HSBC Expands Promising Digital Asset Custody Industry in Asia

2

0

HSBC Holdings will launch a digital asset custody service for institutional clients in 2024. The bank will tap European firm Metaco, owned by Ripple Labs in the US, to safeguard client assets.

The new system will be added to the HSBC Orion service that started issuing tokenized gold last week. Orion already uses Distributed Ledger Technology to ascribe ownership of physical gold represented with digital tokens.

HSBC Says Need for Custody is Growing

Zhu Kuang Lee, the chief digital, data, and innovation officer of securities services at HSBC, noted an increasing demand for digital asset services.

“We’re seeing increasing demand for custody and fund administration of digital assets from asset managers and asset owners, as this market continues to evolve.”

Asia is slowly onboarding the real-world asset tokenization train that could further increase demand for digital asset custody beyond what HSBC is seeing. The Singapore branch of Switzerland’s Sygnum Bank recently received a license to operate a digital asset trading and custody platform. UK-headquartered firm Zodia launched its crypto custody services in Hong Kong in October.

Read more: What is The Impact of Real World Asset (RWA) Tokenization

Moreover, the Hong Kong Securities and Futures Commission is planning to release new laws for real-world asset tokenization in the near future. The legal framework could stoke demand for regional custody services.

Asia Lags European and US Banks

Despite its recent crypto push, Asia’s tokenization efforts trail those of European and US banks. German giant Deutsche Bank started holding crypto assets for its institutional clients in September. It had earlier applied for a crypto custody license from German regulator BaFin.

JPMorgan recently launched a blockchain service to transfer tokenized securities for use as collateral for other trades. Before that, it started offering its clients the ability to settle merchant-client transactions in tokenized versions of US dollars in 2019 and Euros in 2023.

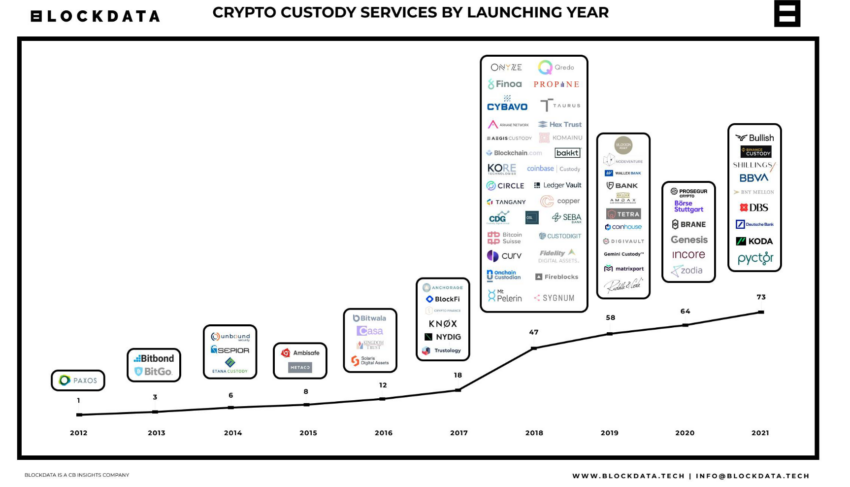

European Banks Onboarded Early. Source: Blockdata

European Banks Onboarded Early. Source: Blockdata

Read more: What is Tokenization on Blockchain?

In February, Goldman Sachs helped German engineering firm Siemens with a $63 million bond on a public blockchain. US Mercantile Bank announced plans to tokenize commercial paper in partnership with crypto startup Prontoblock in August.

Do you have something to say about HSBC’s digital asset business, how Asia is faring in the custody race, or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

2

0

すべての暗号通貨、NFT、DeFiを1か所から管理

すべての暗号通貨、NFT、DeFiを1か所から管理開始に使用しているポートフォリオを安全に接続します。