Bitcoin Rises as US CPI Lands Lower Than Market Expectations

0

0

The US Bureau of Labor Statistics (BLS) released its Consumer Price Index (CPI) report, showing inflation increased slightly in September. Crypto markets reacted in the aftermath, as Bitcoin’s (BTC) price rose.

Notably, this marked the first time since 2018 that the CPI data was released on a Friday amid a US government shutdown.

Annual Inflation Hits 3% in September, US CPI Data Shows

As per the latest data, the US CPI for September 2025 has come in at 3% year-on-year, slightly below expectations of 3.1%. Economists had anticipated that the headline CPI would increase by 0.4% month over month, yet it only rose by 0.3%. This comes after an August CPI reading of 2.9%.

“U.S. CPI: +3% YEAR-OVER-YEAR (EST. +3.1%). U.S. CORE CPI: +3% YEAR-OVER-YEAR (EST. +3.1%),” TreeNews highlighted.

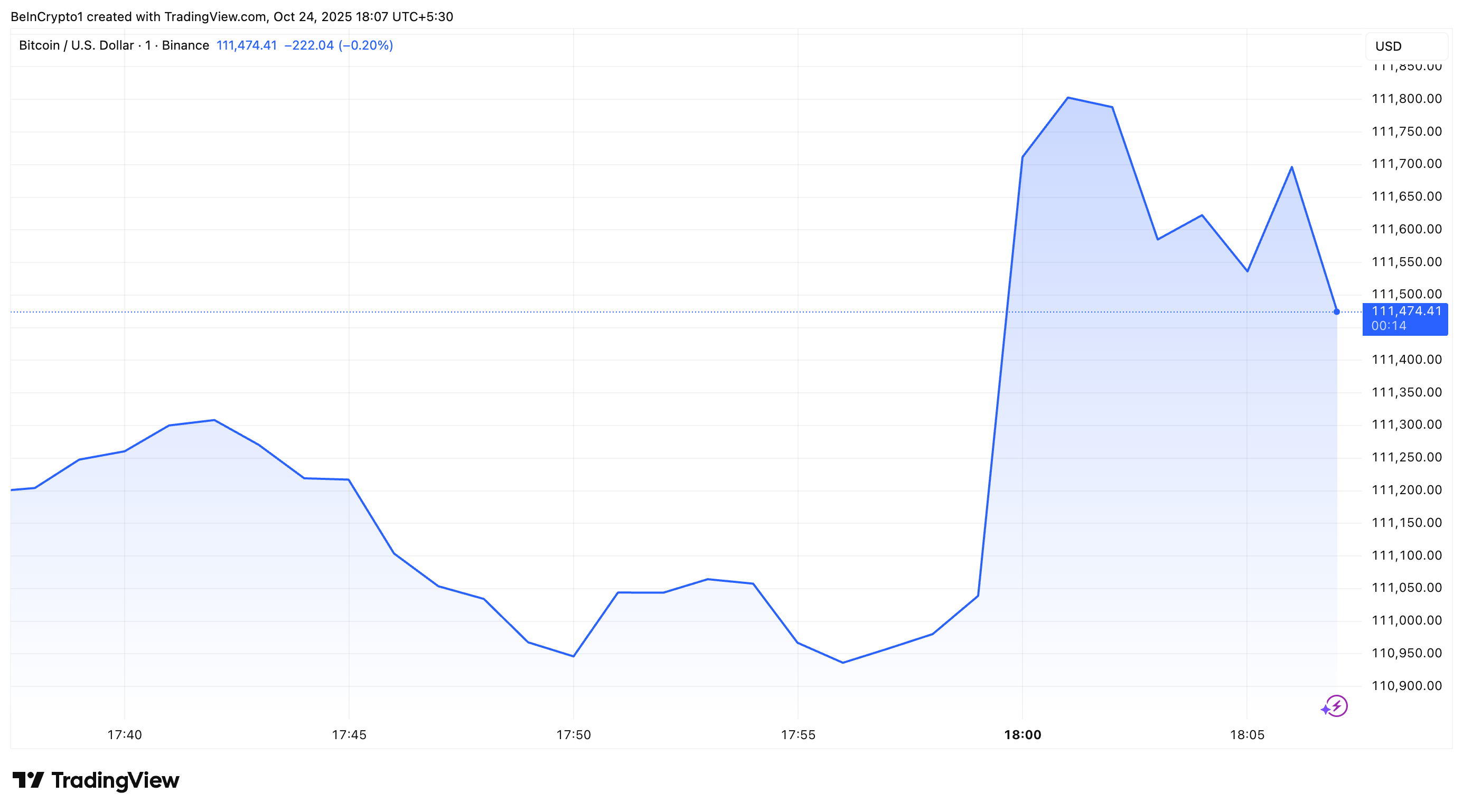

Bitcoin, which had been experiencing volatility following the October crash, surged after the release of the new inflation data. Prices jumped over 1%, with BTC reaching $112,194 before stabilizing at $111,474 at press time.

Bitcoin Price Performance. Source: TradingView

Bitcoin Price Performance. Source: TradingView

CPI measures how prices for everyday goods and services change over time, reflecting the rate of inflation. It tracks the cost of items such as food, housing, and transportation, showing how the overall cost of living shifts.

