Massive $217M Crypto Liquidation Sweeps the Market: A Crypto Bloodbath?

0

0

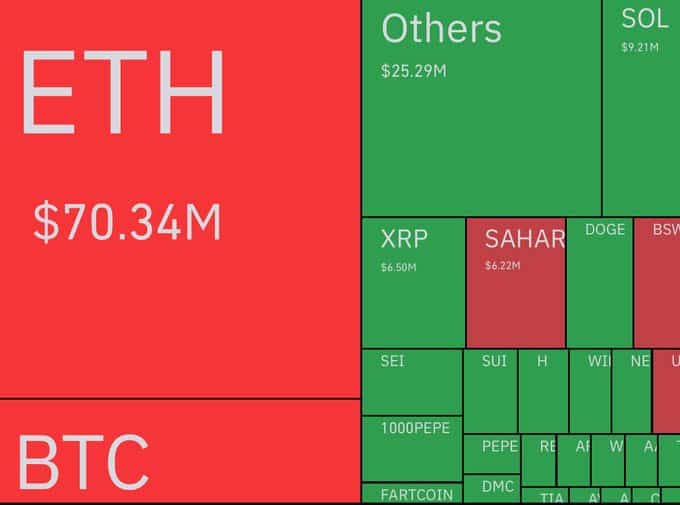

In the last 24 hours, the crypto market has undergone a severe transformation with liquidations offering up an absurd sum of $217 million. Such an enormous selling was mainly by those traders who engage in leverage to increase their wagers. The collapse of the markets took many traders by surprise causing leveraged position to be forcibly realized and creating a domino effect amongst the exchanges.

Crypto Market Liquidations Surge as Long Positions Get Wiped Out

Most of these liquidations were associated with long positions, and as such the market experienced a steep correction. The two widely held cryptocurrencies, or Bitcoin (BTC) and Ethereum (ETH) were among the worst affected. With these various digital assets experiencing tremendous selloffs, the amount of liquidations increased tremendously and created further decline, resulting in additional forced closures.

Leverage trading, which is a popular trend in the crypto community, enables traders to multiply possible gains by taking a loan. Nevertheless, it must also tremendously contribute to the danger of losing. In volatile times, leveraged positions have known to be liquidated within minutes as it occurred in this liquidation.

Such a volatile market encourages a feed back loop with liquidations. This can further push the market down and bring on more liquidations, which further cause the market to go down in a downward cycle. The result is that traders who do not properly manage their risk run the danger of being trapped in this cycle of volatility.

