James Wynn’s Wild Trades Spark Speculation of Hyperliquid PR Strategy

0

0

Recently, James Wynn has gained fame for his massive leveraged trades, betting billions of dollars on Bitcoin and meme coins like PEPE on the Hyperliquid platform.

Is he a daring trader with a passion for big bets, or merely a sophisticated marketing strategy to put Hyperliquid on the DeFi map?

James Wynn in the Eyes of Investors

James Wynn is a trader on the Hyperliquid (HYPE) platform. He earned profits of up to $100 million but quickly lost it all. However, recent moves by James suggest this might be a brilliant marketing campaign.

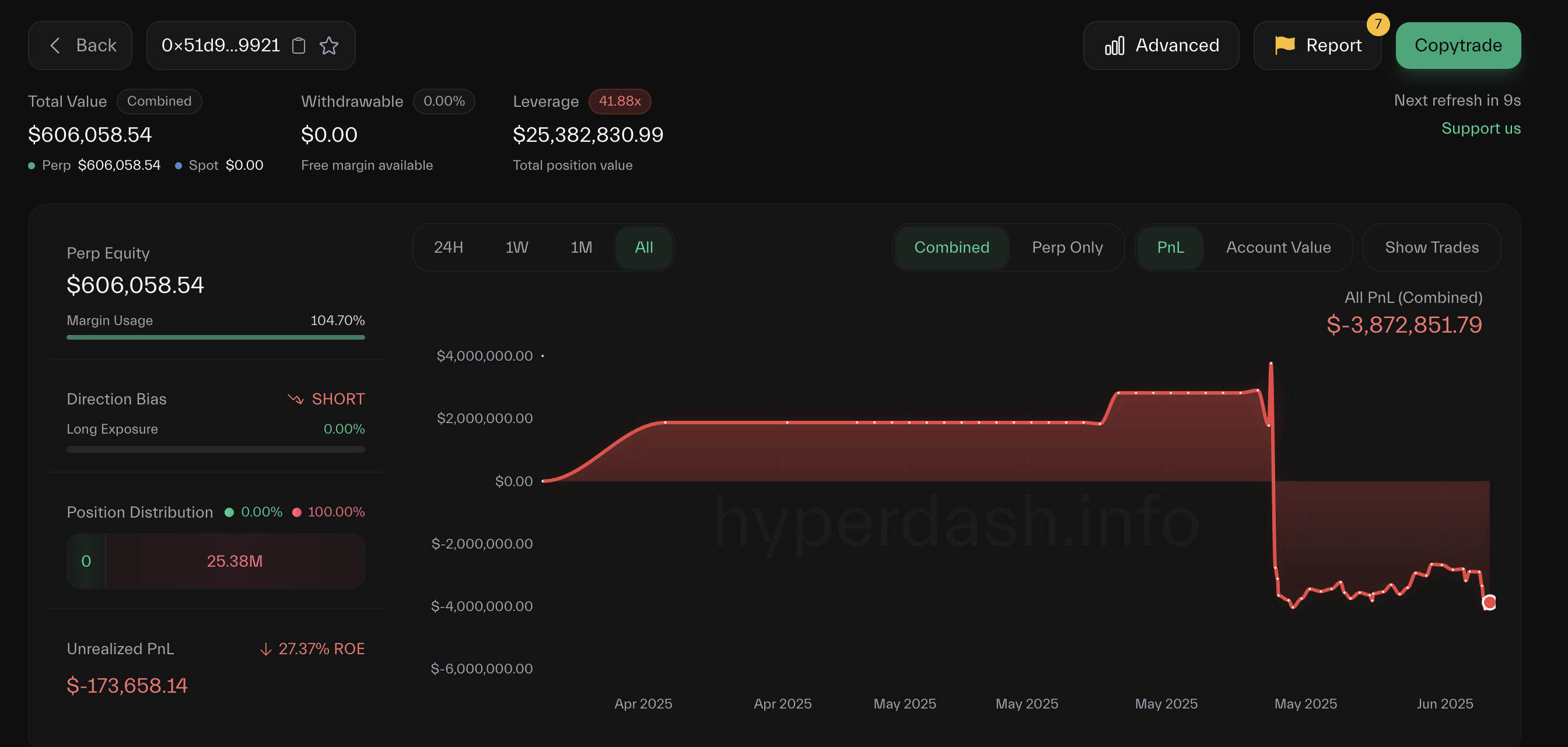

James Wynn’s Investment Performance. Source: hyperdash

James Wynn’s Investment Performance. Source: hyperdash

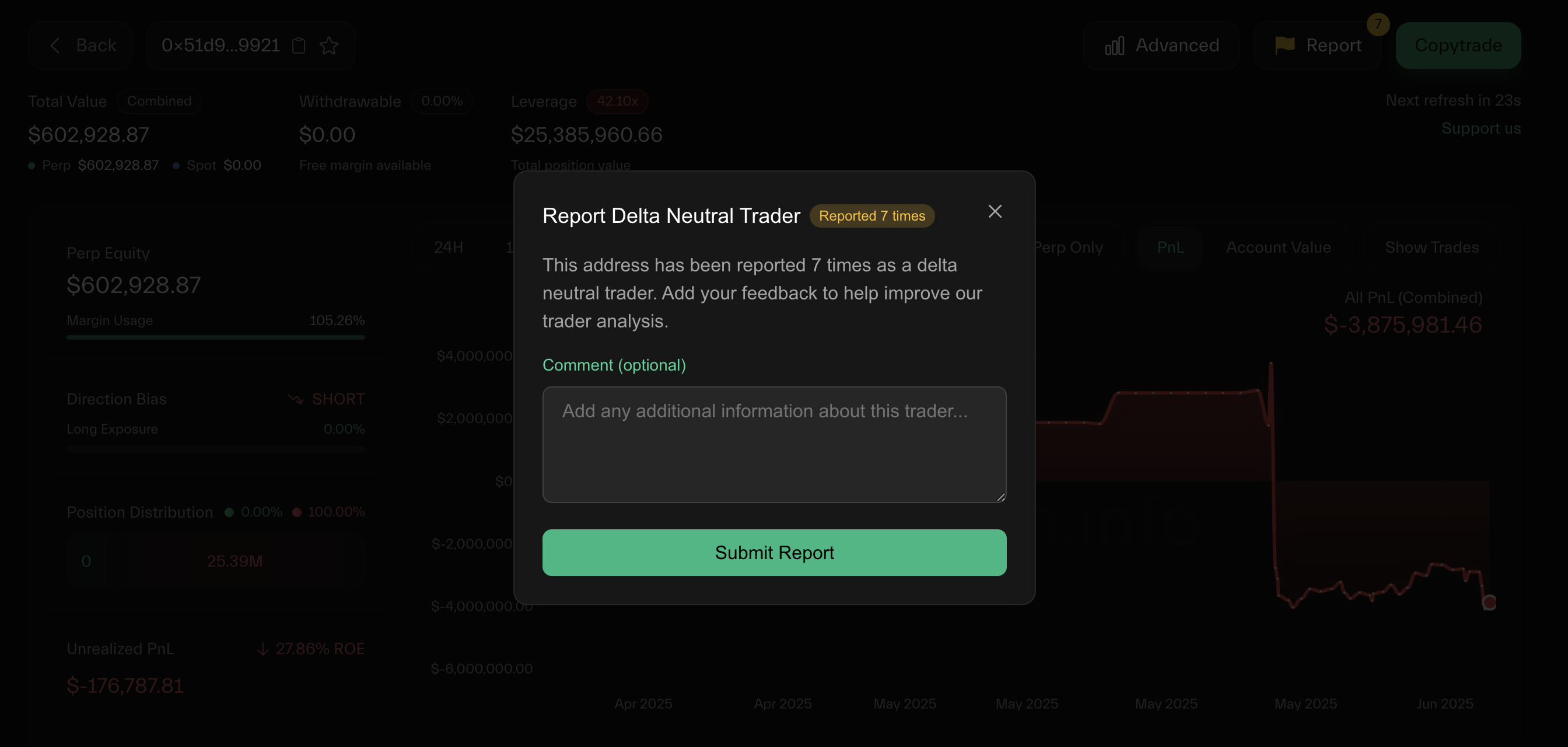

Traders on HyperDash have labeled James Wynn as a delta-neutral trader. This means that James always keeps his portfolio positions at a total Delta of 0.

James has been reported as a delta-neutral trader. Source: hyperdash

James has been reported as a delta-neutral trader. Source: hyperdash

Besides an individual trader fond of risky, high-leverage trades, James has also shown confidence in opening positions despite short-term losses. However, there have been multiple instances where James announced a pause in trading only to resume with new positions shortly after.

Notably, James opened new positions after returning from his latest trading hiatus announcement. Facing liquidation pressure, he called for donations from the community and quickly received over $20,000.

Is the James Wynn Effect a Staged Marketing Campaign?

After many repetitive and bizarre actions, many question the true purpose behind James Wynn’s trades.

Evgeny Gaevoy, founder of Wintermute, publicly stated on X that the James Wynn phenomenon might be a “carefully planned Hyperliquid marketing.” Gaevoy even praised the brilliance of Wynn and the quality of his X posts, hinting that this could be a strategy to draw attention to the Hyperliquid platform.

“But generally I think “wynn” is just a well executed HL promo campaign, well played” Evgeny Gaevoy shared.

