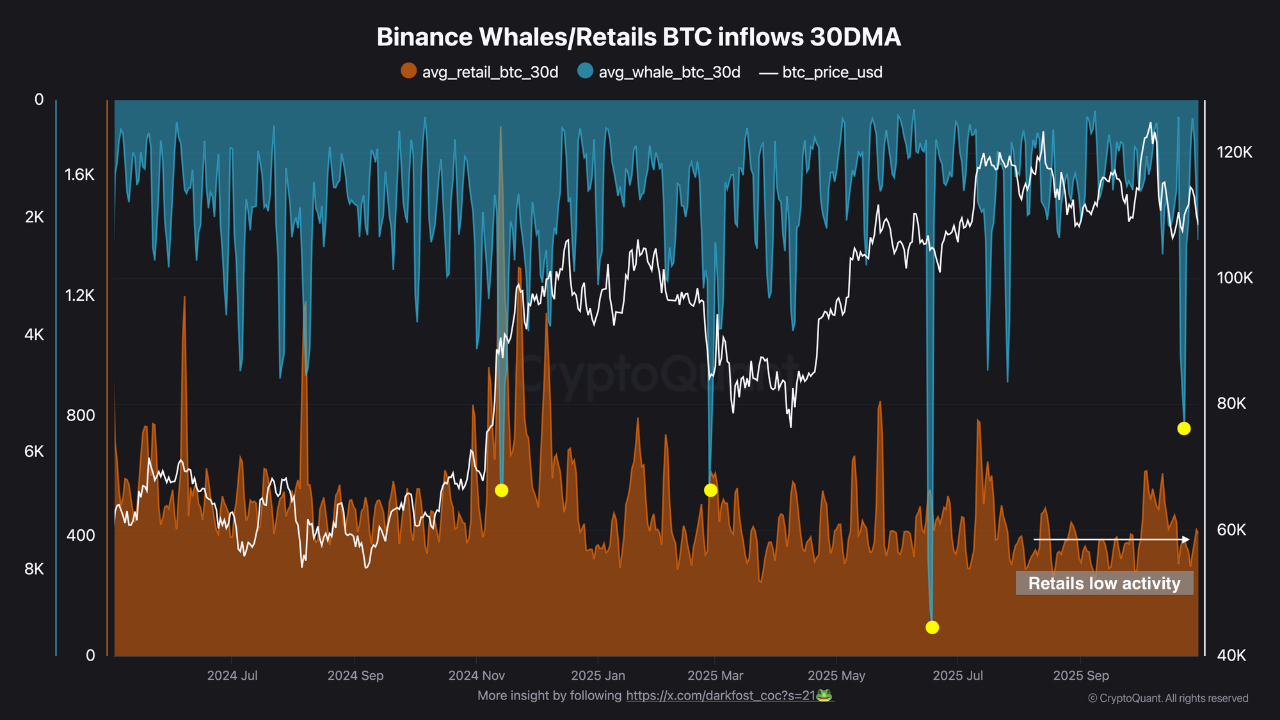

Meanwhile, the long-inactive Bitcoin whale wallets are showing renewed activity. In recent weeks, the monthly average of BTC inflows to Binance from whales climbed to around 5,600 BTC, one of the highest figures recorded this year.

Bitcoin whales and retail inflow to Binance in October. | Source: CryptoQuant

In contrast, retail investors have remained largely on the sidelines. Even when Bitcoin hit its peak of $126,000 on October 7, retail inflows averaged only 600 BTC per month. This is a fraction of what was seen in previous bull markets.

Analysts suggest that smaller investors may be hesitant, waiting for clearer signs of recovery before investing new capital.

BTC Price Outlook for November: Still Room for Optimism

Earlier on October 31, Bitcoin tested the $106,000 support zone. Despite the recent correction, many analysts remain optimistic for November.

Data shared by Bitcoin Vector shows that each time BTC tests the $106,000-$108,000 range, it experiences less volatility, a sign of market resilience.

Each time BTC tests the $106K–$108K zone, it causes less stress on the Risk-Off Signal. It means $BTC is absorbing volatility more efficiently

But to avoid escalation, BTC must reclaim the holders’ cost-basis zone in the coming days; otherwise, downside pressure could resume and… pic.twitter.com/zg1OukiyGC

— Bitcoin Vector (@bitcoinvector) October 30, 2025

The firm noted that Bitcoin needs to reclaim the holders’ cost-basis zone soon to prevent further downside pressure.

However, the overall market health remains solid. Unrealized losses at around $107,000 represent only 1.3% of Bitcoin’s market cap, far below levels seen in previous bear markets.

Despite the bearish sentiment, Unrealized Loss at $107K is only equivalent to ~1.3% of Bitcoin’s market cap.

In mild bear markets, this typically exceeds 5%, and in severe ones, it exceeds 50%.👉 The market pain is still far from what defines a true bear phase. https://t.co/PLxEusjkDm pic.twitter.com/SaQ1rlh9nl

— CryptoVizArt.₿ (@CryptoVizArt) October 30, 2025

Analysts believe this indicates that the bull cycle is still intact, and a new all-time high for Bitcoin could appear before 2025 ends.

Bitcoin Hyper Raises Over $25 Million

Amid high volatility, Bitcoin Hyper (HYPER) is making waves in its presale phase, pulling in $25.3 million as investor excitement builds. The project aims to overcome some of Bitcoin’s most common hurdles like slow transaction times and expensive network fees.

Bitcoin Hyper is a next-generation Layer 2 network designed to supercharge Bitcoin’s efficiency. It uses an advanced virtual machine to execute transactions faster and at lower costs, while still relying on Bitcoin’s secure base layer for trust and stability.

Early participants in its crypto presale are already reaping impressive rewards. Those who stake HYPER tokens can earn a substantial 46% annual yield. This allows them to grow their holdings while supporting the expansion of the ecosystem.

HYPER Tokenomics and Presale Snapshot

The HYPER token is the backbone of the project. It powers everything from transaction fees to staking and premium platform features, driving the network’s economy and governance.

Currently, HYPER is priced at $0.013195 in the ongoing presale, offering early investors a discounted entry before the next price hike.

HYPER Presale Snapshot:

- Ticker: HYPER

- Presale Price: $0.013195

- Funds Raised: $25.3 million

Want to join the presale? We’ve put together a helpful guide on how to buy Bitcoin Hyper safely and securely before it officially launches.

The post Bitcoin (BTC) Price Is Stuck: Analysts Explain Why appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.