Q4 Crypto Surge? Historical Trends, Fed Shift and ETF Demand Align

1

0

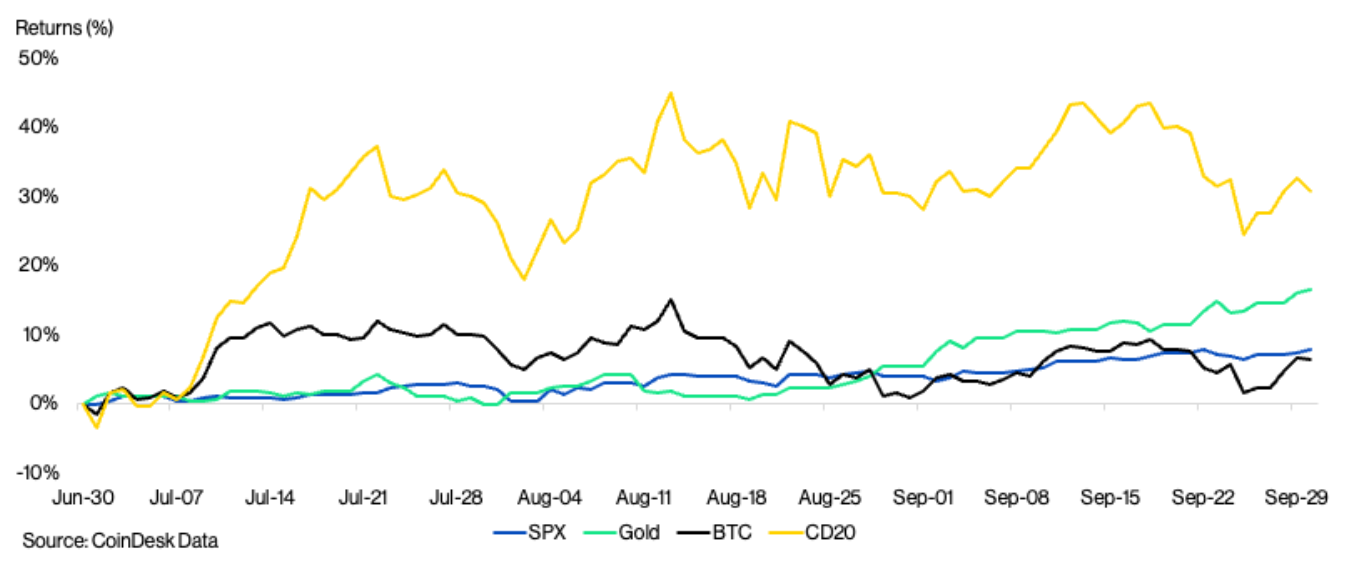

As the final quarter of 2025 gets underway, investors are entering a historically favorable period for crypto markets — particularly for bitcoin (BTC), which has delivered an average Q4 return of 79% since 2013.

According to a new report from CoinDesk Indices, several factors may help that trend repeat, including monetary easing, surging institutional adoption and fresh regulatory momentum in the U.S.

