0

0

A crypto trader reportedly sent $50 million in USDT to a scammer after an address poisoning scam attack, turning one lazy copy‑paste into one of the most expensive mistakes in crypto.

Stablecoins, such as USDT, stayed pegged, so markets did not really move in the aftermath of the attack, which makes this loss even more dangerous for everyday users. While big headlines focus on massive exchange hacks, quiet wallet scams like this hit regular people right where it hurts: their balance.

(Hack vs Scam)

With me, Akiyama Felix, let’s dive deep into this filthy scam. I will be using my expertise from my years in crypto to help you understand the dos and don’ts.

Someone lost $50,000,000 due to one simple mistake.

He transferred $50 to a new address, and then the scammer spoofed a wallet that had the same first and last characters.

The user mistakenly copied the scammer's address and didn't recheck it completely.

And this mistake cost… pic.twitter.com/G1mku9NT8b

— Max Crypto (@MaxCrypto) December 20, 2025

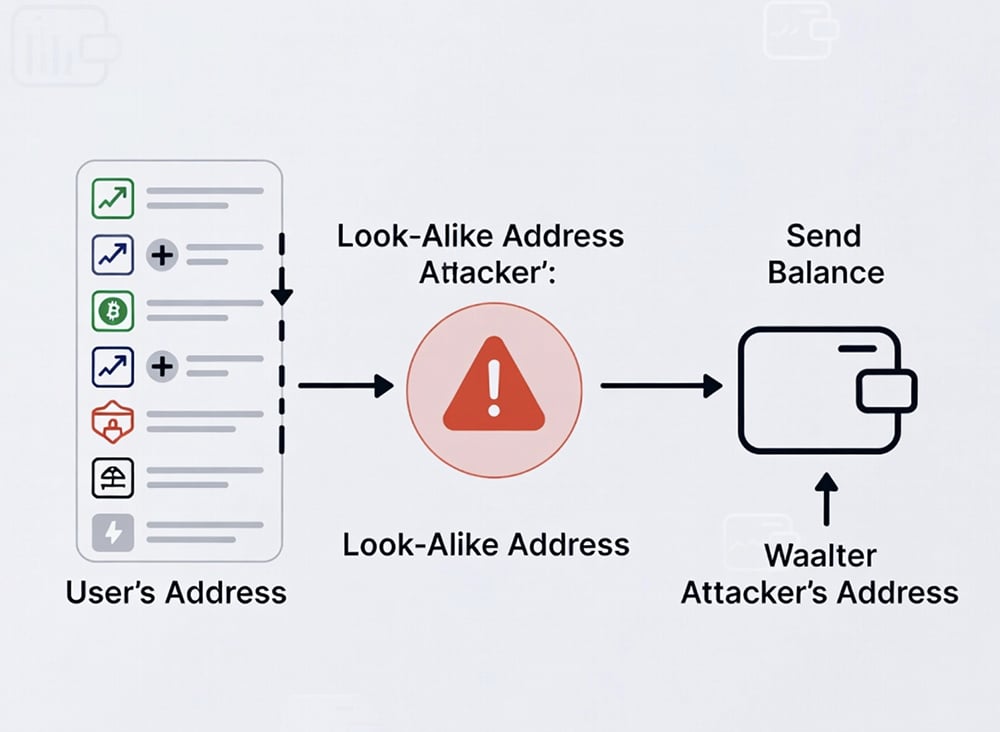

First things first, a crypto address looks like a long, random string of letters and numbers. Most of us never type it; we instead copy and paste, and address‑poisoning scams abuse this habit.

Scammers send a fake transaction for $0 (or a tiny amount) from a wallet that looks almost identical to one you use often. According to MetaMask, attackers often match the first and last characters of your real address, so at a glance, everything seems fine.

The ‘poison’ isn’t just a transaction you received. Attackers use the TransferFrom function in the USDT smart contract to trigger a $0.00 transfer from your own wallet to their look-alike address. This makes it look like you were the one who sent the money, making it much more likely you’ll trust it later.

Your wallet history now shows the scammer’s look‑alike address. Next time you pay a friend, send to an exchange, or move funds to your hardware wallet, you might grab the wrong line from your history. One paste. One click. Money gone.

Reports of address poisoning started rising in early 2023, and Cointelegraph flagged it as a growing threat. MetaMask and other wallets warned users to stop trusting transaction history as an address book and to double‑check every character before hitting send.

