Bitcoin ETFs break $4 billion in inflows during first weeks of December

1

0

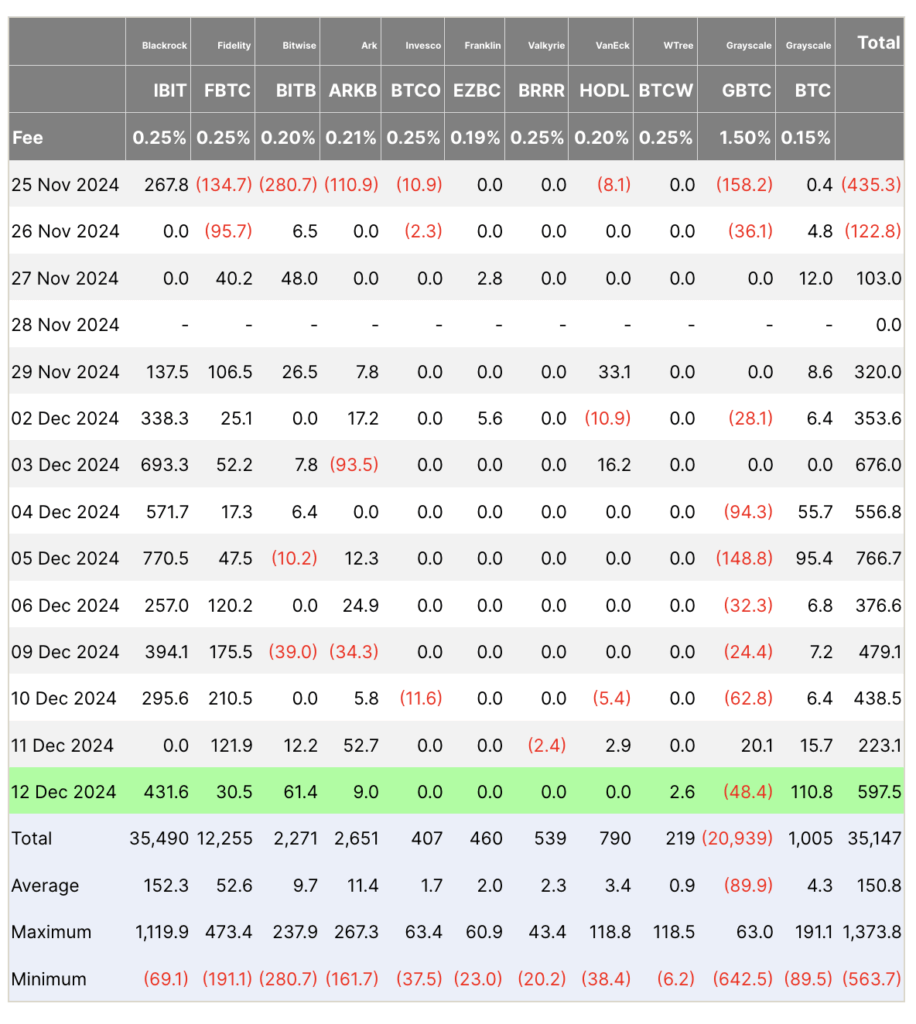

Spot bitcoin ETFs recorded more than $4 billion in combined inflows from Dec. 2 through Dec. 12, according to Farside data. The figures include flows into BlackRock, Fidelity, Bitwise, Ark, Invesco, Franklin, Valkyrie, VanEck, WTree, and Grayscale products. These entries tallied across several funds, moved through the market shortly after Bitcoin surpassed the $100,000 mark on Dec. 5 and continued amid steady price action.

Cumulative totals from Dec. 2 reached $353.6 million, with Dec. 3 adding $676 million, followed by several other days posting hundreds of millions each. Activity slowed on Dec. 11, registering $223.1 million, before rising to $597.5 million on Dec. 12. The aggregate figure across the reporting period exceeded $4.4 billion.

BlackRock and Fidelity contributed strongly to total flows with no outflows and persistent inflows over $100 million. The pattern suggests steady demand during a period when bitcoin traded near record territory.

The post Bitcoin ETFs break $4 billion in inflows during first weeks of December appeared first on CryptoSlate.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.