Overview of the Crypto Market Today

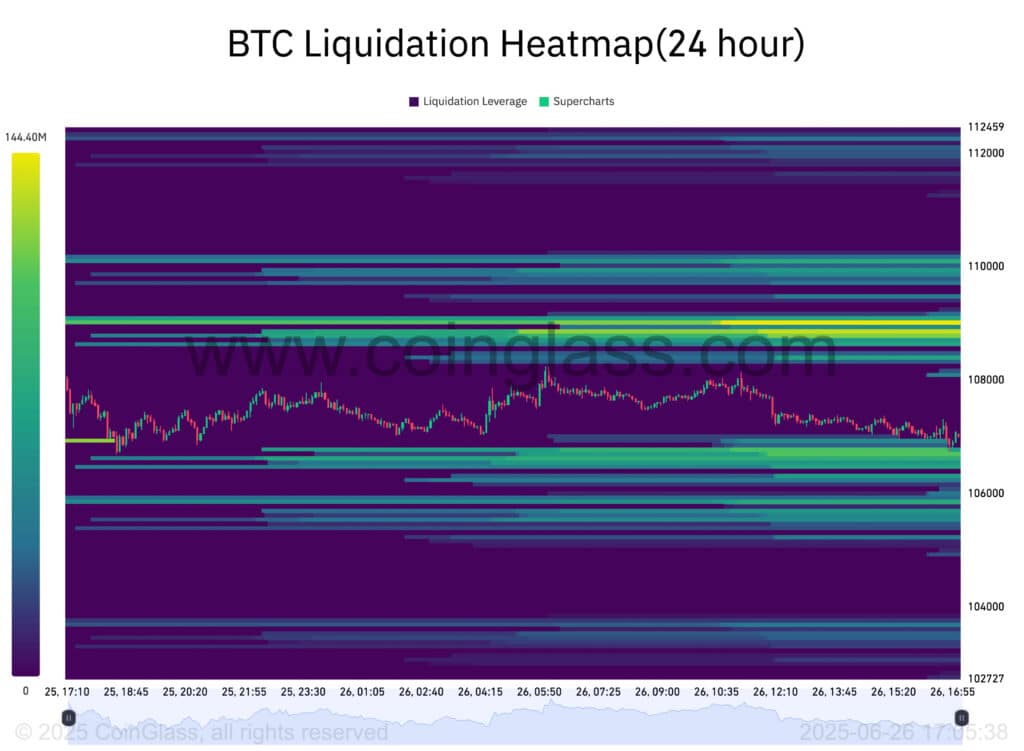

The crypto market has been dominated by an increase in volatility where Bitcoin and Ethereum have recorded a sharp rise and deep falls. As Bitcoin made an effort to go beyond the $108,000 level, it met resistance levels, with lots of market players reporting profits on the way. Otherwise, institutional buyers which are also known as whales were observed gaining exposure, and it is quite possible that bigger players are still optimistic about the market in the long term perspective.

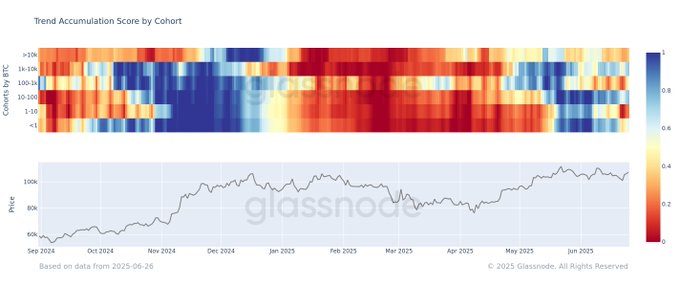

CoinGlass analytics indicate that smaller retail investors were selling it off, but large buyers were buying it up, which could be an indication that the market was just paying off before another possible surge. Glassnode data indicates that recently, the accumulation trend score of Bitcoin has been recovering which indicates wagering by smart money cohort on future gains.

Crypto Market Sentiment: Diverging Views Among Traders

Market sentiment is a point of concern amongst the traders. Smaller investors have decided to lock profits and larger ones are more confident as they have expanded their stocks. This discrepancy of actions is an indication of the confusion that surrounds the crypto market to date. The most important level to monitor is the $108,000 mark on Bitcoin. That was the psychological barrier as well as the liquidity point on the long bets.

According to the popular on-chain analytics company Glassnode, the efforts of Bitcoin price to regain the position at around the $108,000 mark remain split with worry in allude to. Some wallets are still spreading their balances, but larger ones (between 10 and 100 BTC) are also accumulating, which means that they might be preparing additional price rise.

The Role of Leverage in Crypto Market Liquidations

Leverage has long been a double-edged sword for crypto traders. On one hand, it allows traders to amplify their profits, but on the other hand, it exposes them to massive risks in volatile markets. The recentcrypto market liquidation event of $217 million serves as a stark reminder of the dangers of high-leverage trading.

As the crypto market continues to experience significant price fluctuations, experts recommend that traders reduce leverage to avoid devastating losses. Additionally, setting stop-loss orders can provide a safety net against sharp market movements, protecting traders from large drawdowns.

