Bitcoin Price: Whales Dump 30K BTC Despite Arthur Hayes’s $1M Prediction, What’s Next?

0

0

Key Insights:

- Arthur Hayes predicts Bitcoin price could reach $1 million by 2028.

- Over 30,000 BTC were sold by whales within 72 hours, signaling short-term profit-taking.

- Bitcoin’s strongest support lies between $93.8k–$96.9k.

- Matrixport reports rising institutional demand via ETFs and treasury flows.

Bitcoin price is generating a lot of excitement after Arthur Hayes. Former BitMEX CEO, predicted it could reach $1 million by 2028. Hayes discussed how capital leaving traditional resources and reduced confidence in U.S. Treasuries would create the situation.

At the same time, Bitcoin whales are moving in the complete opposite direction. In only 72 hours, more than 30,000 BTC have been sold, suggesting market participants are taking a new approach.

Bitcoin Price to Hit $1M by 2028

According to Arthur Hayes, the current market conditions point to Bitcoin’s price rising sharply over the next three years. In his thesis, he argues that capital is shifting from traditional U.S. Treasuries to Bitcoin and other more decentralized choices.

Arthur Hayes said that as Treasuries lose their value compared to BTC and gold, it gives Bitcoin a stronger role as a store of value. He also pointed out that the movement of money across borders, for example between the U.S. and China, helped cause capital flight into digital assets.

The BitMEX CEO also pointed to underground liquidity activity in China’s over-the-counter (OTC) markets as evidence of persistent demand, even under regulatory pressure.

Additionally, his $1 million Bitcoin price projection is based on the idea that decentralized assets could absorb a portion of global portfolio wealth. A 10% reallocation from the estimated $33 trillion market could overwhelm current exchange liquidity and trigger exponential price increases.

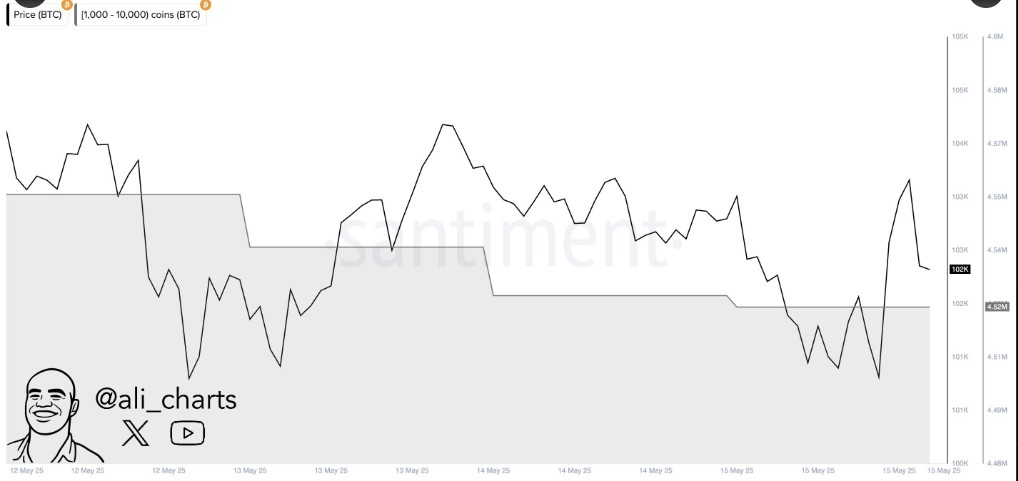

Meanwhile, data from analyst Ali Martinez shows a recent surge in whale selling activity. More than 30,000 BTC were liquidated over a 72-hour span, primarily from wallets holding 1,000 to 10,000 BTC.

This move is interpreted as profit-taking after Bitcoin price rose past the $100,000 mark. The selloff corresponds with reduced wallet holdings and growing volatility, indicating that large investors may be anticipating a short-term correction.

Market Metrics Signal Price Pressure

Moreover, Bitcoin price is currently trading near the $103,000 level after staging a strong recovery from prior lows. Despite short-term selling pressure, the market has shown resilience, supported by bullish momentum since breaking the $84,500 resistance in April.

The 25% rally from those levels has been underpinned by positive earnings sentiment, macroeconomic optimism, and sustained institutional interest.

One of the key indicators being monitored is the 90-day forward implied volatility, which has historically provided predictive value for Bitcoin’s next moves. Additionally, upcoming events such as the FTX estate’s expected $5 billion payout on May 30 could introduce new liquidity into the ecosystem, much of it in stablecoins.

Moreover, analyst Ali Martinez highlighted that the most critical support level for Bitcoin price lies at $95,440, as shown in the latest “In/Out of the Money Around Price” chart. This chart reveals a substantial cluster of buying activity between approximately $93,800 and $96,900, where 2.2 million addresses accumulated about 1.31 million BTC.

These addresses are currently “in the money,” indicating that a majority of holders within this range are sitting on unrealized gains. Such a dense concentration of profitable positions indicates that this price zone serves as a strong support floor. Investors may be likely to defend their holdings by buying more if the price dips into this range.

More so, the data also shows that 82% of Bitcoin’s circulating supply is in profit, while only 17.47% is “out of the money,” indicating a generally bullish sentiment among holders.

Analysts Eye Key Levels as Market Approaches Possible Breakout

Technical analysts are closely tracking structural formations that could define Bitcoin’s next move. Michaël van de Poppe shared that Bitcoin is in a bullish market right now as long as it stays above the support level at $98,000.

He indicated that the market’s recent gathering around $110,000–$115,000 demonstrates its strength and hints at a potential rise. According to Van de Poppe, the current rise in Bitcoin price has been supported by a double-bottom pattern close to $81,000.

The $91,500–$92,000 area is a key liquidity zone that supports the continuation of the trend.

Momentum indicators and volume measures both suggest that the interest in the asset is continuing.

Furthermore, on May 16, the “MatrixOnTarget” report from Matrixport shared a scenario with the same conclusion. Based on the report, Bitcoin price is now showing signs of increased gathering and a bullish pattern typical of this season.

The company named rising institutional transactions in terms of spot ETFs and allocations in the treasury sector as another important factor pushing demand. The experts believe there is room for even more capital to move into digital assets as the economy shifts further.

The post Bitcoin Price: Whales Dump 30K BTC Despite Arthur Hayes’s $1M Prediction, What’s Next? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.