Monero Faces 18-Block Rollback: What the Reorg Means for XMR Security

0

0

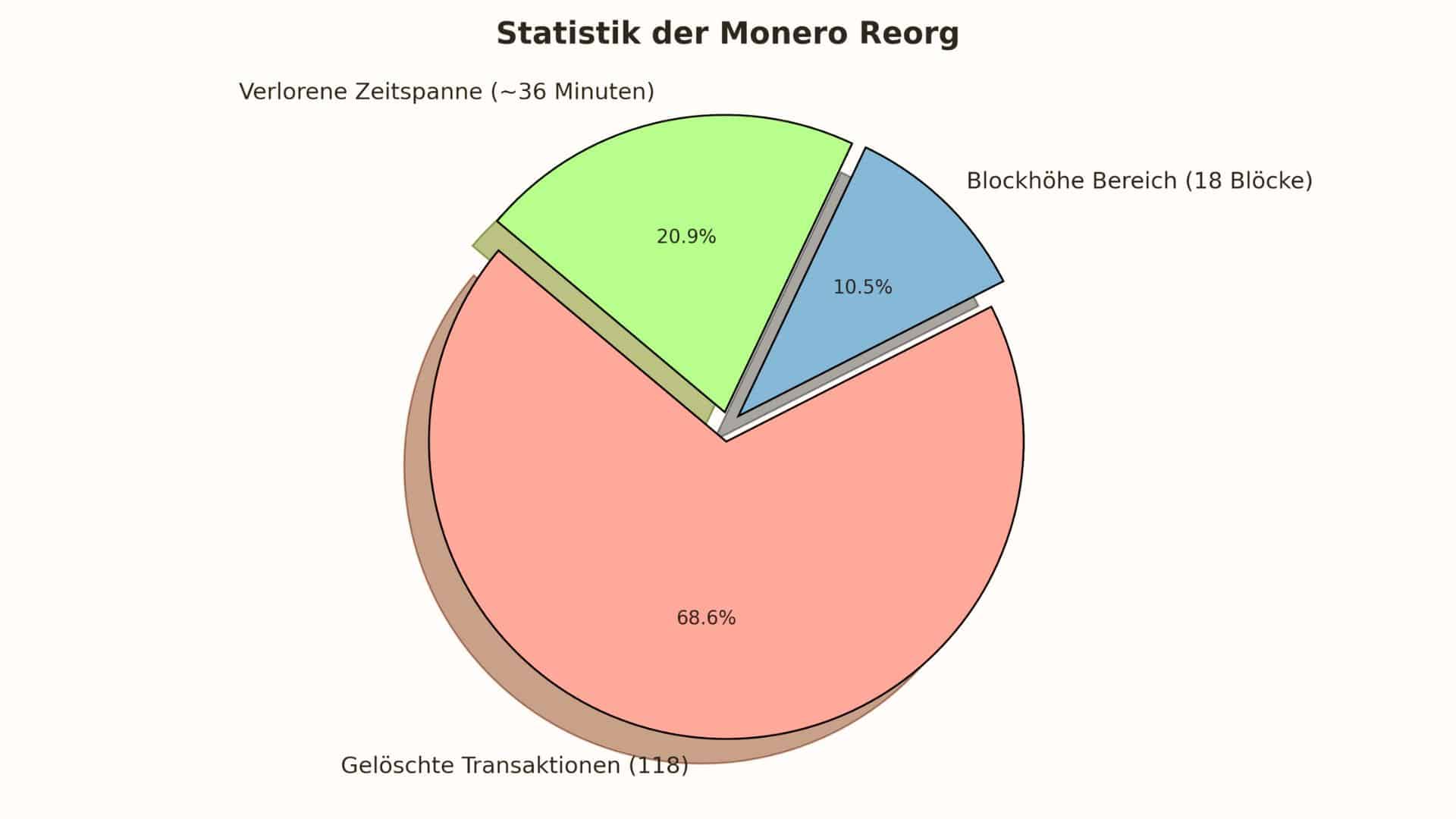

According to recent data, the Monero reorg event alarmed many in crypto circles when the network discovered an 18-block rollback. The incident erased 118 past transfers and left questions over how secure Monero really is.

