Spot Ethereum ETFs See First Net Outflows After 19-Day Inflow Streak

0

0

Highlights:

- Ethereum ETFs end a 19-day inflow streak, recording $2.1 million in net outflows.

- BlackRock iShares Ethereum Trust sees the first pause in inflows after 14 days.

- Institutional interest in Ethereum grows as SharpLink Gaming acquires 176,271 ETH.

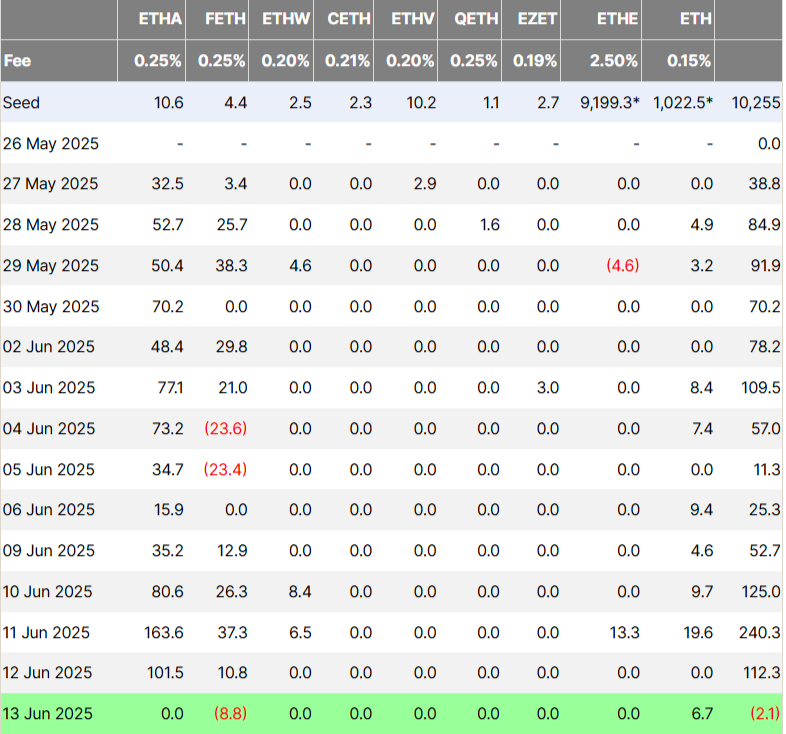

On June 13, U.S.-based spot Ethereum (ETH) exchange-traded funds (ETFs) recorded net outflows of $2.1 million, according to Farside data. This marked the end of a 19-day inflow streak — the longest since these products launched in July 2024.

The 19-day inflow streak for U.S. spot Ethereum ETFs started on May 16, excluding the May 26 market holiday for Memorial Day. During this period, the funds gathered $1.37 billion in net inflows—nearly 35% of their total $3.87 billion since launch. On June 11, the ETFs recorded their highest single-day inflow in over four months, totaling $240.3 million.

On Friday, Grayscale Mini Ether ETF saw $6.7 million in inflows, while the Fidelity Ethereum ETF (FETH) recorded $8.8 million in outflows. With no net flows from other U.S. issuers, total net outflows stood at $2.1 million. The BlackRock iShares Ethereum Trust (ETHA) recorded no activity for the first time following 14 straight days of inflows. Despite the pause, it remains the market leader with $5.2 billion in net inflows since launch. The fund currently holds more than 1.65 million ETH, with total assets under management valued at $4.17 billion.