Policymakers often use CPI data to gauge inflation pressures and guide decisions on interest rates and economic policy. Notably, the data arrives just five days before the Federal Reserve’s next policy meeting and is especially critical now.

The US government shutdown has halted most other key data releases. Thus, CPI data is the only major indicator the Fed will consider ahead of its key October 29 policy meeting.

“This was easily the most impactful inflation report of the year, simply because we haven’t seen any other economic data come out of the US government this month. Investors have been in limbo for weeks, forced to rely on private data releases and surveys. This report finally dispels some of this uncertainty,” Nic Puckrin, co-founder of The Coin Bureau, told BeInCrypto.

Lower inflation suggests that the economy is cooling off in a controlled way, giving the Federal Reserve more room to cut interest rates sooner.

“This is a good news for the FED before next week FOMC. The FED will cut rate for sure and also should end QT,” analyst Darkfost stated.

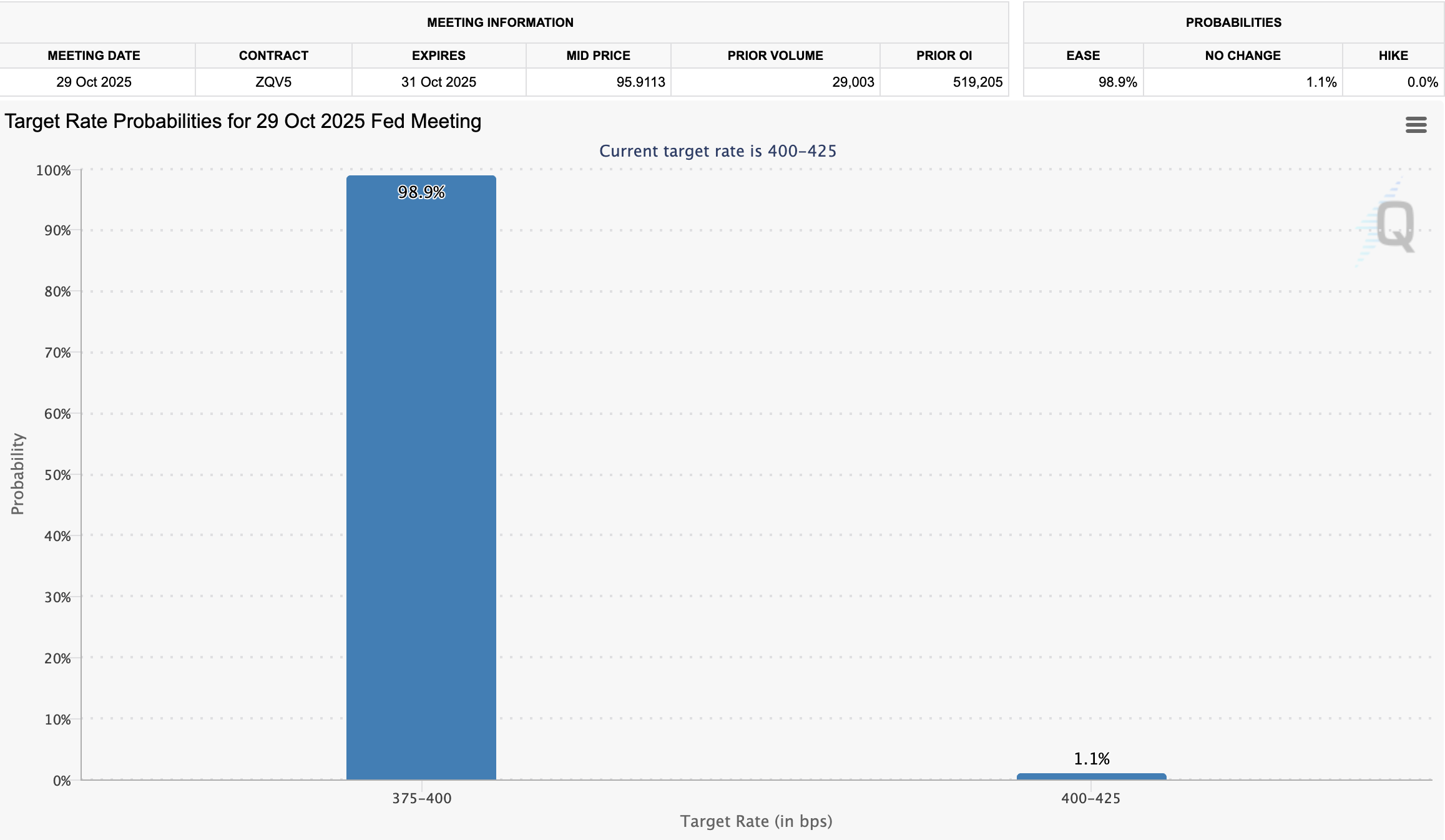

According to the CME FedWatch tool, the market is pricing in 98.9% odds of a 25-basis-point rate cut, while the odds for a 50-basis-point cut remain low at just 1.1%.

Fed Rate Cut Odds in October. Source: CME FedWatch tool

Fed Rate Cut Odds in October. Source: CME FedWatch tool

Interest rate cuts are bullish for the crypto market as they make borrowing cheaper, increase liquidity, and encourage investors to allocate capital into riskier assets such as Bitcoin and altcoins. With inflation easing and rate cuts likely, all eyes are now on the Fed’s next move.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.