Bitcoin OGs Are Dumping BTC: Early Winter or Pre-Rally Blues?

0

0

Bitcoin BTC $107 112 24h volatility: 3.2% Market cap: $2.14 T Vol. 24h: $47.34 B started the week on a shaky note as bears took over the broader crypto market in the early hours of Nov. 3. As of writing, BTC slipped to $107,000, marking a 2% drop in its market cap.

This drop follows a wave of exchange deposits from early Bitcoin holders, often referred to as “OGs.” According to Lookonchain, an early Bitcoin investor has deposited roughly 13,000 BTC (worth $1.48 billion) to Kraken, Binance, Coinbase, and Hyperliquid since Oct. 1.

Similarly, another OG, Owen Gunden, has moved 3,265 BTC ($364.5 million) to Kraken since Oct. 21.

Bitcoin OGs are dumping $BTC!

BitcoinOG(1011short) has deposited ~13K $BTC($1.48B) to Kraken, Binance, Coinbase, and Hyperliquid since Oct 1.

Owen Gunden has deposited 3,265 $BTC($364.5M) to Kraken since Oct 21.https://t.co/qyZllJWfFShttps://t.co/u3b8zn5iYe pic.twitter.com/qQe3dYlnfp

— Lookonchain (@lookonchain) November 3, 2025

Analysts Divided on the Meaning of Whale Movements

Such massive transfers often stir market fear, as investors worry that whales may be preparing to sell. While some see these moves as the beginning of a “crypto winter,” others believe the opposite.

Crypto influencer Joe suggested on X that OGs often “spook the crowd right before liftoff.” He added that big exchange transfers don’t always mean selling, sometimes it’s just rotation or hedging.

Yeah, OGs always know how to spook the crowd right before liftoff.

Big transfers don’t always mean selling, sometimes it’s just rotation or hedging.

Everyone panics when whales move, forgetting they play ten moves ahead.

Retail loves chasing fear while smart money quietly reloads…— Joe | KOL & Alpha Crypto Influencer (@SelfSuccessSaga) November 3, 2025

According to Joe, this kind of shakeout could lead to a larger rally, as retail traders panic while seasoned investors quietly buy back in.

However, the sudden rise in Bitcoin reserves on Binance has raised eyebrows. Increased reserves during a flat market can signal upcoming downward pressure, especially as buy volume remains weak during dips.

Sudden rise in Binance’s Bitcoin exchange reserve | Source: CryptoQuant

A Bullish Setup or Warning Sign?

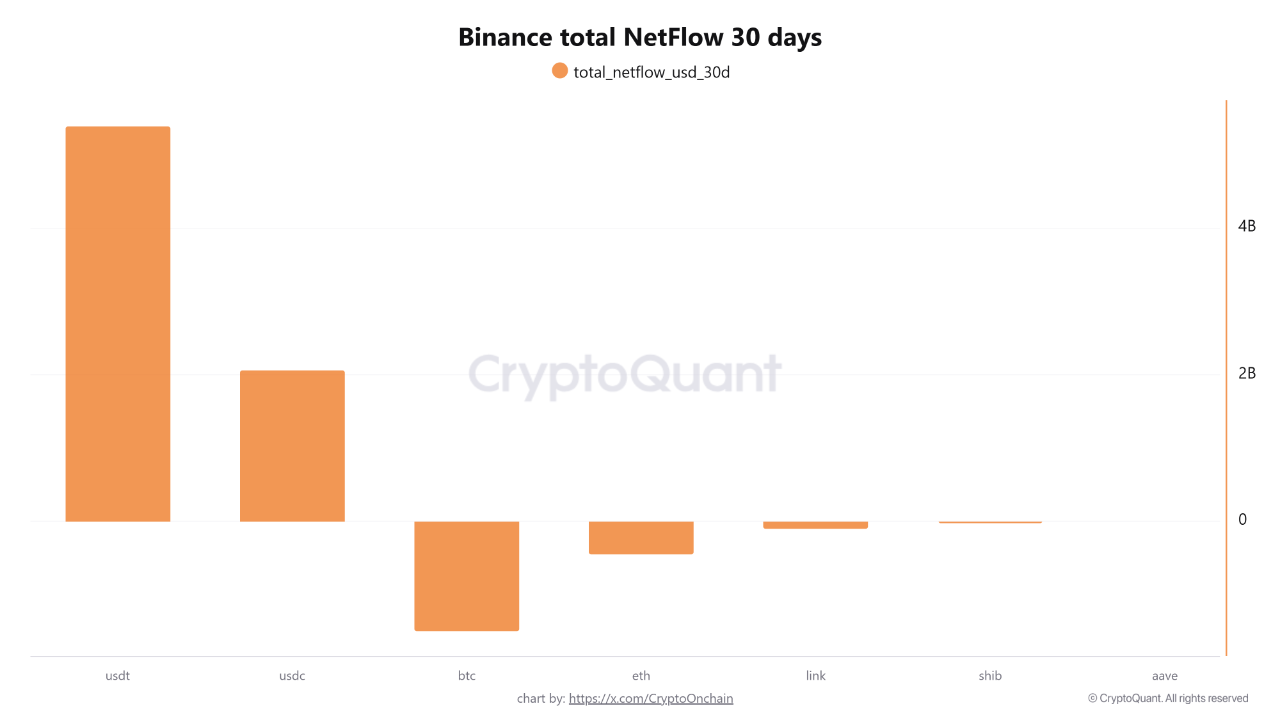

Meanwhile, according to the data by CryptoQuant, Binance reported a record-breaking monthly net inflow of around $7 billion in October. This was largely driven by stablecoins, with Tether’s USDT USDT $1.00 24h volatility: 0.0% Market cap: $183.46 B Vol. 24h: $91.85 B and Circle’s USDC USDC $1.00 24h volatility: 0.0% Market cap: $75.77 B Vol. 24h: $11.81 B bringing $5 billion and $2 billion, respectively.

Binance netflow in October | Source: CryptoQuant

Interestingly, Bitcoin and Ethereum ETH $3 693 24h volatility: 4.5% Market cap: $446.62 B Vol. 24h: $27.54 B saw exchange outflows in October. Binance recorded a $1.5 billion net outflow in BTC and $500 million in ETH, a pattern often seen as bullish since it implies long-term holding behavior.

According to a CryptoQuant contributor, this suggests that traders are stockpiling capital, waiting for the right moment to re-enter the market.

Bitcoin $BTC might not be done yet!

If this is indeed a broadening top, we could see a new all-time high first, followed by a brutal reversal. pic.twitter.com/YvK1ssnQUu

— Ali (@ali_charts) November 2, 2025

However, analyst Ali Martinez noted that Bitcoin has been forming a “broadening top” since July and might not have peaked yet. He predicted a possible surge in November, followed by a “brutal reversal” by year-end.

The post Bitcoin OGs Are Dumping BTC: Early Winter or Pre-Rally Blues? appeared first on Coinspeaker.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.