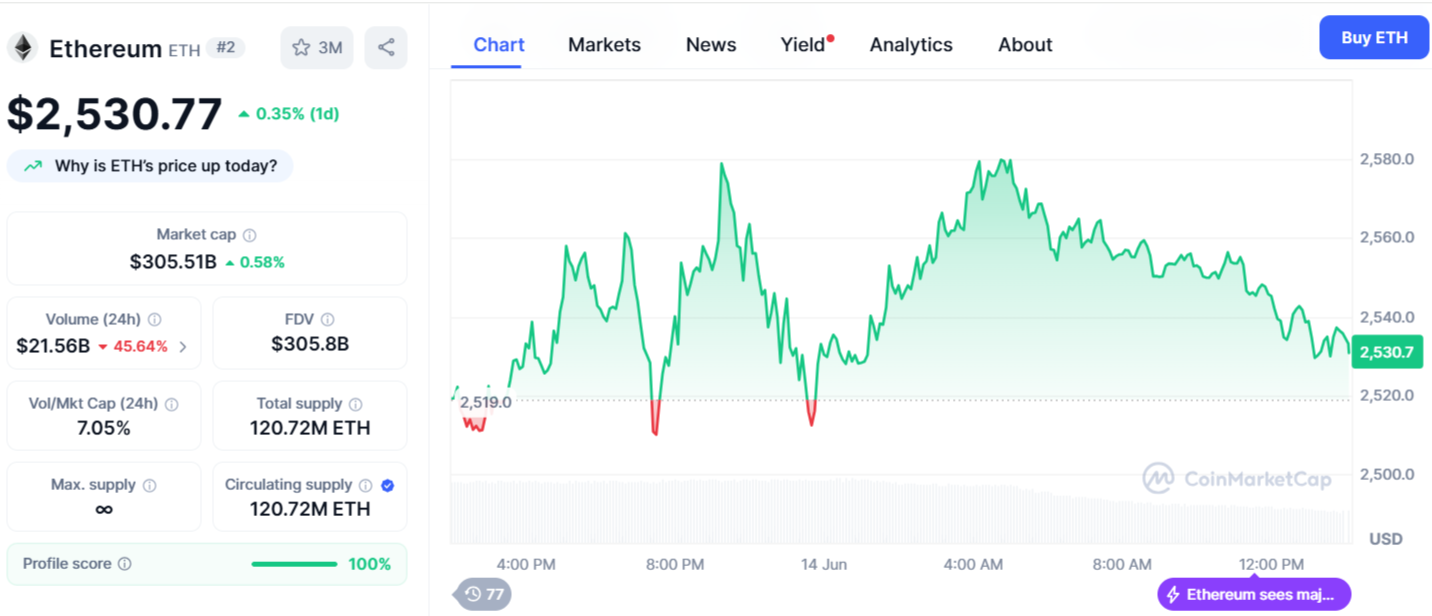

Ethereum Stuck Below $2,600

Despite strong demand for Ethereum ETFs, ETH is currently priced at $2,530—still below the $2,620 mark seen when the recent inflow streak began. Over the past month, the token has declined by 1.01%, based on data from CoinMarketCap. Analysts believe the absence of staking functionality may be holding back greater investor interest. Back in March, BlackRock’s head of digital assets, Robbie Mitchnick, remarked that Ethereum ETFs feel “less complete” without offering staking rewards.

Institutional Interest in Ethereum on the Rise

Institutional interest in Ethereum continues to grow. On June 13, SharpLink Gaming made headlines by acquiring 176,271 ETH—valued at around $463 million—becoming the largest publicly listed holder of Ether to date. In addition, data from Arkham Intelligence shows a clear uptick in ETH whale activity. Over the past two weeks, nearly 140,000 ETH have been withdrawn from exchanges, signaling strong accumulation.

This week, Ethereum fell from $2,800 to under $2,500, causing panic selling and liquidations. Binance open interest dropped 19% as longs got cleared.

Bitcoin ETFs See $301M Inflows

On June 13, institutional demand for Bitcoin surged as ETFs brought in strong inflows, boosting overall market sentiment. Farside Investors reported a total of $301.7 million in net inflows across all Bitcoin ETFs. Leading the day was BlackRock’s IBIT with $239 million, while Fidelity’s FBTC and Bitwise’s BITB followed with $25.2 million and $14.9 million, respectively. Grayscale’s GBTC added $9.1 million, and smaller funds like BTC and HODL saw inflows of $7.5 million and $6 million.

These figures show a clear rise in institutional interest in Bitcoin through regulated investment products. Like Ethereum, Bitcoin is also rising steadily amid growing tensions between Israel and Iran. BTC is currently priced at $105,001, up 0.5% over the past 24 hours, according to CoinMarketCap.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.