The Impact of Volatility on Crypto Market Capitalization

Volatility in the crypto market has a direct impact on its overall crypto market capitalization. Sharp price drops, as seen during this liquidation event, can lead to a significant decrease in the total market value of cryptocurrencies. The market capitalization of Bitcoin and Ethereum was notably affected, as both assets experienced large sell-offs during the past 24 hours.

| Month | Minimum Price | Average Price | Maximum Price | Potential ROI |

|---|---|---|---|---|

| June | $108,368.30 | $121,967.26 | $135,566.21 |

26.6%

|

| July | $118,429.09 | $128,148.24 | $137,867.39 |

28.7%

|

| August | $101,427.14 | $100,669.87 | $99,912.59 |

-6.7%

|

| September | $104,100.89 | $106,689.52 | $109,278.15 |

2%

|

| October | $100,263.06 | $100,126.13 | $99,989.19 |

-6.6%

|

| November | $102,291.70 | $112,355.99 | $122,420.27 |

14.3%

|

| December | $100,639.47 | $100,305.69 | $99,971.90 |

-6.7%

|

However, despite these setbacks, the market capitalization of the entire crypto market remains resilient, supported by long-term investors and institutional players. As market sentiment shifts, it’s likely that the market will continue to undergo phases of both growth and contraction.

The Future of Crypto Market Liquidations

Looking ahead, market experts predicts that crypto market liquidation events like this will continue to occur as long as volatility remains high. Traders are advised to stay vigilant and practice prudent risk management strategies to protect themselves from such events. With the increased interest from institutional investors and continued adoption of blockchain technology, the crypto market is expected to evolve, but not without facing challenges like the one witnessed today.

Conclusion

The recent $217 million crypto market liquidation round is a stark reminder of the dangers of leveraging and volatility in the cryptocurrency market. Since Bitcoin and Ethereum struggle with dependant resistance levels and diverse market mood, traders must proceed with caution. The situation on the crypto market is an indication of the risks and opportunities that exist on the market in the digital asset environment that is still developing.

Summary

A crypto market liquidation event of more than 217 million occurred, and this was mainly on traders who had taken leveraged long positions. Ethereum and Bitcoin were hit so hard that the prices plunged, leading to forced liquidations, which further contributed to the plunge.

There is an increased risk of quick losses with high profits through leverage trading. When crypto market liquidations increased, a positive feedback loop occurred driving the prices further down. The incident shows the risk of trading with a high leverage and the necessity of proper risk management in unsteady crypto markets.

Frequently Asked Questions (FAQ)

1-What caused the recent $217 million crypto market liquidation?

The liquidation was triggered by a sudden downturn in prices, primarily affecting traders using leverage to amplify their positions. This led to forced position closures and a cascading effect across exchanges.

2- How do liquidations affect the crypto market?

Liquidations can drive prices lower, creating feedback loops that lead to further forced closures and increased volatility. This can impact market sentiment and lead to larger price swings.

3- Is leverage trading safe in volatile markets?

Leverage trading increases both potential profits and risks. In volatile markets, leveraged positions can be wiped out quickly, making it important for traders to manage their risks effectively.

4- What can traders do to avoid liquidations?

Traders should consider reducing leverage, setting stop-loss orders, and closely monitoring key price levels to protect themselves from sudden market movements.

Appendix: Glossary of Key Terms

Crypto market Liquidation: The forced closure of a trader’s position when the market moves against them, resulting in the loss of their collateral.

Leveraged Trading: Borrowing funds to increase the size of a position, amplifying both potential profits and risks.

Long Position: A bet that the price of an asset, like Bitcoin or Ethereum, will rise.

Market Downturn: A period of declining prices across financial assets, leading to losses.

Feedback Loop: A situation where crypto market liquidations drive prices lower, triggering further liquidations and amplifying the market decline.

Risk Management: Strategies used by traders to limit potential losses, including setting stop-loss orders or reducing leverage.

Reference

Coinomedia – coinomedia.com

Read More: Massive $217M Crypto Liquidation Sweeps the Market: A Crypto Bloodbath?">Massive $217M Crypto Liquidation Sweeps the Market: A Crypto Bloodbath?

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.