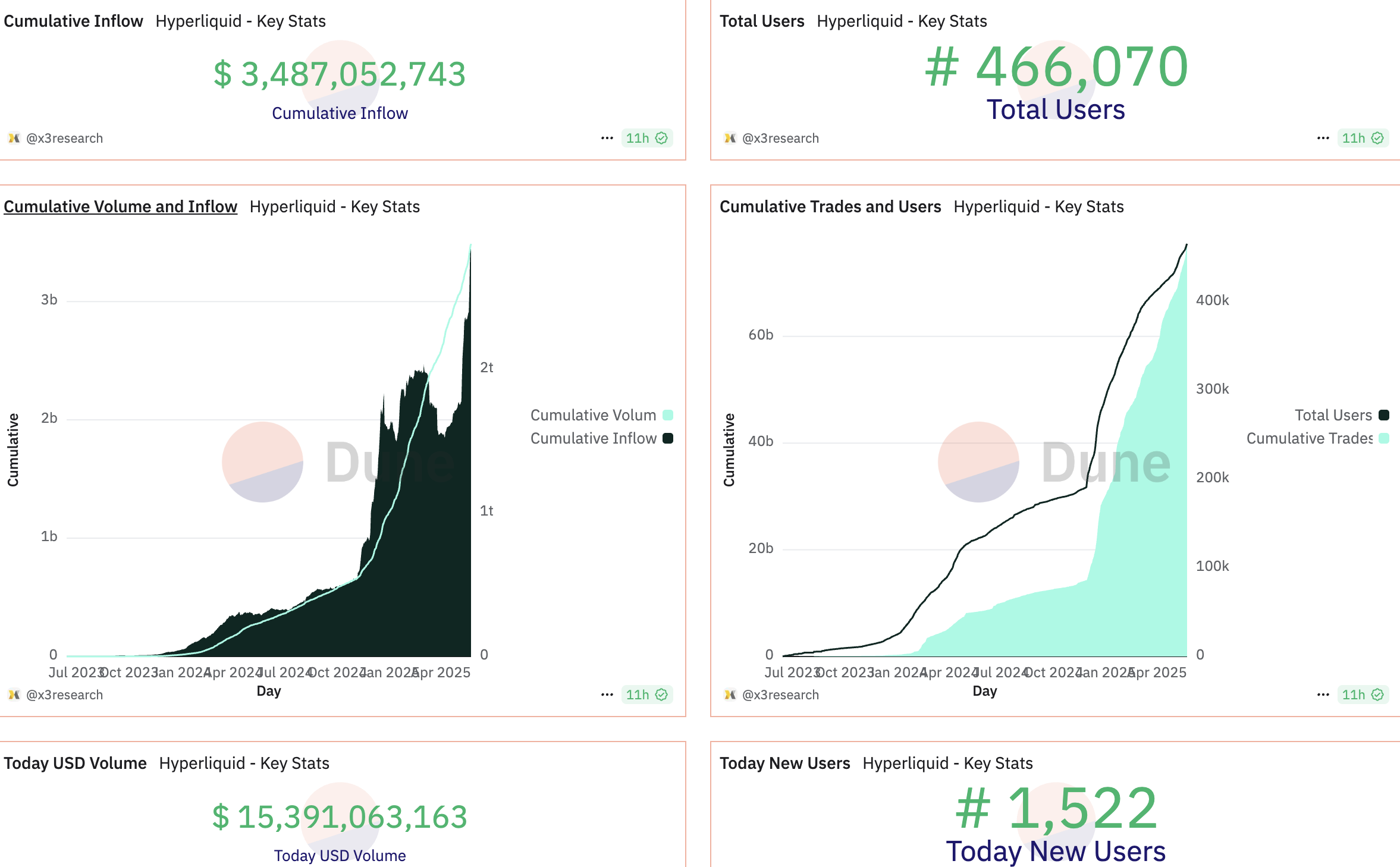

This perspective is reinforced by the fact that Hyperliquid has recently garnered significant attention due to Wynn’s billion-dollar trades, helping the platform stand out in the fiercely competitive DeFi market.

Data from Dune Analytics also shows that Hyperliquid’s total trading volume and user count have reached all-time highs (ATH). The price of Hyperliquid’s HYPE token surged 73% over the past 30 days, reaching $32.93 as of June 3, with a market capitalization exceeding $10.99 billion.

Hyperliquid’s performance. Source: Dune

Hyperliquid’s performance. Source: Dune

From another perspective, agreeing with Evgeny Gaevoy, Arthur Hayes, Co-founder of BitMEX exchange, also hypothesized that Wynn may have used hedging transactions at an anonymous address to optimize the benefits from Hyperliquid’s next airdrop round.

“I’m starting to think this might go down in crypto history as one of the best exchange marketing campaigns ever. $HYPE for the win. Also this dude is probably just farming the next airdrop by counter trading on another dark address.” Arthur Hayes stated.

However, some voices question Hyperliquid’s transparency, especially following the market manipulation scandal involving the JELLY token in March 2025. They raise concerns about the risk of Hyperliquid becoming “a second FTX.”

Meanwhile, co-founder of Hyperliquid, Jeff Yan, posted a lengthy response to X addressing criticisms of the “transparent market scandal.” He asserted that the platform operates transparently and does not engage in manipulation. However, these responses have not quelled doubts about James Wynn’s true role.

As BeInCrypto reported, Changpeng Zhao proposes a dark pool-style DEX for perpetual futures to combat front-running and enhance trade privacy. CZ’s idea surfaces amid James Wynn’s volatile trades on Hyperliquid, sparking debate on transparency risks in leveraged crypto trading.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.