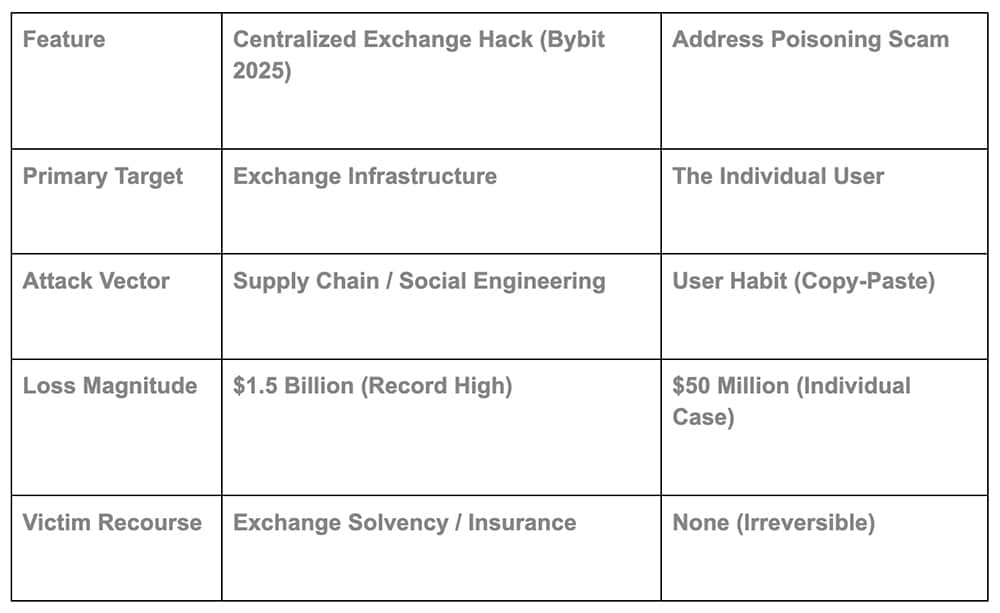

This $50M USDT loss is not a one‑off freak event. It sits next to huge centralized hacks like the 2025 Bybit theft, where attackers drained about $1.5 billion, and the 2024 WazirX breach of $235 million, as reported by The Guardian. Hackers now target both exchanges and individuals with equal focus.

Think of it like bank robbery vs. pickpocketing. Big exchange hacks are the bank heists. Address‑poisoning scams are the pickpockets on a crowded street. If you only watch the bank doors, the pickpocket still gets your wallet.

USDT plays a huge role in crypto trading and DeFi. It acts like a crypto version of digital dollars. When someone loses $50M in USDT in a single bad transaction, it does not break the stablecoin market, but it reminds everyone how final these transfers are. No chargebacks. No support ticket that restores the money.

For more on how these stablecoins sit at the center of this story, you can read our coverage of the broader stablecoin market and how companies like Visa now use them for payments in our stablecoin adoption report.

You do not need to be scared of self‑custody, but you do need to change a few habits. Start with one rule: never trust your transaction history as your address book. Treat it like a spam folder. It might contain something useful, but assume the worst.

Instead, save trusted addresses in a contact list. MetaMask, for example, lets you store known contacts so you do not rely on random past transactions. Hardware wallets add another layer by forcing you to confirm the address on the device screen, not just your laptop or phone. That extra check stops many copy‑paste mistakes.

Before any large transfer, read the entire address on your hardware wallet or wallet pop‑up. Not just the first and last four characters. Every character for life‑changing amounts. It feels slow. It feels annoying. It is cheaper than a $50M typo.

Make it a habit to test new addresses with a tiny “test transaction” first, especially for big moves or new exchanges. Think of it as sending a postcard before you mail the safe.

If you want to understand how these targeted attacks compare with other major wallet breaches, check our recent report on a $27M multi‑sig wallet hack. Different method, same end result: money gone forever after one security slip.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

As attackers get smarter, wallets will need to behave more like banking apps. Expect better address books, warnings when you send to an address you never used, and maybe even scam‑address blocklists. MetaMask already shares detailed guidance and explains why double‑checking every character matters in its security guides.

Personally, I’ve adopted a 4-4-4 rule: I check the first 4 characters, the middle 4, and the last 4. If any are off, I treat the whole address as a landmine. In a world of $50M mistakes, paranoia is your best asset.

On the user side, this is the wake‑up call. Every bull market brings in new people who treat crypto like a quick app download. But self‑custody means you play the role of your own bank security team. Your habits decide whether a scammer gets your funds.

Scammers will keep inventing new tricks, but you only need a short checklist to stay ahead: use contacts, verify on‑device, test with small amounts, and never rush a life‑changing send. The tech will improve, but your habits today already decide whether your next transaction is just another payment or your own $50M horror story.

DISCOVER: 10+ Next Coin to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Trader Loses $50M in USDT to Address Scam: Check Your Wallet Habits appeared first on 99Bitcoins.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.