Helium Price Soars 10% Amid AT&T Partnership – Analyst Foresees a Rally to $15

0

0

Highlights:

- Helium price boasts a bullish outlook, soaring 10% to $4.32 in the past 24 hours.

- This rally comes following Helium’s AT&T partnership.

- A Crypto analyst eyes $15 if the Helium price breaks out soon.

The Helium price has broken out from the symmetrical triangle and is currently up 10% to $4.32. The recent rally comes as the wider crypto market upholds a bullish outlook, led by Bitcoin, which boasts a 1% surge to $95K. The HNT token also upholds a bullish picture, as the Bulls have flipped the 50-day MA into support. The HNT token is now up 26% in a week and 28% in a month, indicating growing investor confidence. Its daily trading volume is also up over 100%, suggesting a rise in market activity, hence investor confidence.

Meanwhile, the Helium network has partnered with AT&T to enable its users to connect automatically to Helium’s Decentralized WiFi network. Moreover, the Helium mobile will add about 3000 subs daily, outpacing other major carriers in prepaid.

NEW: Helium partners with AT&T to provide its users with automatic access to Helium’s decentralized WiFi network. $HNT $T pic.twitter.com/LKzX4a0IG1

— Investing Broz (@InvestingBroz) April 25, 2025

Can the Recent Partnership Push Helium Price Toward $5?

The Helium price has shown strength, as it has broken out of the triangle pattern, currently oscillating between $3.60 and $4.59. This slight consolidation may act as an accumulation phase, which could spike a rally toward $5 in the short term. Moreover, if the $3.14 support level holds, the Helium price could surge toward $4.53 in the near term. A break above this level will call for more upside toward $5, $5.05, and $5.08.

According to SolbergInvest on X, he has hinted at further upside toward $15. He has noted that so far, Helium is 80% up according to his previous analysis, and if the token breaks out, the $15 mark would be plausible.

$HNT Macro Update:

Up 80% since my call and looking great—strong run so far!

If we get a breakout, my target is $15.What’s your $HNT prediction?#HNT #CryptoTrading #MarketAnalysis pic.twitter.com/qJ3jCQG0tQ

— Solberg Invest (@SolbergInvest) April 25, 2025

A quick look at the Helium technical indicators paints a bullish picture. The Relative Strength Index has soared toward the 70-overbought region, warning traders to be cautious of a bull trap. The MACD indicator has flipped above the neutral level, towards the positive territory. This indicates that the buying pressure is surging, calling for more traders and investors to add HNT tokens.

However, as the token has crossed above the overbought region, the HNT price may retrace to allow the bulls to sweep through liquidity. In such a case, the Helium price may drop to the $3.73 support area. A breakdown of this level would cause a deeper correction towards $3.62, $3.41, and $3.14.

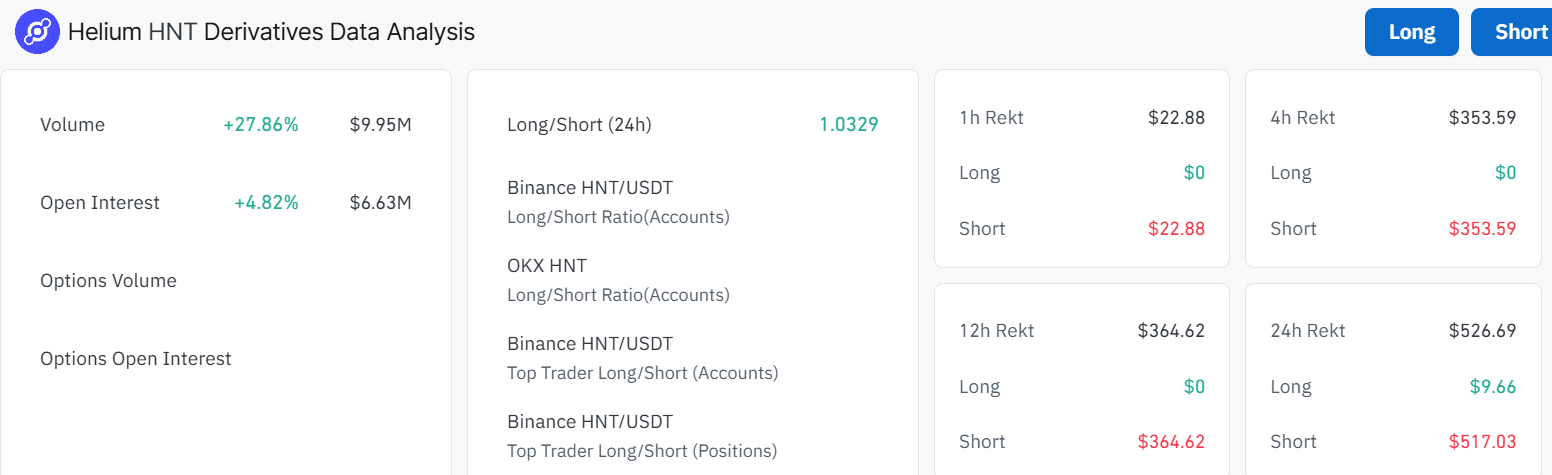

Helium Derivatives Data Analysis

A closer look at the Coinglass data, the Helium Derivatives data analysis shows a surge in open interest and volume. The OI has increased 4% to $6.63M as the volume is up 27% to $9.95M. This suggests a rise in market activity as new money flows to the HNT market.

Further, the short liquidations outweigh the long liquidations, which sit at $517.03, hinting at a bullish sentiment. This indicates that the bears are facing mounting pressure from the buyers as the bulls take root. In the meantime, if the crypto market maintains a positive outlook, the Helium price could keep surging. Trades and investors should cautiously monitor the increasing volume and key support and resistance levels in the Helium market.

Best Crypto Exchange

- Over 90 top cryptos to trade

- Regulated by top-tier entities

- User-friendly trading app

- 30+ million users

eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.