Donald Trump to Hit 7 Nations With Tariffs on Aug 1st, Will Crypto Market Crash?

0

0

The post Donald Trump to Hit 7 Nations With Tariffs on Aug 1st, Will Crypto Market Crash? appeared first on Coinpedia Fintech News

Bitcoin is holding steady around $108,700, showing resilience while the global markets react to Trump’s Tariffs. Bitcoin remains mostly unfazed and shows growing confidence among investors. The institutional demand also remains strong with steady ETF inflows.

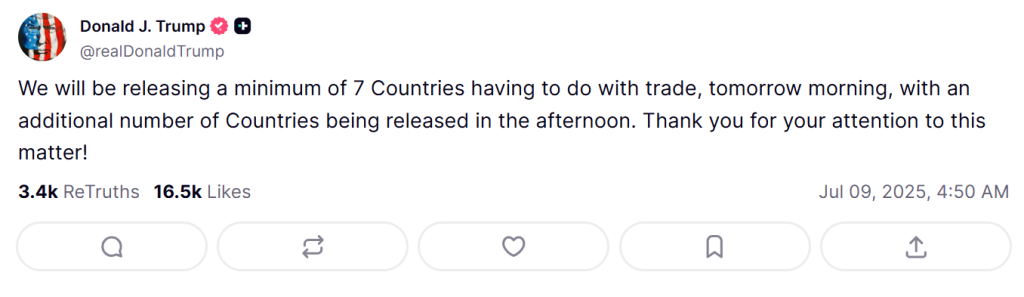

New Tariffs Incoming

President Trump shared in a Tuesday evening post that he is all set to announce new trade tariffs targeting at least 7 countries, with more to be followed later. This would spark sudden volatility across global stock markets and crypto. The letters will announce new tariffs of 25% to 40%, set to take effect on August 1, 2025.

Will Crypto Market Drop Again?

He has warned earlier that if 14 countries don’t strike trade deals by early next month, then tariffs will jump back to the higher April levels.

Recently, he slapped tariffs of 25% to 40% on 14 countries, and it quickly impacted the crypto market. Within 24 hours, the total market had dropped 4.5% and all the major coins were trading in red. Bitcoin dipped 1.56% to just under $108,000, while Ethereum fell 1.89% to $2,535. Dogecoin saw the biggest drop, sliding 4.78%.

Stocks like Microstrategy and Robinhood also closed lower, and Bitcoin mining stocks dropped even more sharply. The impact was seen in the broader market, too. The Dow, S&P 500, and NASDAQ all dropped.

This was similar to what happened in April, when U.S.-China trade tensions sent Bitcoin below $80K and triggered major sell-offs.

Trump has also announced an additional 10% tariffs on countries that support BRICS. With more tariffs set to kick in on August 1, the crypto market could stay under pressure, and further declines are also possible.

Critics warn that Trump’s tough tariff plans could hurt the global economy and even push the U.S. toward a recession. But he has held by them and says that it’s necessary.

Trump Says Tariffs Have No Effect on Inflation

The U.S. just added over $350 billion in debt in a single day, hitting a new all-time high and the biggest spike since 2024. Analysts claim that this is bullish for Bitcoin and crypto as concerns over fiat stability continue to grow.

The hopes for a July rate cut have also faded from 90% to just 61%. The rising tariffs and inflation fears may keep the Fed from easing, and this could limit crypto’s upside. However, Trump claims that according to a new CEA study, tariffs had “zero” impact on inflation. He is now calling out Fed Chair Jerome Powell to cut interest rates immediately.

Bullish Momentum For Bitcoin?

Bitcoin’s breakout is strong, and the market is holding up. Some analysts believe that the worst-case scenarios, including a potential war, are already priced in. With rising money supply, there could be bullish months for both crypto and stocks, targeting $120K–$130K for BTC.

For Bitcoin to stay bullish, it needs to hold above $99,000. After dipping to $107,400 to fill its CME gap, BTC now has a solid shot at pushing toward the $110K-$114K range in the days ahead.

0

0

Manage all your crypto, NFT and DeFi from one place

Manage all your crypto, NFT and DeFi from one placeSecurely connect the portfolio you’re using to start.

BREAKING:

BREAKING: (@DrProfitCrypto)

(@DrProfitCrypto)