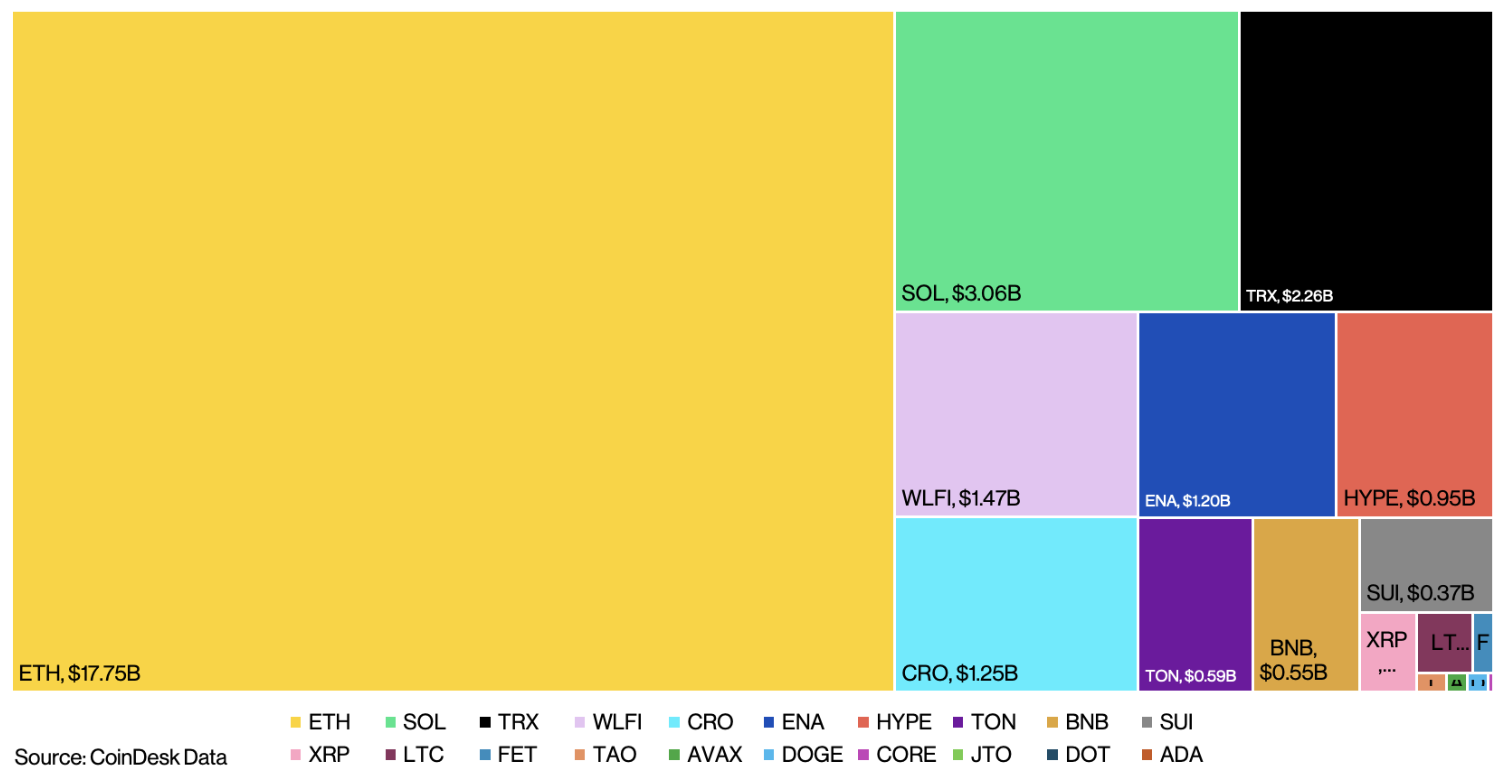

The backdrop is shifting fast. The Federal Reserve’s latest rate cut brought interest rates to their lowest level in nearly three years, setting the stage for broader risk-on sentiment. Institutions responded aggressively in Q3: U.S. spot bitcoin and ether (ETH) ETFs saw combined inflows of over $18 billion, while public companies now hold more than 5% of bitcoin’s total supply.

Altcoins, too, have made inroads, with over 50 listed firms now holding non-BTC tokens on their balance sheets, 40 of which joined just last quarter.

Bitcoin ended Q3 up 8%, closing at $114,000, driven largely by treasury adoption among public companies. With expectations for further rate cuts and growing interest in bitcoin as a hedge against currency debasement, CoinDesk Indices expects the asset’s momentum to continue into year-end.

But this time around, bitcoin is sharing the spotlight. Ethereum surged 66.7% in Q3, hitting a new all-time high near $5,000. That move was led by treasury accumulation and ETF flows, but future gains may hinge on November’s Fusaka upgrade which is aimed at improving scalability and network efficiency. If successful, it could reinforce Ethereum's role as the foundation for on-chain financial activity, especially in “low-risk” DeFi.

Solana (SOL) saw a 35% quarterly gain, backed by large-scale corporate purchases and record ecosystem revenue. With new exchange-traded products launching and the Alpenglow upgrade in the pipeline, Solana is positioning itself as the high-performance layer for decentralized applications, a narrative that resonates with institutions seeking throughput and cost efficiency.

XRP, meanwhile, delivered a year-to-date gain of nearly 37%, fueled by legal clarity after the Securities and Exchange Commission (SEC) and Ripple withdrew appeals in their long-running case. Investors are watching closely as Ripple's stablecoin RLUSD expands globally. The stablecoin’s rapid growth could draw more DeFi protocols to the XRP Ledger, deepening XRP’s utility.

Cardano (ADA) rose 41.1% in Q3, outperforming several of its peers. While activity on the chain remains relatively modest, consistent growth in stablecoin use, derivatives volume and DEX activity has created a more stable base for potential expansion. A pending decision on a spot ADA ETF could mark a turning point for institutional adoption.

The broader trend is also evident in index performance. The CoinDesk 20 Index, which tracks the 20 most liquid and tradable digital assets, gained over 30% in Q3, outpacing bitcoin. The CoinDesk 80 and CoinDesk 100, which capture mid- and small-cap assets, also posted strong returns, reflecting growing interest across the market cap spectrum.

Looking ahead, the approval of generic listing standards for crypto ETFs and the emergence of multi-asset and staking-based ETPs could further accelerate inflows. For traders, Q4 presents a unique mix: a favorable macro environment, deepening institutional engagement and renewed interest in altcoins.

1

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.