Why are tech stocks plunging despite Nvidia’s stellar Q3 earnings?

0

0

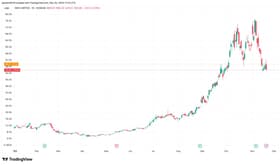

Nvidia’s earnings triumph turned into a market disaster in real time on Thursday.

The chipmaker crushed expectations late Wednesday with $57 billion in quarterly revenue and a stellar Q4 guidance of $65 billion, numbers that should have triggered a tech rally.

Instead, investors witnessed one of the market’s cruelest reversals.

Nvidia’s stock surged 5% in early trading Thursday morning, lifting the entire sector with it. The Dow jumped 1.2%, the S&P 500 climbed 1.8%, and the Nasdaq spiked 2.5%.

Then, midday, the market simply gave up. By afternoon, Nvidia had flipped to down 2%, dragging Palantir down 5.5%, AMD and Oracle each down roughly 5%, and the Technology Select Sector SPDR Fund down 1.6%.

The broader indices erased all gains, with the S&P falling back into negative territory. This wasn’t profit-taking.

This was something far more troubling: a market so gripped by AI spending fears that even the best earnings couldn’t sustain enthusiasm.

The bubble skepticism won’t quit

The intraday collapse reveals a painful truth for the AI trade: nothing Nvidia says can cure what’s really bothering investors.

The company’s CEO Jensen Huang directly addressed bubble concerns on the earnings call, insisting cloud GPUs and Blackwell chips are completely sold out and demand is “off the charts”.

This should have reassured the market. Instead, it highlighted exactly why investors are nervous.

Nvidia’s supply sold out doesn’t prove that those hyperscaler customers: Meta, Google, Microsoft, and Amazon will generate returns justifying their spending.

A Bank of America survey of 202 global fund managers revealed that for the first time in two decades, 53% believe AI stocks are in a bubble, and net 20% of investors now say companies are “overinvesting” in AI capex.

This wasn’t fringe opinion. There was consensus among professional money managers.

The core fear crystallized around November 20th: Nvidia proved its own business is thriving, but that actually confirms the AI infrastructure boom is accelerating and potentially out of hand.

Meta’s recent $30 billion corporate bond issuance hit record oversubscription, suggesting capital is flowing into data centers faster than anyone can properly evaluate returns.

OpenAI alone is projected to spend $130 billion on computing by 2027, while burning billions annually with unclear profitability timelines.

As investor jitters intensified, selling accelerated, not despite Nvidia’s earnings, but because of what those earnings implied about the magnitude of the AI spending arms race.

Valuation math breaks when rates stay sticky

The Thursday reversal also exposed how fragile tech valuations are to Fed policy shifts.

Earlier in the morning, the September employment report, which included a major downward revision showing August posted 4,000 job losses instead of 22,000 gains, initially boosted rate-cut expectations.

The December Fed rate-cut odds jumped from 28-30% to 42%. For a few hours, the combination of Nvidia’s beat plus falling rate-cut expectations buoyed sentiment.

But as the trading day wore on, reality set in: the Fed’s recent hawkish commentary means rates are likely staying higher for longer.

Tech valuations cannot survive sustained higher rates when those companies are now asset-heavy capex businesses rather than the asset-light software businesses they pretended to be.

That math breaks when the Fed stops cutting.

Nvidia’s earnings were genuine, but the market recognized on November 20th that no single company’s beat, no matter how impressive, can overcome structural concerns about an entire sector that has lost its ability to compound without massive, uncertain capital deployment.

The post Why are tech stocks plunging despite Nvidia’s stellar Q3 earnings? appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.