This piece walks through what happened, what the figures show, and what may come next for those holding or trading XMR.

What Happened in the Monero Reorg

Key Facts and Figures

| Item | Detail |

|---|---|

| Depth of reorg | 18 blocks |

| Number of transactions erased | 118 transfers |

| Time span lost | ~36 minutes of block history |

| Block heights | From block 3,499,659 to 3,499,676 |

Also Read: Monero Attack Raises Fears Over Blockchain Centralization Risks

Who’s behind it

Mining pool Qubic holds over 51 % of Monero’s hashrate, according to reports. Observers accuse Qubic of using selfish mining: holding blocks in private, then releasing a chain longer than the public one to force reorgs.

Price and Market Reaction

- Monero’s price was about $287.54 before the reorg. Within hours it jumped to $308.55, up around 7.4 % despite broader crypto markets dropping roughly 1 %.

- Current Monero trading data shows a price around $270–$280 USD, a market cap of about $5.1 billion, and a 24-hour trading volume of near $80–90 million.

Why the Monero Reorg Matters

Trust and Finality

Monero previously used a safeguard that treated blocks deeper than 10 confirmations as safe. The 18-block reorg broke that assumption. For traders and services, that means more uncertainty for transaction confirmation.

Hashpower Concentration

When one pool controls the majority of hashing power, it can influence blocks, reject others’ work, roll back transactions or even censor. The Monero reorg shows how dangerous centralization of power can be.

Possible Fixes

Proposals under discussion include:

- Adopting DNS checkpoints so nodes pull trusted block data from community servers.

- Changing consensus rules to make 51 % dominance less harmful.

- Localizing mining or merge mining to reduce influence of any single pool.

Also read: Altcoins Price Predictions for 2025 Show Big Targets for Polkadot, Uniswap and Monero

Conclusion

Based on the latest research, Monero reorg episodes mark more than a technical slip. They strike at trust in network security and finality. Replacement of 118 transactions and 18-block rollbacks show how vulnerable proof-of-work networks can be when one actor holds most of the hashrate. Industry watchers must now press for protocol changes and decentralization to protect Monero’s future.

Summary

The Monero reorg event erased 18 blocks and 118 transfers, driven by Qubic’s over-50 % hashrate control. Price rose from roughly $287.50 to $308.55 shortly after the rollback. Market cap sits near $5.1 billion with trading volumes around $80–90 million. The incident exposed weak points in Monero’s safeguards and prompted talks of adopting DNS checkpoints, altering consensus rules, and reducing mining centralization. Readers should track these developments closely.

Glossary of Key Terms

Monero (XMR): A privacy-focused cryptocurrency that obscures sender, receiver, and amounts.

Block reorg (reorganization): When the blockchain discards some blocks and replaces them with another chain.

Selfish mining: Strategy where a miner withholds mined blocks instead of broadcasting them, to later override other blocks.

Hashrate: Total computational power used to produce or validate new blocks in a proof-of-work network.

51 % attack: When one actor or pool controls more than half of the network’s hashrate and can manipulate transactions or block creation.

FAQs about Monero Reorg

What triggered the Monero reorg?

Mining pool Qubic released a longer private chain that overtook the public chain at block 3,499,659. It replaced 18 blocks and invalidated past transactions.

How many transactions were erased?

The reorg removed 118 confirmed transfers.

Did price suffer after Monero reorg?

Actually price jumped by about 7.4 %, from ~$287.54 to ~$308.55 hours after the reorg.

Is Monero safe now?

Not entirely. Network security risk remains until hashing power becomes more distributed or stronger safeguards engage. Proposed fixes are under discussion.

Will Monero implement changes?

Yes, community proposals are active. They cover checkpointing, consensus changes, possibly merge mining and reducing reliance on any single major pool.

Read More: Monero Faces 18-Block Rollback: What the Reorg Means for XMR Security">Monero Faces 18-Block Rollback: What the Reorg Means for XMR Security

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.