Bitcoin Price Could Reach $400,000 to $600,000 by 2026–27, Analyst Predicts

0

0

Highlights:

- Analyst predicts market cycle may be longer and stronger, breaking the traditional four-year trend.

- Bitcoin dominance nears 60%, driven by big institutions and government interest.

- The falling Bitcoin coin age signals whales moving, suggesting a historic bull run ahead.

Crypto analyst Michael van de Poppe believes the current market cycle is different from previous ones. He expects it to be longer, stronger, and unlike the traditional four-year trend. Despite the uncertainty, he remains confident that Bitcoin price could reach between $400,000 and $600,000 by 2026 or 2027.

Bitcoin has recently climbed above $111K and is gaining more dominance in the crypto market. In past cycles, Bitcoin would rally first, followed by a rise in altcoins, and then a full market correction before a new cycle began. But this time, things might be changing. He believes the usual four-year rhythm may no longer apply. The market seems to be evolving, possibly leading to a longer and more powerful cycle than ever before.

This cycle has been more complex and completely different than the previous cycles.

Why should the rest of the cycle be identical to the previous ones?

I think you'll need to have an open mind and thesis for the upcoming 1-2 years for #Bitcoin and #Altcoins.

Markets can…

— Michaël van de Poppe (@CryptoMichNL) May 23, 2025

Bitcoin has been leading the crypto market for the past 18 months, reaching new highs while other coins trail behind. Its market dominance is now close to 60%, something we haven’t seen in a long time. Usually, when Bitcoin gets this strong, a slowdown follows. But this time is different. Big institutions—not just regular traders—are helping push the price higher. They now see crypto as more than just a risky bet. Moreover, spot Bitcoin Exchange-Traded Funds (ETFs) and rising interest from governments show that something bigger may be coming.

Bitcoin Shows Signs of a Historic Bull Run

Santiment’s recent tweet highlights a key on-chain signal behind Bitcoin’s bullish trend—the falling Mean Dollar Age of BTC holdings. This means the average age of coins in circulation is getting younger, a pattern often seen before major bull runs. In the last five years, three major rallies have shown the same trend. Each time, the average age of held Bitcoin dropped noticeably. Since April 16, this number has fallen from 441 days to 429 days, suggesting that long-time holders, or whales, are starting to move their coins again.

As these older coins re-enter active circulation, it reinforces the view that the market is in an “unprecedented” bull phase. This phase might be one of the most important in Bitcoin’s history. Glassnode’s analysis also showed that despite Bitcoin price’s all-time high, realized profit-taking volume was only $1 billion—less than half of the $2.10 billion seen when Bitcoin first crossed $100K in December.

Bitcoin's new all-time high now stands at ~$111.9K, with a strong chance of this mark continuing to be extended the rest of the week. Historically, a great justification that crypto is in a bull cycle is when the average age of all $BTC held is getting younger (aka moving down… pic.twitter.com/nq632QqDd7

— Santiment (@santimentfeed) May 22, 2025

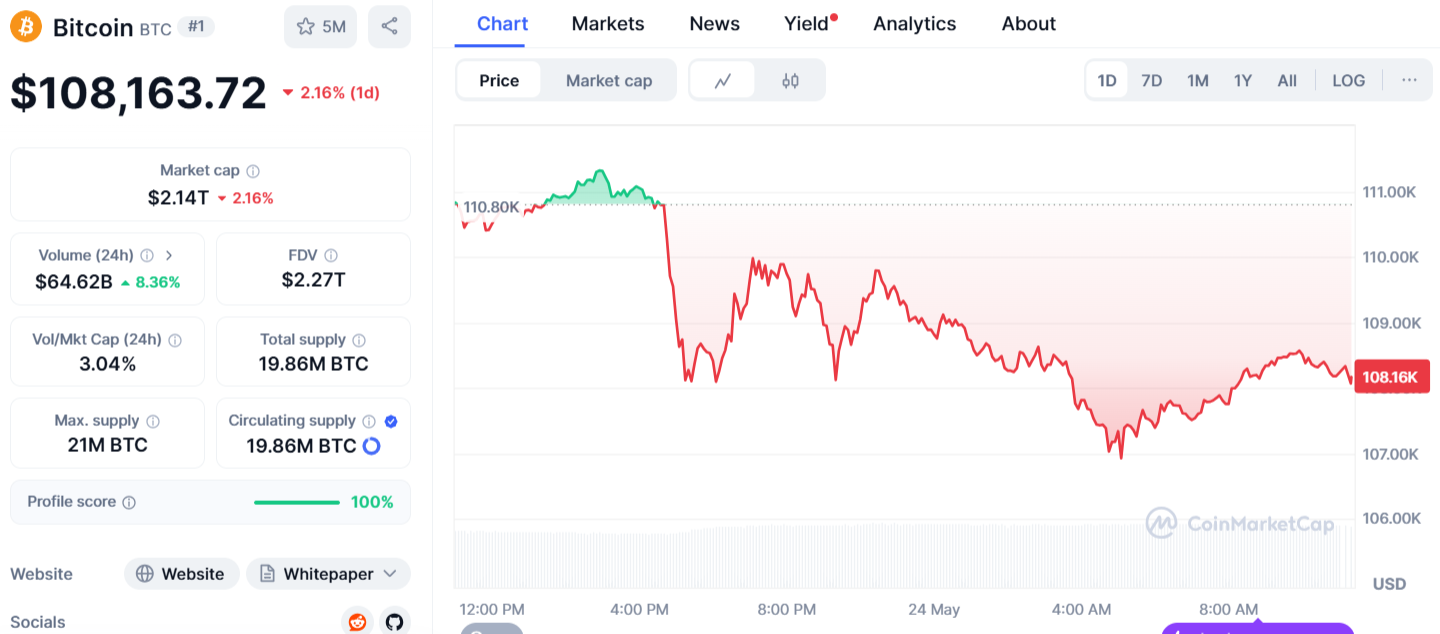

Bitcoin Price Falls Below $110K Amid Tariff Threats and Market Sell-Off

Bitcoin price dropped 2.16% within 24 hours trading at $108,163, falling below $110,000 after President Trump threatened the EU with 50% tariffs. The sell-off started before the market opened on Friday and sped up during the New York session. According to CoinGlass, this sudden decline liquidated $640 million in leveraged positions. During his Friday statement, Trump said he won’t make a deal with the EU but might delay tariffs if the EU builds factories in the U.S. This announcement raised fears of a renewed trade war.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.