Crypto News: BTC, ETH, XRP Records $1.04B Inflow, Rally to Sustain?

0

0

Key Insights:

- Digital asset funds saw $1.04B in weekly inflows, pushing total AuM to a record $188B as per latest crypto news.

- Ethereum averaged 1.6% of AuM in inflows over 11 weeks, outperforming Bitcoin’s 0.8%.

- The U.S. led with $1B in inflows, while Canada and Brazil recorded outflows of $29.3M and $9.7M.

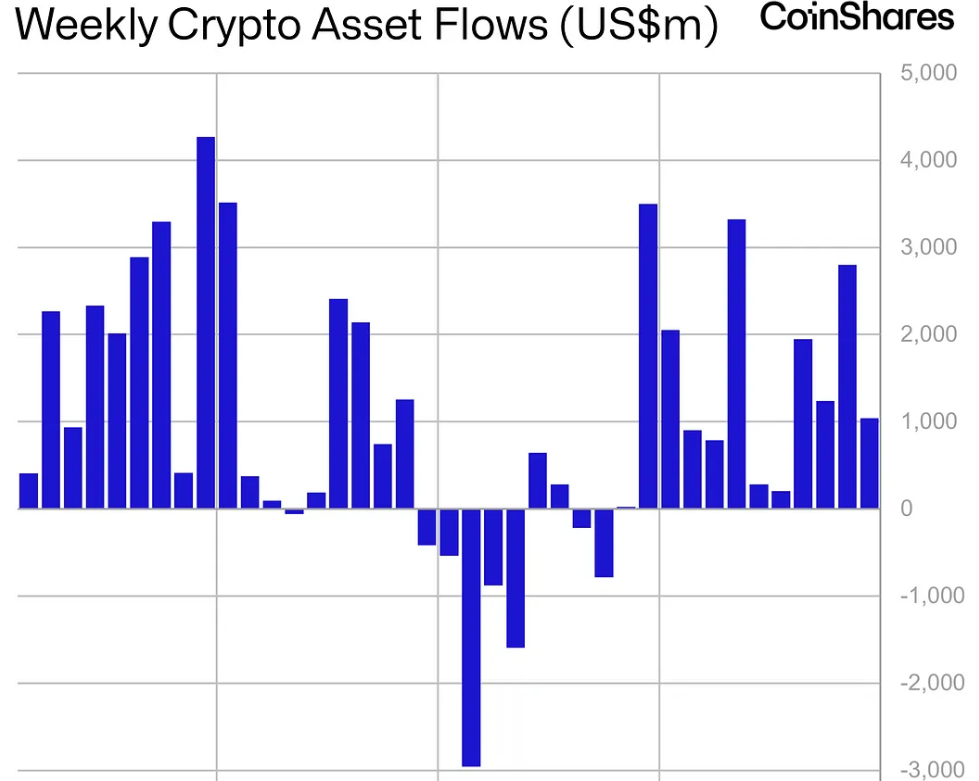

Digital asset investment product flows were also positive in the past week, both as an accumulation of $1.04 billion, 12 weeks running, that took assets under management (AuM) to a new high of 188 billion.

The most recent crypto news implied that institutional interest in such cryptocurrencies as Bitcoin (BTC), Ethereum (ETH), and XRP rose.

Crypto News: Digital Asset Inflows Push AuM to Record $188 Billion

Notably, the total weekly inflow of $1.04 billion marks the 12th consecutive week of positive net flows into digital asset funds, according to the latest crypto news.

As revealed by the recent CoinShares report, this influx of capital allowed AuM in crypto-based investment products to reach a record high of 188 billion, adding to new all-time highs. This growth has been fuelled by a mix of rising prices and new sources of capital.

In addition, trading volume also remained steady, with $16.3 billion processed over the week. To compare, this number is similar to the average weekly volume achieved thus far in 2025.

This indicated a stable interest shown by both institutional and retail investors. Bitcoin contributed to most fund activity, whereas other digital assets also gained some interest.

