James Wynn goes long on PEPE after $2.2B bets on Bitcoin went south

0

0

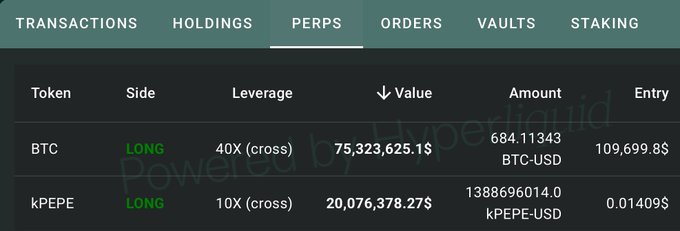

Renowned crypto trader James Wynn is back in the spotlight after opening a 10x leveraged long position on PEPE via the Hyperliquid platform.

Known for his aggressive trading style, Wynn’s pivot to PEPE — a speculative meme token — signals a calculated bet on renewed momentum in the altcoin space as sentiment improves across the broader crypto market.

James Wynn’s bets on Bitcoin (BTC) ended in a loss

Wynn, often dubbed a “memecoin maxi,” has a history of profitable trades, particularly in the memecoin sector.

For instance, his 2023 PEPE trade turned a $7,000 investment into $25 million, cementing his reputation as a high-stakes trader with sharp market intuition.

He is also currently betting on his own memecoin, Moonpig (MOONPIG), that has rallied almost 3000% in less than three weeks.

However, Wynn’s aggressive trading style, often involving 10x or higher leverage, has sparked debates about the risks of such strategies, especially after his recent Bitcoin losses.

Recently, Wynn opened a $1.26 billion long position on Hyperliquid, only to close it within 47 minutes at a $13.4 million loss as Bitcoin’s price dipped from $108,921 to $107,746, with Wynn narrowly avoiding liquidation, which could have happened if the price dropped to $105,179..

However, Wynn quickly pivoted to a bearish stance, opening a $1 billion short position on 9,402 BTC with a liquidation price of $149,100.

Unfortunately, this bet backfired as Bitcoin held steady around $107,000, forcing Wynn to close the position within a day and incur a $15 million loss.

Combined with the previous day’s loss, his total deficit over 24 hours reached a staggering $27,908,962.20, as illustrated in a chart showing his profit and loss over 21 hours.

Wynn attributed his bearish Bitcoin outlook to weak trading volumes, an undersold chart, and macroeconomic pressures, including a 50% tariff announcement by Trump that added downward pressure on Bitcoin prices.

He has, however, opened another 40x leveraged $75 million long position, which is currently running.

Shifting gears to PEPE with high leverage

Following his Bitcoin ordeal, Wynn swiftly turned his attention to PEPE, a memecoin showing promising technical signals.

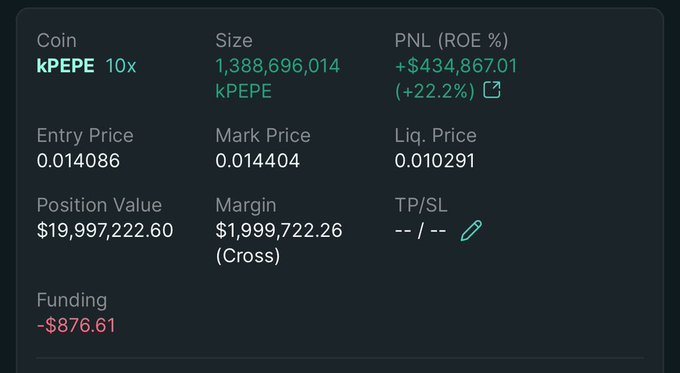

On May 26, 2025, he opened a $1 million long position with 10x leverage on Hyperliquid, comprising 1,388,696,014 KPEPE at an entry price of $0.014086.

The position has already yielded an unrealised profit of $434,867.01, up from the unrealised profit of $130k that had been reported by Lookonchain in the morning.

Moreover, PEPE’s price, currently at $0.014404, is eyeing a potential 20% jump to $0.000017, a level that previously acted as resistance last May.

Technical analysis supports Wynn’s bullish outlook, as PEPE has rallied 90% this month after breaking out of a consolidation on May 8.

Additionally, the memecoin is holding above the 20 EMA and 50 SMA, which have maintained a bullish crossover since mid-April, providing dynamic support.

If PEPE surpasses $0.000017, analysts predict it could reach $0.000020 to $0.000021, marking a 40% gain from current levels.

Notably, Wynn’s move aligns with his history of capitalising on memecoin momentum, having previously earned $4.8 million on Fartcoin and $6.8 million on Trump.

The post James Wynn goes long on PEPE after $2.2B bets on Bitcoin went south appeared first on Invezz

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.