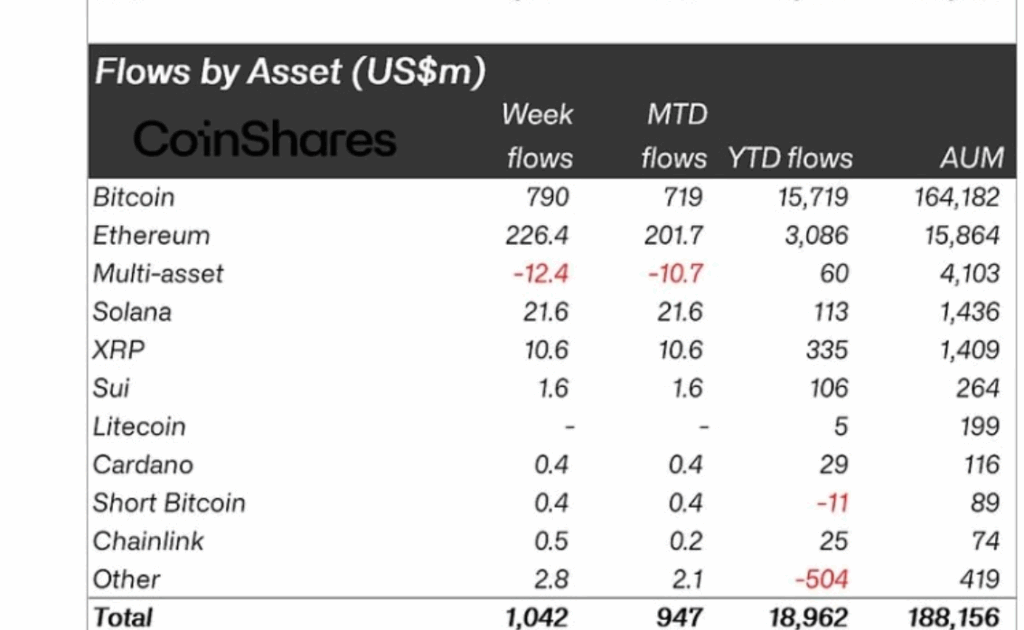

Weekly inflows into Bitcoin-oriented products amounted to $790 million. This amount, though notable, was slower than the three-week average of $1.5 billion.

Ethereum Inflows Remain Consistent, Outpacing Bitcoin

Ethereum recorded its 11th consecutive week of inflows, attracting $226 million over the last seven days. This brought the cumulative total to $2.85 billion during the current streak. What stands out is Ethereum’s inflow as a percentage of its total AuM.

Over these 11 weeks, ETH funds averaged 1.6% of AuM in weekly inflows, double Bitcoin’s 0.8% average over the same timeframe.

This is indicative of an investor interest turning towards Ethereum-based assets, perhaps due to the proximity of its applications in decentralized applications, staking, and DeFi infrastructure.

Moreover, positive sentiment also boosted investment products related to XRP, but their flows were smaller than those of Bitcoin and Ethereum.

It seems that investors are monitoring Ripple’s progress and its market positioning, given that regulatory clarity may generate effects in future capital flows.

BTC, ETH, XRP Lead Fund Activity, Rally Momentum Builds Amid Positive Crypto News

More so, the crypto news from the week had the largest fund inflows for Bitcoin, Ethereum, and XRP. These three cryptocurrencies together represented almost all of the $1.04 billion.

Although the inflow momentum of Bitcoin was slightly decreased, the general profile was inclined toward accumulation.

As digital asset AuM sets its record and targeted assets attract persistent attention, the rally is likely to persist. This is provided that the market structure does not shift and that macroeconomic factors do not alter ongoing investor action.

US Market Dominates Inflows

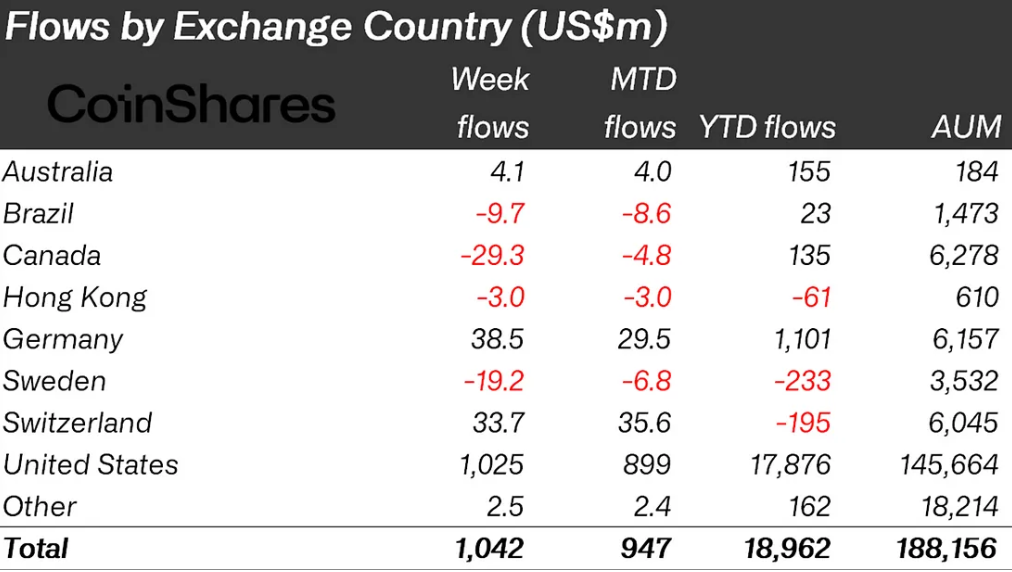

Regionally, the inflow surge was still dominated by the United States, as per the latest crypto news report. Investment products based in the US registered a net inflow of $1 billion in the week.

The cause behind this capital injection was the increased institutional demand and the sustained evolution of regulated exchange-traded products.

Germany and Switzerland were next with inflows of 38.5 million and 33.7 million, respectively. These figures suggest that European markets continue to expand their crypto offerings through licensed platforms and ETPs.

Conversely, Canada and Brazil recorded outflows. Canada recorded a digital asset fund outflow amounting to an income of $29.3 million, and Brazil recorded an outflow of $9.7 million.

Such regional activity variability could indicate investor sentiment, regulatory perception, or risk exposure procedures.

The post Crypto News: BTC, ETH, XRP Records $1.04B Inflow, Rally to Sustain? appeared first on The Coin Republic.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.